Ethereum Updates: The Ongoing Bridge Debate—Balancing Centralized Authority and Decentralized Protection

- Vitalik Buterin warns of off-chain risks despite blockchain's security advancements, emphasizing centralized vulnerabilities in cross-chain bridges and L2 solutions. - Solana's Anatoly Yakovenko criticizes Ethereum L2s' permissioned multisig systems for undermining decentralization, proposing ZK-based Solana-Ethereum interoperability. - Sovereign Labs' Cem Özer advocates for STF-level rollup designs to isolate bridge risks, enabling flexible yet secure multi-bridge ecosystems. - The debate highlights ten

Blockchain Update: Vitalik Warns of Off-Chain Risks Despite On-Chain Security

Vitalik Buterin, one of Ethereum’s co-founders, has once again highlighted the dangers posed by off-chain vulnerabilities, even as blockchain systems advance. His comments arise as the crypto community continues to debate the safety of cross-chain bridges and layer-2 (L2) solutions—key components for scaling decentralized platforms, yet still controversial in terms of security.

Recent conversations between

Özer responded by emphasizing that the effectiveness of escape hatches—mechanisms for users to recover assets if a bridge fails—relies on the design of rollups. Sovereign Labs’ rollups implement forced transactions at the state transition function (STF) layer, which helps prevent censorship and lowers the risks tied to bridges. This method contains vulnerabilities to individual bridges, rather than putting the entire L2 network at risk. Özer maintained that having multiple bridges with different security approaches can coexist, offering users more choice without compromising protection, a perspective further detailed in the same article.

This ongoing debate has real-world consequences for

The conversation gained momentum within the community. Some questioned if STF-level enforcement would restrict user options, but Özer argued it actually increases user empowerment by distributing control. Others noted that Sovereign’s strategy confines risks to specific bridges, reducing the chance of widespread failures. These points reflect a broader industry push to streamline rollup frameworks while upholding strong security, as mentioned in the article.

As blockchain ecosystems grow, finding the right balance between innovation and risk management remains crucial. Vitalik’s caution about off-chain threats highlights the importance of thorough technical reviews and decentralized oversight in bridge development. The dialogue between Solana and Ethereum illustrates a maturing sector where interoperability and security must be carefully engineered to work together.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Current Correction Mirrors a Previous Bullish Fractal — Is a Reversal Ahead?

ADA Heads Toward $0.32 as BTC Sets the Tone for What Comes Next

BTC OG Insider Whale Holds $730M Long Across BTC, ETH, and SOL with $41M Unrealized Losses

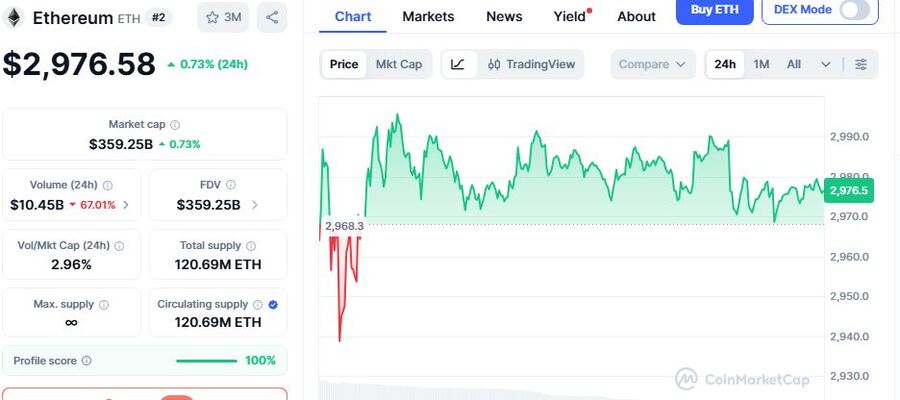

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum