AAVE Rises 0.11% Following Aave Labs’ Purchase of Stable Finance

- Aave Labs acquired Stable Finance, a DeFi yield app, to expand retail crypto services and strengthen its $37B TVL ecosystem. - Despite AAVE's 1-month (17.44%) and 1-year (26.65%) price declines, the move targets growing on-chain yield demand amid regulatory uncertainties. - The acquisition follows U.S. bans on yield-bearing stablecoins but avoids legal clarity on DeFi protocols, intensifying competition with Coinbase and Crypto.com. - Analysts suggest the deal could boost retail engagement and liquidity,

As of October 25, 2025,

Aave Labs has completed the acquisition of Stable Finance, a San Francisco-based mobile platform that lets users earn returns on stablecoins through overcollateralized DeFi markets. This acquisition highlights Aave’s ongoing expansion into crypto products aimed at everyday consumers.

The agreement, revealed on October 23, brings founder Mario Baxter Cabrera and his engineering team into Aave. Although the purchase price was not made public, this move builds on Aave’s recent institutional initiatives, such as its

This acquisition comes at a time when competitors like Coinbase and Crypto.com are also launching their own DeFi yield features. Even though U.S. lawmakers have enacted the GENIUS Act, which prohibits yield-generating stablecoins, on-chain lending protocols remain outside current legal frameworks, creating friction with traditional banks and paving the way for further DeFi expansion.

Although AAVE’s price has generally trended downward over the past month and year, this acquisition demonstrates Aave’s strategic intent to broaden its retail DeFi services. Adding a stablecoin yield platform further strengthens Aave’s role in decentralized lending.

Market analysts believe this acquisition could attract more retail users and boost liquidity on Aave’s platform. The timing coincides with increased institutional involvement in DeFi, as shown by Coinbase’s recent purchase of Echo and Pave Bank’s $39 million Series A round. These developments signal growing confidence in DeFi’s ability to expand beyond its current institutional focus.

To evaluate the market effects of such strategic actions, a backtesting approach was used based on a rule-driven, event-based model. This strategy identifies when an asset’s closing price drops by at least 10% over 21 days, marking it as a possible buying opportunity. When this condition is met, a position is opened at the next day’s open and held for 20 trading days, simulating a medium-term investment. This framework helps assess the potential returns from strategic moves like Aave’s acquisition.

The model uses a set holding period without stop-loss or take-profit rules, focusing solely on how the market responds to the event. Applied to Aave, this strategy would test whether acquiring Stable Finance could trigger a short- to mid-term price rebound.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Here’s how Euro stablecoins hit $1B despite weak hype

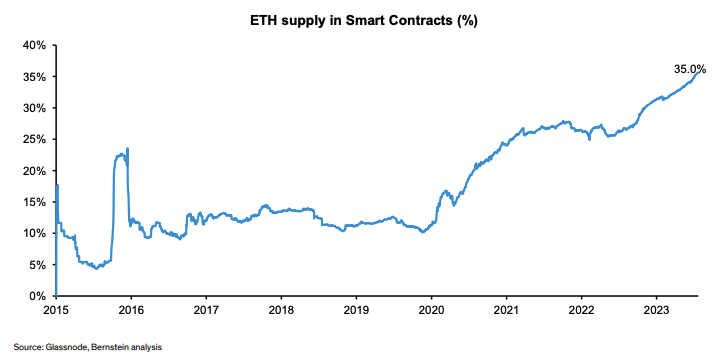

Prospect of spot ETFs not behind ether’s break above $3,000: Bernstein

Yuga Labs protects NFT royalties ahead of Magic Eden's Ethereum marketplace launch

Crypto Market Surge – Canton Network Lands First in Top Gainers at Close to 40% Gain