JPMorgan Connects Wall Street and Cryptocurrency through Collateral Initiative as Regulatory Frameworks Converge

- JPMorgan allows institutional clients to use Bitcoin/Ether as loan collateral by 2025, integrating crypto into Wall Street credit systems. - Shift reflects JPMorgan's evolving stance on crypto and aligns with global regulatory developments under Trump, EU, and UAE frameworks. - DeepSnitch AI's $450K presale gains traction as market seeks utility-driven tokens amid crypto's $10B Q3 institutional lending surge. - Regulatory clarity efforts, including CFTC leadership changes, aim to resolve jurisdictional a

JPMorgan Chase & Co. is ramping up its efforts to blend cryptocurrencies with mainstream finance, planning to let institutional clients use

This initiative, which is part of a larger push to mainstream digital assets, represents one of the most significant integrations of crypto into Wall Street’s lending frameworks. The program, which uses a third-party custodian to hold assets, allows clients to access liquidity without liquidating their crypto, further establishing digital currencies as credible assets alongside stocks and gold, according to

JPMorgan’s move signals a notable change in its approach, as the bank has traditionally been wary of digital currencies. CEO Jamie Dimon, who previously likened Bitcoin to a "pet rock," now allows clients to buy and hold the cryptocurrency, even though the bank itself does not directly safeguard it, as stated by

JPMorgan’s collateral initiative is anticipated to enhance liquidity in crypto markets, which saw $10 billion in institutional lending in the third quarter of 2025, according to Coinpaprika. Regulatory clarity remains a key concern. Trump’s nomination of Michael Selig, the current head of the SEC’s crypto task force, to chair the CFTC, is seen as a step toward unified oversight of digital assets and resolving regulatory uncertainties that have slowed adoption, as

As financial giants like

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC OG Insider Whale Holds $730M Long Across BTC, ETH, and SOL with $41M Unrealized Losses

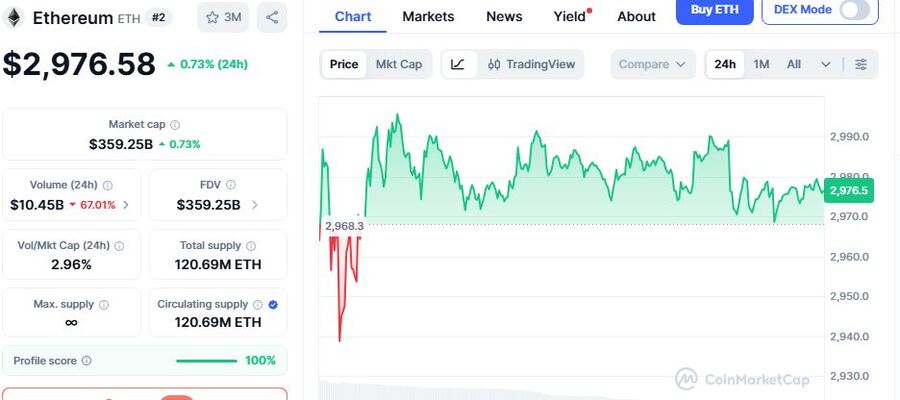

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum

Digital Renminbi Fraud Traps: How Scammers Push Wallet Schemes and How to Protect Your Funds