Ethereum Updates Today: Institutional Support Protects Crypto Against Cultural Disruptions

- Benita Valente's death had no impact on crypto markets, per Kanalcoin analysis, as cultural events historically fail to influence digital asset valuations. - Coinbase's $375M Echo acquisition and Pave Bank's $39M Series A highlight institutional-driven crypto consolidation and hybrid banking innovation. - Bitcoin ETFs gained $90.6M while Ethereum ETFs lost $93.6M, with BTC stabilizing above $111k amid U.S. government shutdown uncertainty. - Brazil's $40M pension tokenization via XRP Ledger and BNB custod

Benita Valente, the renowned American soprano who died at the age of 91, had no observable effect on cryptocurrency markets, as noted by

At the same time, the cryptocurrency sector continues to be active, propelled by institutional capital and regulatory shifts. Coinbase’s recent $375 million purchase of the on-chain investment platform Echo demonstrates ongoing industry consolidation, according to

Activity in Bitcoin and

Institutional involvement is expanding beyond conventional finance. Brazilian company VERT Capital has tokenized $40 million in pension funds using Ripple’s XRP Ledger, positioning Brazil at the forefront of blockchain-based finance, as reported by

However, not all areas performed well. NFT sales dropped by 42% to $93 million, with

Investors remain attentive to the sector’s core strengths. Mike Giampapa of Galaxy Ventures pointed out that recent market swings have strengthened blockchain-based finance, as mentioned in the Yahoo Finance report. Likewise,

Ultimately, Benita Valente’s passing highlights how the crypto market remains largely unaffected by cultural events. As institutional adoption and technological progress continue, digital asset markets are evolving independently from unrelated global occurrences.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CLARITY Act explicitly leaves DeFi rules blank, risking a total retail protection collapse if negotiations fail

Watch Out: Numerous Economic Developments and Altcoin Events This Week! Here’s the Day-by-Day, Hour-by-Hour List

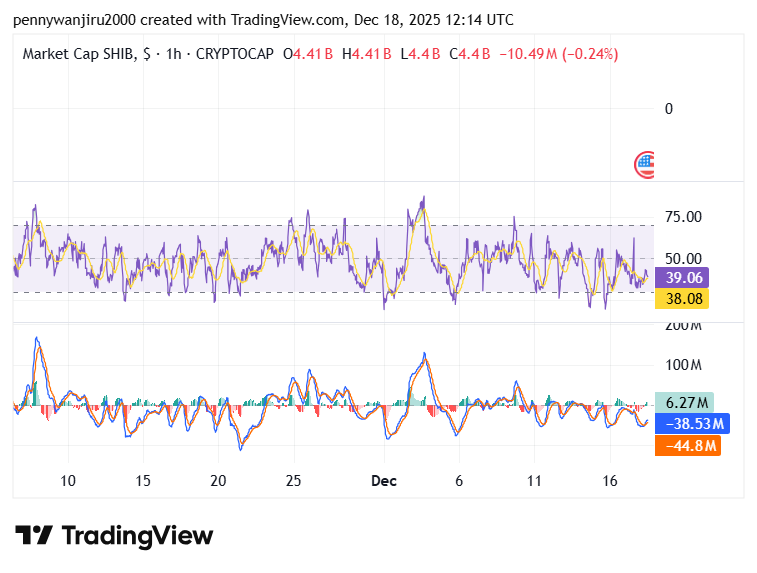

Shiba Inu Price Slips 2.9% as SHIB Defends $0.0574 Support Amid Tight Trading Range

The 15 Most Searched Altcoins in Recent Hours Have Been Revealed – Here’s the List