Retail Clothing Giant Agrees To Hand $3,800,000 To Customers To Settle Accusations of Deceptive Practices and Hidden Fees

A billion-dollar clothing giant is preparing to pay $4.8 million to resolve accusations of deceptive practices, with $3.8 million going directly to affected customers.

TFG Holding, Inc., the parent of online fashion brands JustFab, ShoeDazzle, and FabKids, is resolving accusations that it misled customers in its VIP membership program.

Attorneys general from four US states spearheaded the investigation, saying shoppers expected one-time buys but faced recurring fees without clear warnings or easy exits.

The $3.8 million will be paid to customers across 32 states, with the remaining $1 million allocated to the participating states for investigation costs and consumer protection efforts.

TFG allegedly auto-enrolled buyers without explicit consent, violating consumer laws and effectively misrepresenting the true prices of its products. Many people discovered the extra fees too late, which AGs say were buried in fine print.

TFG denies wrongdoing but must now disclose terms upfront, secure consent and simplify cancellations.

Customers who enrolled in the VIP program before May 31, 2016, will receive automatic payments from the settlement if they made only an initial purchase, never logged in or attempted to skip a monthly charge, and did not receive or redeem a credit or refund.

The settlement applies to people in the District of Columbia, Pennsylvania, Maryland, Texas, Michigan, Alabama, Arkansas, Connecticut, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Massachusetts, Minnesota, Mississippi, North Carolina, North Dakota, New Hampshire, New Jersey, New Mexico, Nevada, Ohio, Oklahoma, Oregon, Rhode Island, Tennessee, Vermont, Washington and Wisconsin.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

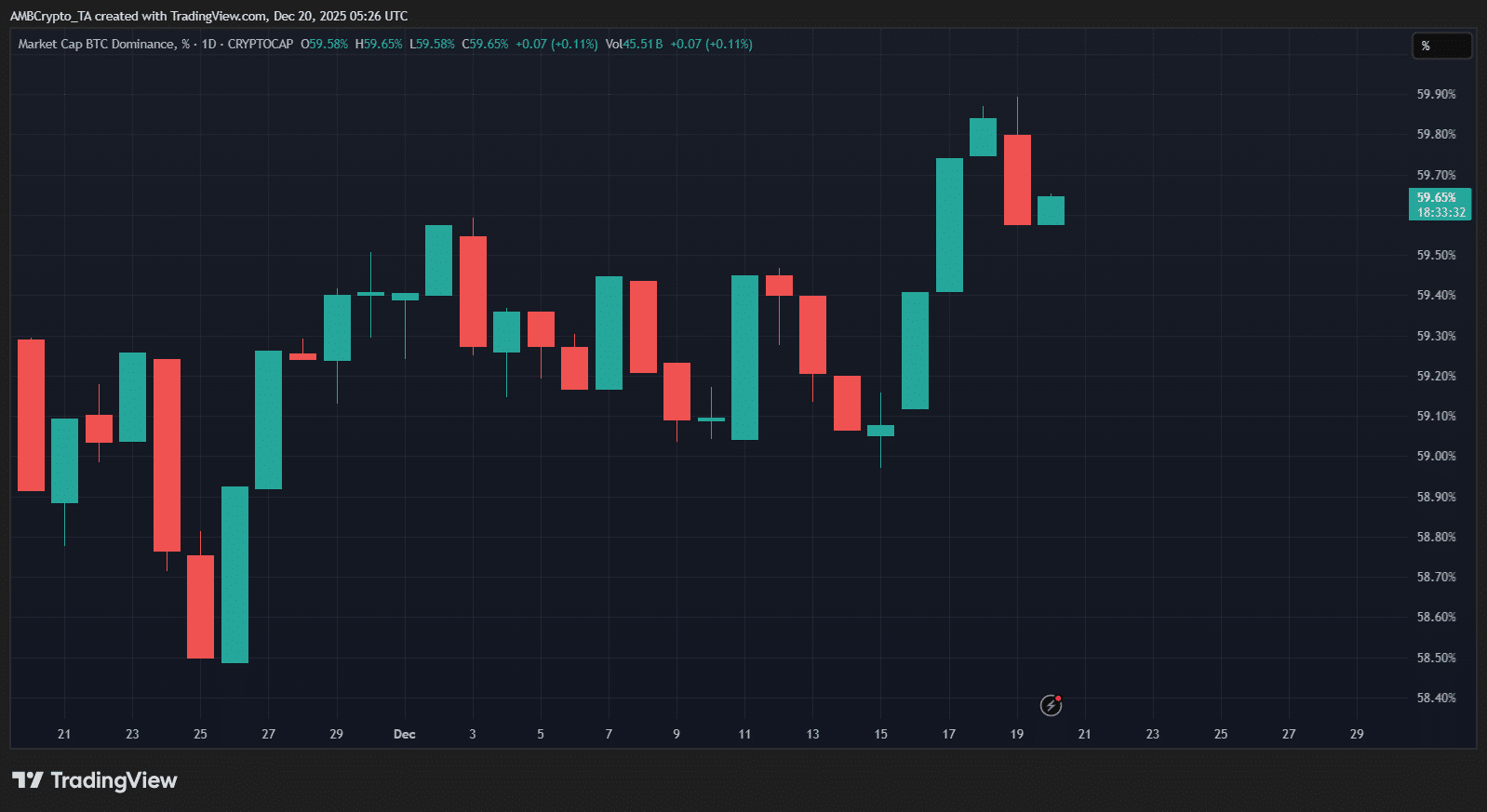

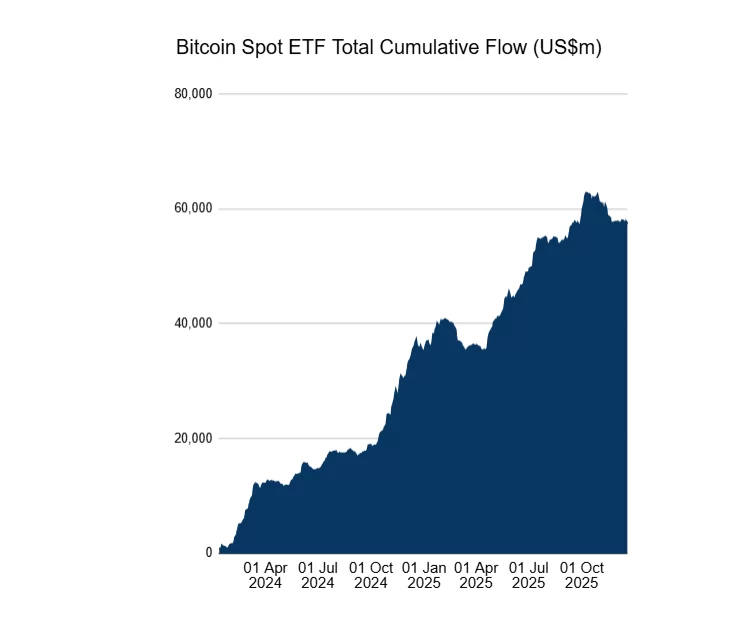

‘Altcoin season isn’t gone’ – Why 2026 may be the year to watch

Crypto Trends Capture Attention as Market Struggles

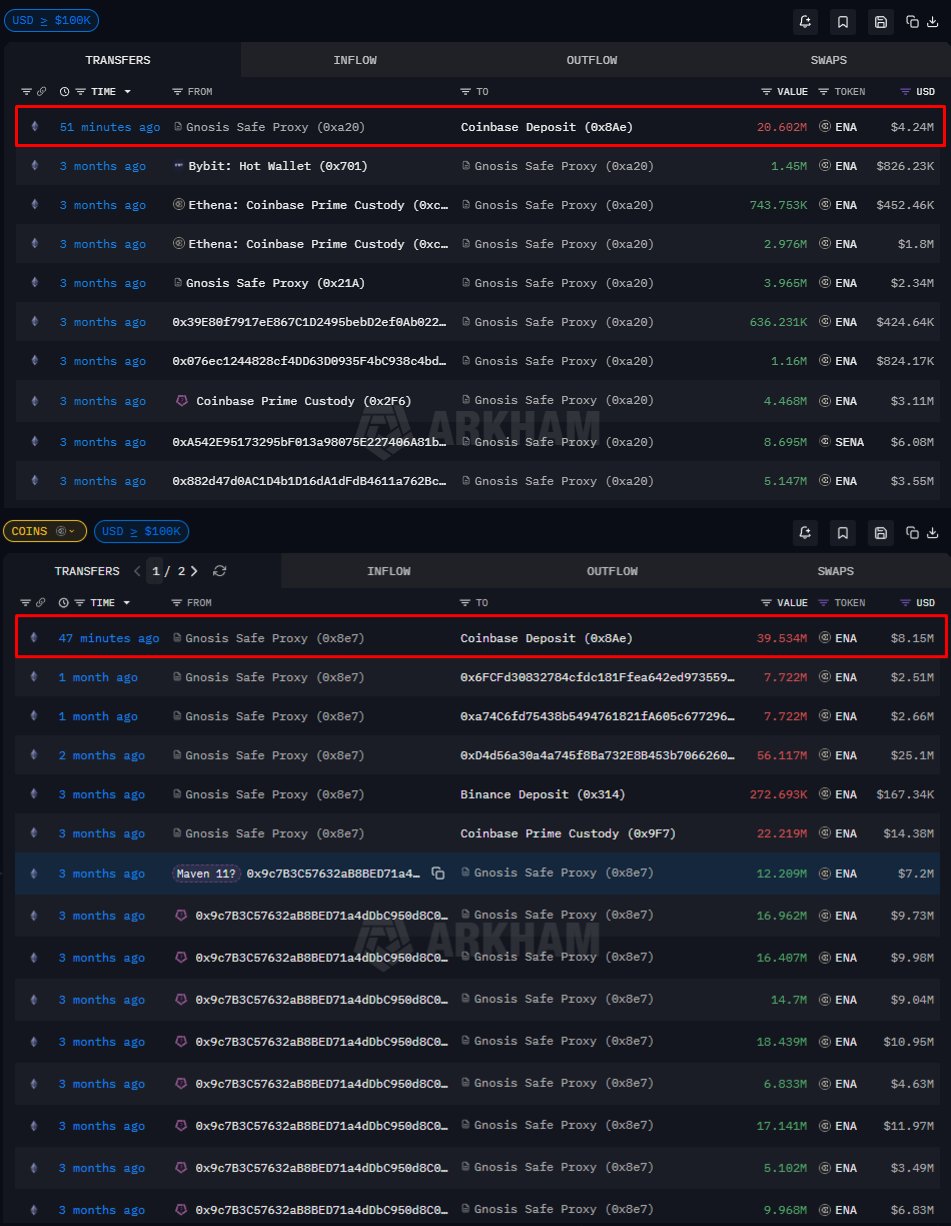

Can Ethena hold $0.20 after 101M ENA flood exchanges?

Galaxy Digital, Which Manages Billions of Dollars, Reveals Its Bitcoin, Ethereum, and Solana Predictions for 2026