Bitcoin Updates: Major Institutions Drive Crypto Adoption as Bitcoin and Ethereum Surge

- Institutional giants like JPMorgan and BlackRock drive crypto adoption through Bitcoin mining acquisitions, ETF investments, and blockchain infrastructure deals. - Bitget's 300%+ reserve coverage and Merkle-tree audits address solvency concerns, while POSCO International adopts JPMorgan's blockchain for cross-border payments. - XRP's $1B SPAC-backed treasury and DeFi innovations like Mutuum Finance signal institutional-grade utility, contrasting Ethereum's $4,000 resistance challenges. - BlackRock's 800,

The cryptocurrency sector is currently undergoing significant institutional and technological shifts, which experts describe as the most optimistic developments for

JPMorgan recently pointed out that CoreWeave’s acquisition of Bitcoin mining company Core Scientific at $20.40 per share establishes a new industry valuation benchmark, though the bank emphasized this is likely a unique case,

Confidence from large investors is further strengthened by increased transparency from leading exchanges. Bitget published its Proof of Reserves (PoR) report for October 2025, showing reserve ratios of 307% for Bitcoin, 224% for Ethereum, and over 100% for stablecoins such as

JPMorgan’s impact goes beyond mining operations. Its Kinexys blockchain payment network was recently adopted by South Korean trading powerhouse POSCO International for international payments, with a test run between Singapore and the U.S. already finished,

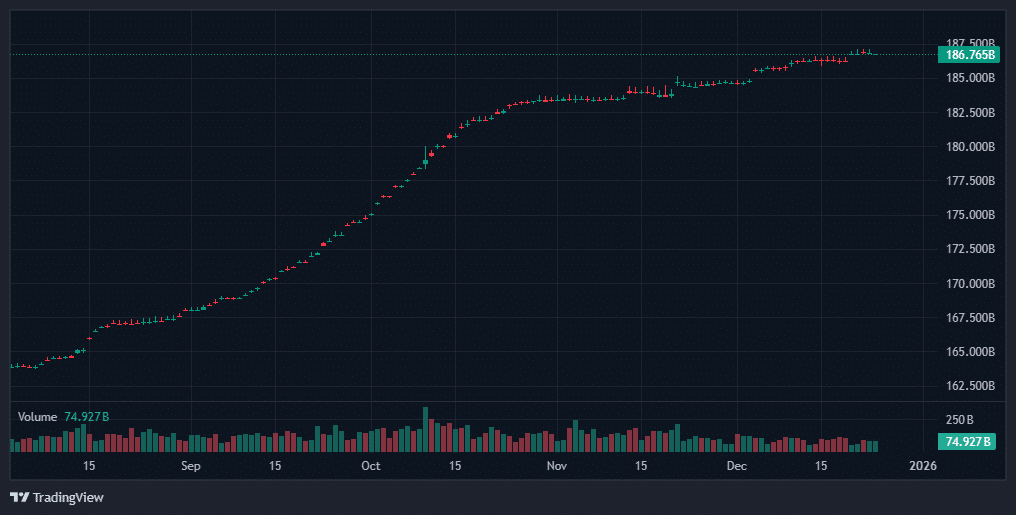

BlackRock, the largest asset manager globally, purchased an additional $211 million in Bitcoin for its spot ETF in October 2025, raising its total holdings to over 800,000 BTC,

Ethereum is currently facing short-term challenges, having failed several times recently to surpass the $4,000 mark,

Outside of Bitcoin and Ethereum, institutional interest in

Innovation in DeFi is also fueling positive sentiment. Mutuum Finance (MUTM) has wrapped up Phase 1 of its development plan, with the launch of its V1 protocol coming soon, according to

As the crypto industry adapts to clearer regulations and improved infrastructure, the combination of institutional involvement, blockchain progress, and DeFi expansion is setting up Bitcoin and Ethereum for continued growth. With influential organizations like

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US ETF Market Hits Triple Crown While BTC Bleeds and XRP Soars

Altcoin Market Cap Breaks 90-Day Downtrend: 5 Crypto Coins Worth Risking as TOTAL Eyes an 80% Upside Move

Bitcoin Price Trading Near 'Fair Value,' Says On-Chain Model

Stablecoins hit $310B ATH, but macro and regulatory questions arise