Bitcoin News Update: Bitcoin Companies Resemble REITs, Seek Returns as Premiums Decline

- Bitcoin treasury firms trade below BTC holdings as market sentiment falters, with many trading at mNAV multiples below 1x. - Companies like Semler Scientific (0.80x mNAV) and Strive (50% discount to BTC value) exemplify the sector's valuation collapse. - The model pioneered by MicroStrategy now faces sustainability challenges, shifting focus to BTC yield generation via lending or infrastructure. - Market recalibration highlights risks of speculative premiums, with future success dependent on tangible val

Bitcoin Treasury Companies Now Trading Below

Firms holding significant bitcoin reserves—once celebrated for their aggressive moves into crypto—are currently valued by the market at less than the worth of their

Semler Scientific (SMLR), which began its bitcoin treasury initiative in mid-2024, is a prime example of this shift. Despite accumulating more than 5,000 BTC, its stock price has hovered around $24, giving it an mNAV of just 0.80x. The situation is even more severe for

This trend is seen throughout the industry. Data from BitcoinQuant indicates that companies such as Capital B (ACPB), The Smarter Web Company (SWC), and H100 Group (GS9) are trading at mNAV ratios as low as 0.72x. During the summer rally, these firms were valued at much higher premiums, as highlighted by Coindesk.

The downturn marks a turning point for the bitcoin treasury approach. First popularized by MicroStrategy’s Michael Saylor, the strategy involved raising funds, converting them to BTC, and holding long-term. Now, more than 160 publicly traded companies have adopted this model, collectively holding close to 1 million BTC—roughly 4% of all bitcoin in circulation, according to

"Premium valuations may not last based solely on narratives and BTC reserves," a Yahoo Finance analysis observed. The next chapter for these companies will likely involve finding ways to generate income from their bitcoin, much like how REITs transitioned from simply owning property to producing revenue. Possible strategies include lending backed by BTC, building Lightning Network infrastructure, or creating innovative financial products. However, these paths come with risks such as counterparty issues and operational challenges, Yahoo Finance noted.

The difficulties facing the sector illustrate the struggle between speculative hype and solid financial performance. While some companies may shift toward yield-focused strategies, others could face further dilution and lower mNAV ratios. For investors, the current discounts suggest a realignment of expectations, moving away from hype and toward a focus on actual value creation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Current Correction Mirrors a Previous Bullish Fractal — Is a Reversal Ahead?

ADA Heads Toward $0.32 as BTC Sets the Tone for What Comes Next

BTC OG Insider Whale Holds $730M Long Across BTC, ETH, and SOL with $41M Unrealized Losses

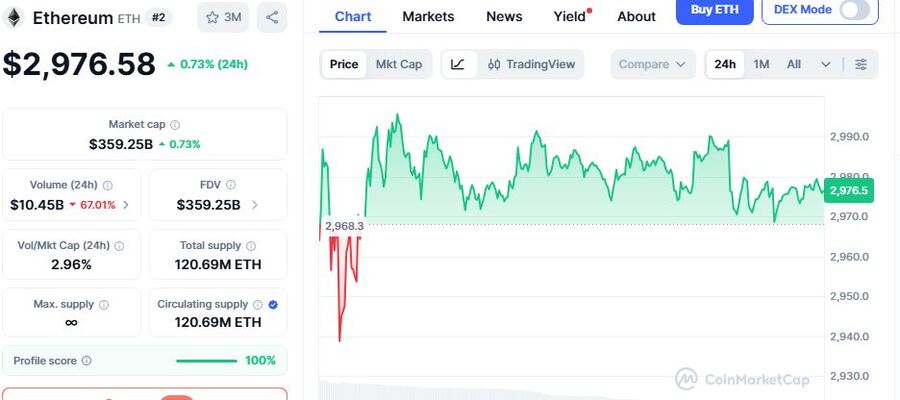

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum