Kalshi $4 Billion Volume Signals Rise of Prediction Markets

Quick Take Summary is AI generated, newsroom reviewed. Kalshi surpassed $4 billion in trading volume over the past 30 days. Expansion into sports markets boosted user engagement and trades. Partnerships with platforms like Robinhood increased accessibility. Institutional interest and global reach highlight Kalshi’s growing market impact.References JUST IN: Kalshi surpasses $4,000,000,000 in volume over the past 30 days.

Kalshi, a U.S.-based prediction market platform, has reached a huge milestone. The company reported over $4 billion in trading volume in the past 30 days, reports Whale Insider. This shows strong interest from both retail and institutional investors. The platform allows users to trade on the outcomes of real-world events. Users can buy contracts that pay out based on yes-or-no questions. Also, Kalshi’s $4 billion volume approach is different from traditional betting. It operates under CFTC regulations, providing a safe environment for trading.

JUST IN: Kalshi surpasses $4,000,000,000 in volume over the past 30 days. pic.twitter.com/vzgskDf8dO

— Whale Insider (@WhaleInsider) October 25, 2025

What Makes Kalshi Unique

Kalshi was founded in 2018 by Tarek Mansour and Luana Lopes Lara. The platform focuses on event-based markets and users can trade on politics, sports, economics and more.

The platform gives people a way to hedge risks or speculate on future events. For example, someone can bet on the outcome of a presidential election or a major sports game. This makes trading both engaging and useful.

Why Trading Volume Surged

There were a lot of reasons that made Kalshi grow. First, the company expanded into sports markets, attracting a wider audience. Now, users can trade on game results, player stats, and other events. This expansion increased activity and engagement.

Second, partnerships with apps like Robinhood made Kalshi more accessible. Reports suggest that Robinhood users make up around 25–35% of Kalshi’s daily trading volume. This integration brought new users and boosted trades.

Finally, global expansion helped too. Kalshi now operates in over 140 countries, opening doors to international traders.

Institutional Interest

Kalshi’s fast growth attracted institutional investors. The platform’s valuation doubled to $5 billion in just three months. Therefore, investors are confident in Kalshi’s business model and long-term potential.

Institutions see value in prediction markets as they give data and insights about future events. Kalshi’s growth shows that both individual and institutional investors trust its platform.

Future Growth and Opportunities

Kalshi plans to keep innovating, while trying to expand its markets more and improve accessibility. Partnerships and global outreach will continue to play a key role.

The platform also faces challenges like navigating U.S. and international regulations carefully. The company needs to manage market risks and stay competitive.

If Kalshi works well, it could become a huge player in prediction markets. The platform may attract even more users and investors. This growth could make the company’s position stronger and make event-based trading mainstream.

Kalshi’s Impact on the Prediction Market

Kalshi’s $4 billion volume in trading reflects its success. Strategic expansions, partnerships and global access fueled this growth. Both retail and institutional investors are participating more actively.

As Kalshi continues to innovate, the platform could shape the future of prediction markets. By keeping XRP active and accessible, it sets a standard for safe, engaging trading. Kalshi’s journey shows that event-based trading is becoming a major part of the financial ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC OG Insider Whale Holds $730M Long Across BTC, ETH, and SOL with $41M Unrealized Losses

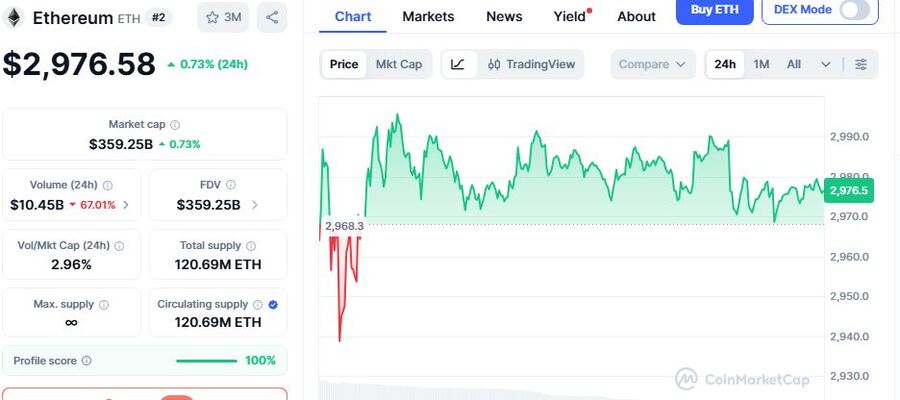

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum

Digital Renminbi Fraud Traps: How Scammers Push Wallet Schemes and How to Protect Your Funds