SHIB's Blockchain Departure: Sign of Optimism or a Bear Market Snare?

- Shiba Inu (SHIB) saw 289B tokens exit exchanges in one day, signaling reduced selling pressure and long-term accumulation. - On-chain data shows exchange reserves dropped to 81.9T SHIB, with investors shifting tokens to private wallets amid bullish sentiment. - Technical indicators highlight SHIB's $0.0000100 price struggle, oversold RSI (37), and unbroken resistance at $0.0000119-$0.0000121. - Analysts warn of bearish risks if SHIB breaks below $0.0000095 support, despite broader crypto market optimism

Shiba Inu (SHIB) has experienced a notable change in its market landscape, with more than 289 billion tokens leaving exchanges within a single day. This movement hints at possible long-term holding and a decrease in immediate selling pressure. Data from CryptoQuant shows that this withdrawal, which accounts for about 1.45% of the monitored supply, has lowered exchange reserves from 85.5 trillion to 81.9 trillion

From a technical perspective, SHIB faces a challenging setup. The token is currently trading inside a descending wedge, with its price hovering around $0.0000100 and struggling to move above the 200-day moving average at $0.0000130, according to TradingView. The Relative Strength Index (RSI) is at 37, which points to oversold conditions and suggests a possible short-term bounce to the $0.000011–$0.000012 range if buying interest picks up. Still, overall market caution remains, as SHIB has not yet managed to break through important resistance at $0.0000119 and $0.0000121, as highlighted by NewsBTC.

Although the recent outflows may suggest a stabilizing trend, some experts warn against excessive optimism. SHIB's price is still at risk of falling below the crucial support level of $0.0000095, which has been tested several times this month, TradingView notes. On-chain data also reveals that netflow remains nearly neutral, with exchange inflows and outflows almost equal at -0.34%. This balance indicates that investors are hesitant, with no major whale buying or selling impacting the market.

The overall crypto environment further complicates SHIB’s prospects. Ethereum’s recent recovery and Bitcoin’s steady performance have sparked renewed attention in mid-cap altcoins like SHIB. At the same time, institutional activities—such as a $500 million capital injection into Ethereum-based DeFi projects—point to strengthening fundamentals in the ecosystem. However, SHIB’s lack of distinctive utility compared to other tokens makes it more vulnerable to broader economic changes and speculative trading.

Currently, SHIB’s trajectory depends on two main factors: continued accumulation on-chain and a decisive move above $0.0000112. Should SHIB hold above $0.0000095 while trading volume rises, bulls could drive the price toward $0.0000120, according to TradingView. Conversely, if support fails, a drop to $0.0000090 could occur, potentially intensifying bearish sentiment, as NewsBTC warns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

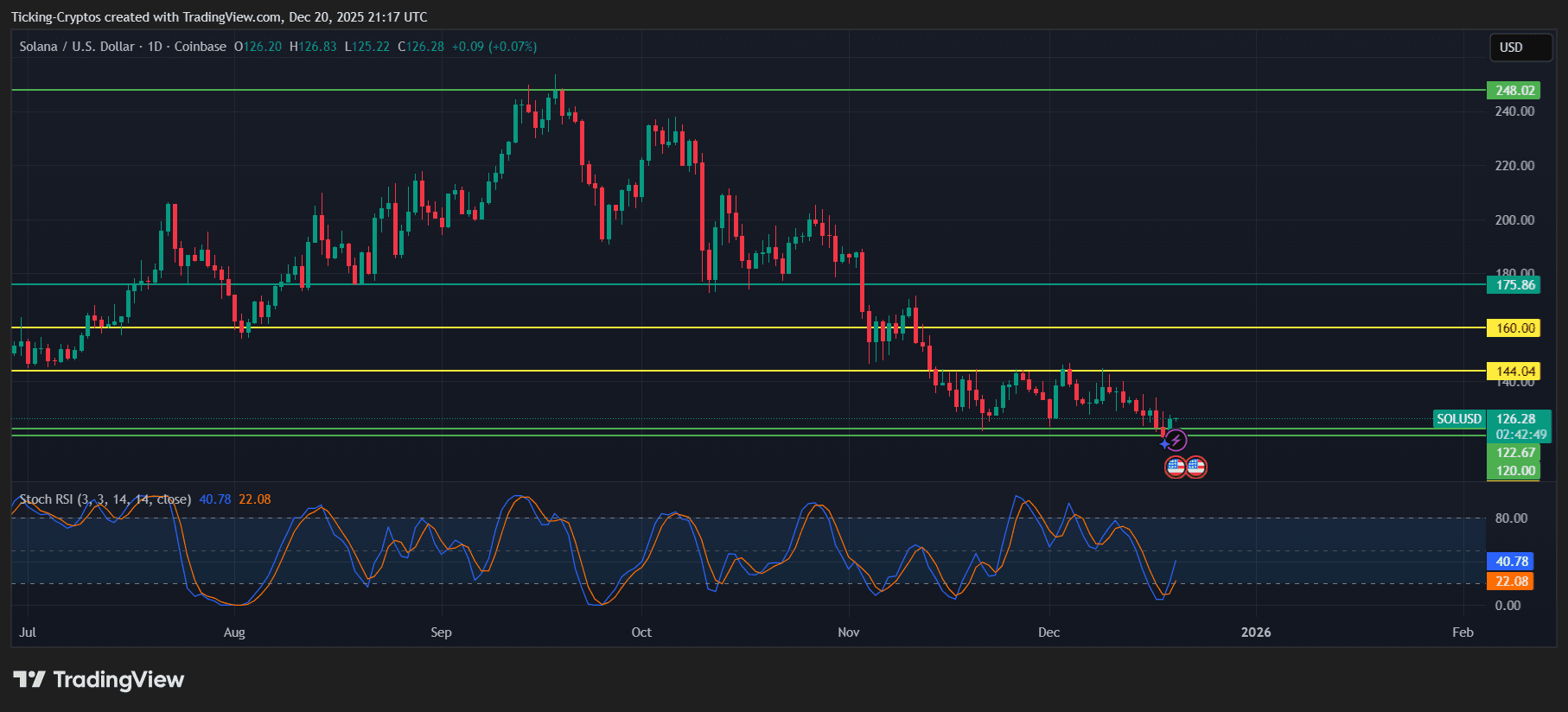

Solana Price Depends On Existing SOL Holders, Here’s Why

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels

Banks Need XRP To Be Pricier—Here’s Why A Finance Expert Says So

Midnight Blockchain Draws Attention with Record Trading Volume and Strategic Partnerships