Fed Faces Rate Decision: Is a Cut Possible Without Key CPI Insights?

- U.S. Federal Reserve faces delayed September CPI release due to 22-day government shutdown, complicating inflation assessment ahead of October FOMC meeting. - ADP employment data gap forces reliance on alternative metrics, with Fed Chair Powell acknowledging limitations in private-sector data substitutes. - Markets price 98.9% chance of 25-basis-point rate cut, but hotter-than-expected CPI could delay action, triggering market volatility and global dollar impacts. - Mixed market reactions include a stron

The U.S. Federal Reserve is at a pivotal moment as financial markets await the postponed September Consumer Price Index (CPI) figures, now scheduled for release on October 24, 2025. This delay, caused by a 22-day government shutdown, has left Fed officials without crucial private-sector employment data from ADP, as reported by the Wall Street Journal

, making it harder for them to evaluate inflation trends before the Federal Open Market Committee (FOMC) meets on October 28-29. With inflation persisting above the Fed’s 2% goal and mixed signals from the job market, investors are closely monitoring for any indication of whether the central bank will move forward with a rate reduction.The CPI delay has become a central issue for investors, who, according to CBS News, are already factoring in a 98.9% chance of a 25-basis-point rate cut at the upcoming FOMC gathering

. Projections suggest the headline CPI will climb 3.1% year-over-year, just under August’s 3.1% estimate but still above the Fed’s target, as noted by Yahoo Finance . This pattern points to inflation stabilizing after a period of volatility, with some economists attributing the moderation in price increases to President Donald Trump’s tariff measures, according to Newsmax . Still, the Fed’s policy choices are further complicated by the shutdown, which has disrupted normal data collection and forced reliance on alternative indicators, as highlighted by the Wall Street Journal.The shutdown has heightened uncertainty, as the Bureau of Labor Statistics (BLS) has been unable to publish key employment figures, the Wall Street Journal noted. ADP’s move to stop sharing data with the Fed—a practice that had been in place for years—has made it even more difficult for policymakers to assess private-sector hiring, the Journal reported. Fed Chair Jerome Powell has admitted these challenges, stating that while private data can serve as “fairly good substitutes,” they cannot fully replace official government reports. Without comprehensive data, analysts told Newsmax, the Fed risks making decisions with limited visibility as it tries to balance inflation management with labor market health.

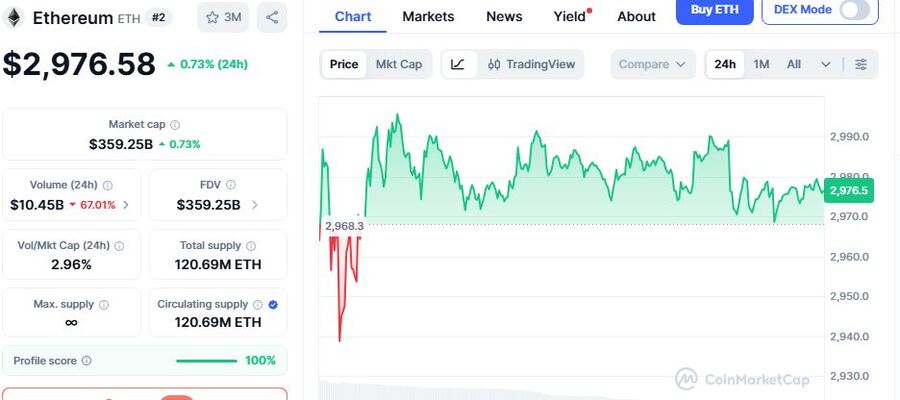

Market responses to the prevailing uncertainty have been varied. The U.S. Dollar Index (DXY) has climbed past 98.60, signaling renewed faith in the dollar amid easing trade frictions and expectations of Fed rate cuts, according to StreetInsider

. Meanwhile, Treasury yields have moved downward, with the 10-year yield falling to 3.949% as investors anticipate monetary easing, Reuters reported ( ,2025:newsml_L1N3W30QK:0-us-yields-dip-in-line-with-broad-trend-after-20-year-bond-auction/). In contrast, cryptocurrencies have outperformed, with the total crypto market capitalization increasing by 1.4% to $3.74 trillion as traders position for Fed easing, according to TradingView .The outcome of the CPI release is expected to have significant consequences. If inflation comes in higher than anticipated, the Fed may delay cutting rates, which could trigger volatility in both stock and bond markets. On the other hand, a softer inflation reading could strengthen the case for a rate cut, boosting risk assets and easing upward pressure on the dollar. Companies are already preparing for different outcomes: financial institutions like JPMorgan Chase (JPM) could benefit from prolonged higher rates, while global firms such as Apple (AAPL) may face challenges from a stronger dollar, as noted by StreetInsider.

With the October 24 CPI report approaching, the Fed’s challenge of balancing inflation and employment remains at the forefront. As signs point to a cooling labor market and inflation edging up, policymakers must carefully consider the trade-offs between tightening policy and holding steady. The decision will influence not only U.S. monetary policy but also global financial markets, where a stronger dollar could put pressure on emerging economies and increase debt servicing costs, StreetInsider warned. For now, market participants are focused on Friday’s data, seeking direction in an environment marked by ongoing uncertainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC OG Insider Whale Holds $730M Long Across BTC, ETH, and SOL with $41M Unrealized Losses

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum

Digital Renminbi Fraud Traps: How Scammers Push Wallet Schemes and How to Protect Your Funds