Crypto Giants Secure MiCA Licenses for EU Expansion

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- MiCA licenses issued by EU regulators.

- Enhanced crypto access in the EU region.

Blockchaindotcom, Relai, and Revolut have secured MiCA licenses, enabling regulated crypto services across the EU. This regulatory achievement allows increased crypto trust, with key leaders highlighting new compliance opportunities and broader market access for Bitcoin and Ethereum.

MiCA licensing for Blockchaindotcom, Relai, and Revolut is notable for expanding regulated crypto offerings in the EU, promising increased financial innovation and growth.

Blockchaindotcom, founded in 2011, Relai, established in 2020, and Revolut, headquartered in the UK, have all secured MiCA licenses enabling them to operate under a unified regulatory framework. This development allows them to legally offer a broader range of crypto services across the EU.

Blockchaindotcom received approval from Maltese regulators, whereas Relai and Revolut were licensed in France and Cyprus, respectively. Their efforts focus on enhancing consumer confidence and facilitating broader access to cryptocurrencies in the European Union.

“We are very proud to be among the first to receive the MiCA license, allowing us to offer regulated Bitcoin services throughout Europe. Our goal is to make Bitcoin simple, safe, and accessible for as many people as possible.” – Julian Liniger, Co-Founder CEO, Relai

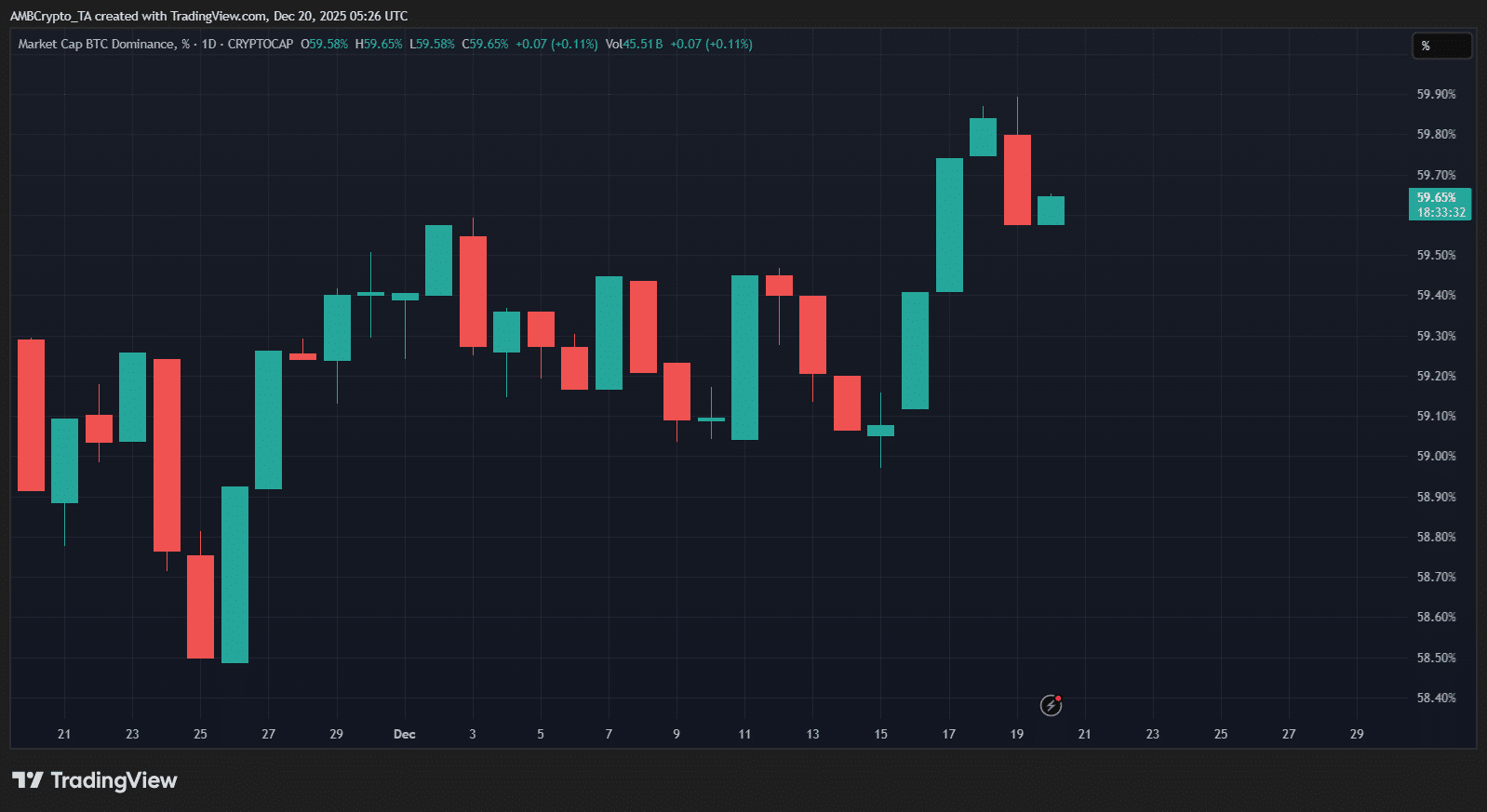

With these licenses, the companies aim to increase user engagement and trust owing to enhanced legal certainty. A notable market impact is expected as these firms expand their services while complying with EU standards.

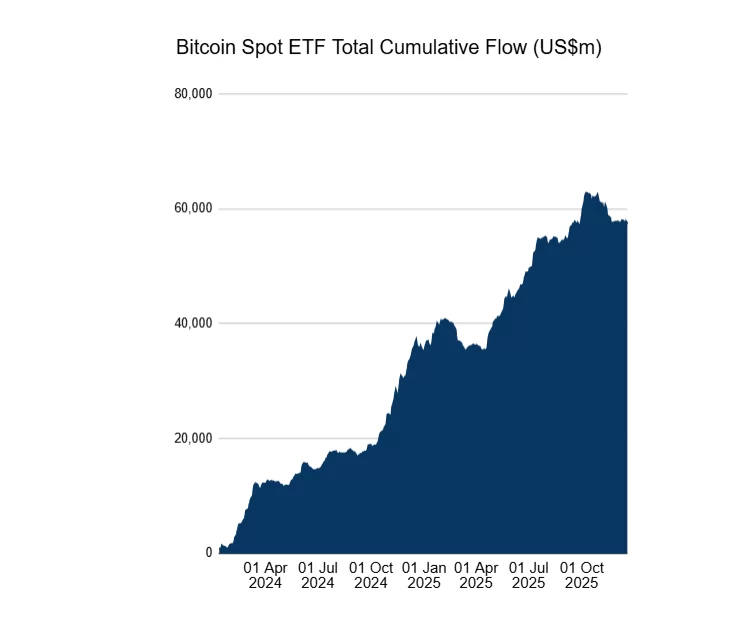

Economists anticipate heightened financial activity and market trust through these newly regulated services, potentially augmenting cryptocurrency flows involving Bitcoin, Ethereum, and other prominent tokens across European markets.

This collated approach by crypto firms indicates a shift towards more robust regulatory compliance, addressing investor protection while fostering technological advancement. Historical trends from other regulatory frameworks suggest an impending surge in user adoption and transaction volumes within regulated parameters by crypto giants .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fundstrat warning and market upheaval: What are the prospects before 2026?

a16z: 17 Exciting New Crypto Directions for 2026

‘Altcoin season isn’t gone’ – Why 2026 may be the year to watch

Crypto Trends Capture Attention as Market Struggles