Short Squeezes and Meme Tokens: Is the Wild Ride of 2021 Making a Comeback or Falling Apart?

- Retail investors and social media are driving a GME-style short squeeze in Beyond Meat (BYND), surging 146% amid 63% shorted shares. - Meme coins like GameStop Coin (GME) and Axolotl Token (AXOME) mirror stock volatility, with AXOME surging 37x before stabilizing. - Base Protocol tokens (PING, CLANKER) see sharp gains from tokenomics upgrades, while crypto analysts warn of speculative risks and lack of utility. - Cross-market parallels to 2021's frenzy emerge, but experts caution smaller scale and emphas

Once again, retail traders and hype fueled by social media are causing turbulence in the markets,

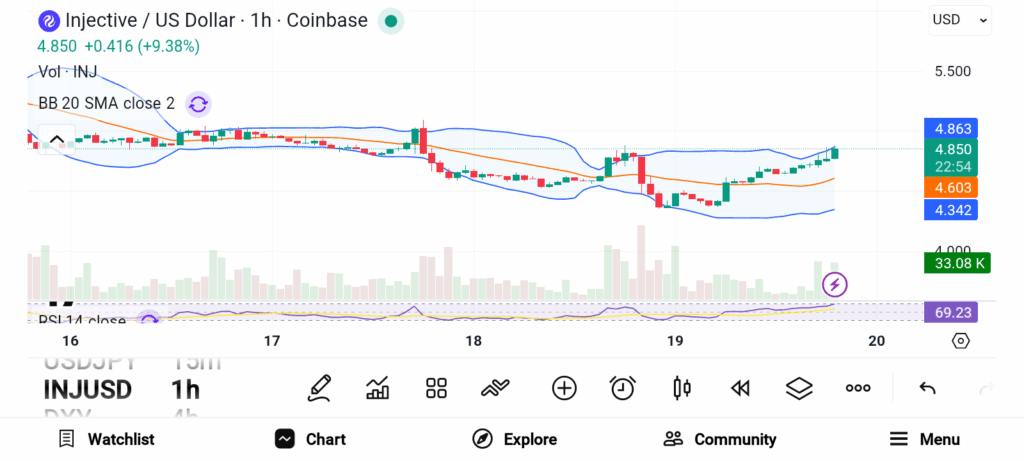

Meanwhile, in the world of cryptocurrencies,

The Base Protocol ecosystem is also seeing heightened activity. PING, a token from the x402 protocol, posted a 970% gain in just 24 hours, pushing its market cap above $36 million, according to a

There are clear links across markets. BYND’s rally has influenced crypto, with traders comparing it to meme coins such as

With the speculative frenzy ongoing, prudence is advised. “This isn’t 2021,” cautioned a Reddit user, pointing out that WallStreetBets and similar forums are limiting

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Smart Money Is Accumulating These 3 Altcoins Ahead of Potential 300% Runs

Essential Guide: Bitcoin World’s 24/7 Cryptocurrency News Service Hours Revealed

Tether Hires Chief Software Engineer to Develop AI-Driven Mobile Wallet Powered by WDK and QVAC