AI-powered Growth in Crypto Faces Regulatory and Operational Challenges

- PING token surged 802% in 24 hours, driven by Coinbase's x402 AI protocol, reaching $33M market cap. - Binance-linked YZi Labs invested $25.5M in Sign, while Binance faces lawsuits over October 11 liquidation crisis. - Malta rejected Binance's $39M BNB donation over privacy risks; Kadena (KDA) halted operations, causing 40% price drop. - Hyperliquid hit $1.3T trading volume in October; Tether's USDT surpassed $160B market cap. - Analysts warn of meme coin risks and centralized fragility as crypto navigat

Late October saw the cryptocurrency sector undergo sharp price swings, influenced by a combination of strategic investments, regulatory hurdles, and operational setbacks. One of the most notable events was the dramatic ascent of the PING

The surge in PING’s value happened alongside broader changes in the crypto industry. YZi Labs, previously known as Binance Labs and associated with Binance, invested $25.5 million in

Regulatory disputes also escalated. Malta turned down a $39 million

The rapid growth of decentralized trading platforms further demonstrated the industry’s vitality. Hyperliquid set new records in October, achieving $1.3 trillion in perpetual trading volume, with a single-day high of $78 billion, according to a

CryptoNews report . This achievement points to rising interest in on-chain derivatives, as traders look for leveraged opportunities without direct ownership of assets. Meanwhile, Tether’sNevertheless, significant risks remain. The wild price swings of the PING token reflect broader worries about

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Big Bull Cathie Wood Discusses Bitcoin Price: “The Four-Year Cycle Is No More”

New Arbitrum Wallet Executes TWAP to Buy $2M Worth of HYPE Tokens While Holding About $7M USDC

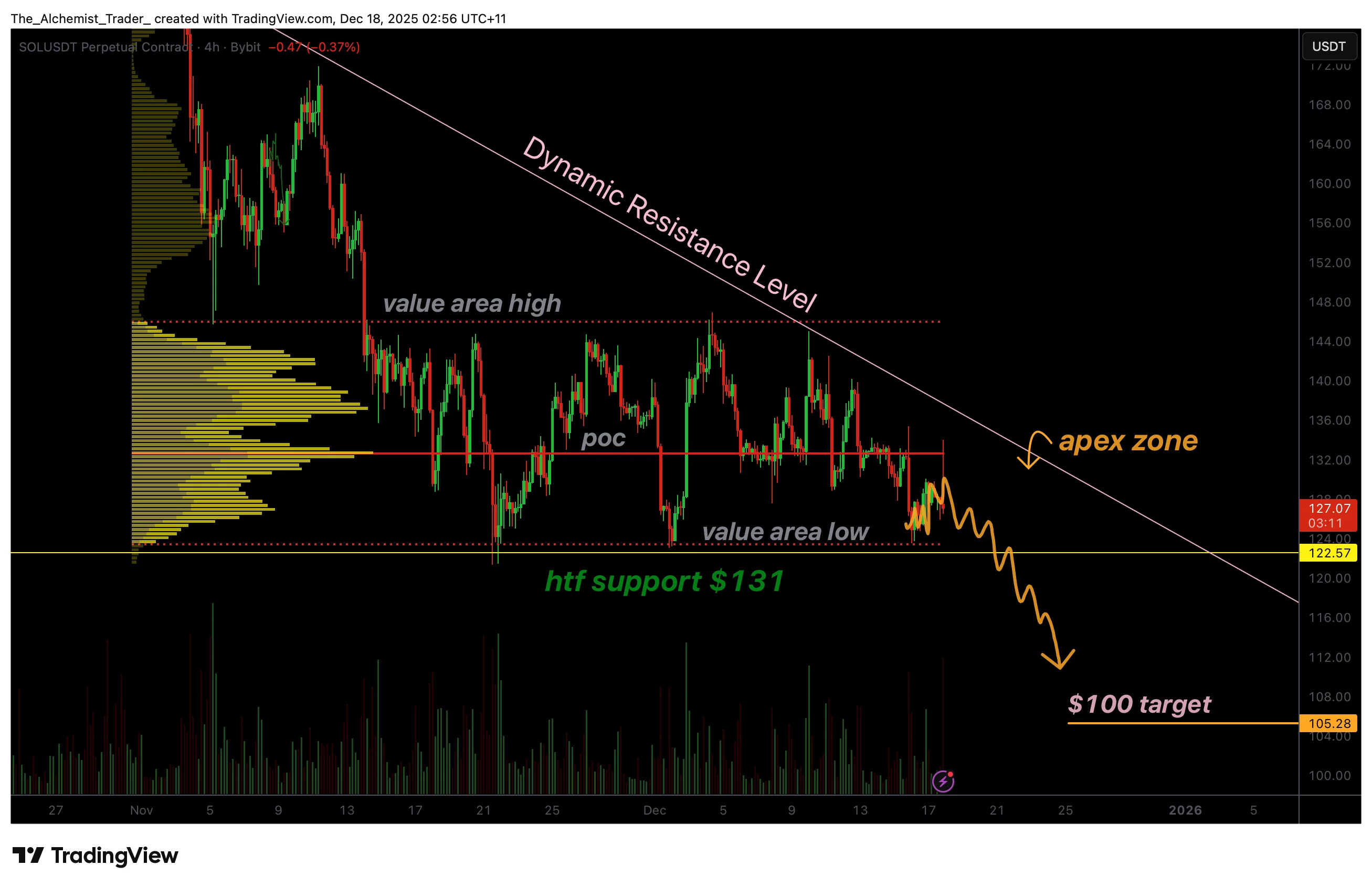

Solana price compresses into triangle apex, breakout risk builds

Ethereum price forms an ABCD correction pattern, putting $2,500 in focus