$69,713 Per Second : How Fast U.S. Debt Is Growing ?

In the midst of budget paralysis, the US public debt reaches 38 trillion dollars, a historic record. This threshold, revealed by the Treasury, raises questions about the budget trajectory of the United States, as monetary policy remains under pressure and crypto regulation remains unclear.

In Brief

- The United States crosses a historic record with 38 trillion dollars of public debt, amid a partial government shutdown.

- The debt has increased by 1 trillion dollars in less than two months, an unprecedented acceleration outside of the pandemic period.

- Experts warn of the consequences: increased inflation, higher borrowing costs, and an explosion of interest charges to come.

- The administration claims to have reduced the deficit to 468 billion dollars, thanks to a policy of budgetary austerity.

The US Debt Crosses a Historic Threshold

The gross US debt surpassed this week the threshold of 38 trillion dollars, a rapid increase marking “the fastest accumulation of a trillion dollars outside the pandemic”, according to the Treasury report .

The country reached 37 trillion last August, meaning that an additional trillion was added in less than two months. This steep rise occurs even as the federal administration undergoes a shutdown due to a political deadlock over the budget. The Congressional Joint Economic Committee calculated that the debt is currently increasing at the rate of $69,713.82 per second.

The economic consequences of this dynamic are widely documented by experts :

- Increased inflation and reduced purchasing power : “this additional inflation accumulates and erodes consumers’ purchasing power”, explains Kent Smetters from the University of Pennsylvania, discussing the impact on younger generations’ ability to own homes ;

- Rising borrowing costs for households : the Government Accountability Office warns about the mechanical effect of high debt on mortgage and auto loan interest rates ;

- Reduced private and public investments : a growing share of available resources is absorbed by debt, to the detriment of the real economy ;

- An explosion of interest charges to come : “we spent 4 trillion dollars on interest over the last decade, but will spend 14 trillion in the next ten years”, says Michael Peterson of the Peterson Foundation.

Trump, Bessent and the Promise of a Shift to the Right in Fiscal Policy

In this highly volatile budget context, Scott Bessent, Treasury Secretary and former hedge fund manager, stated Wednesday that the US deficit was brought down to 468 billion dollars between April and September 2025, “the lowest level since 2019”.

The White House, through spokesperson Kush Desai, claims that this improvement is the result of a policy combining “spending cuts and revenue increases”, and promises to continue this strategy with “robust economic growth, lower inflation, increased customs revenues, reduced borrowing costs, and a fight against waste and fraud”.

Contrary to warnings by several economists, the Trump administration presents these results as signs of prudent management. However, this interpretation questions the real sustainability of the long-term budget strategy, especially if interest rates remain high.

The choice of Scott Bessent, a figure from speculative finance, may also indicate an intention to strengthen deregulation, which could influence financial regulation and thus the crypto environment. Even though no direct statements about cryptos, particularly bitcoin, have been made at this stage, this more liberal economic direction could affect risk perception by investors and the dollar’s role as the world reserve currency.

In the medium term, this fiscal positioning could cause tensions with the Federal Reserve or reignite a showdown over the debt ceiling, with systemic consequences on global markets. In this uncertain context, some sector players already see bitcoin or other assets as safe havens in case of a shock to US sovereign debt.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

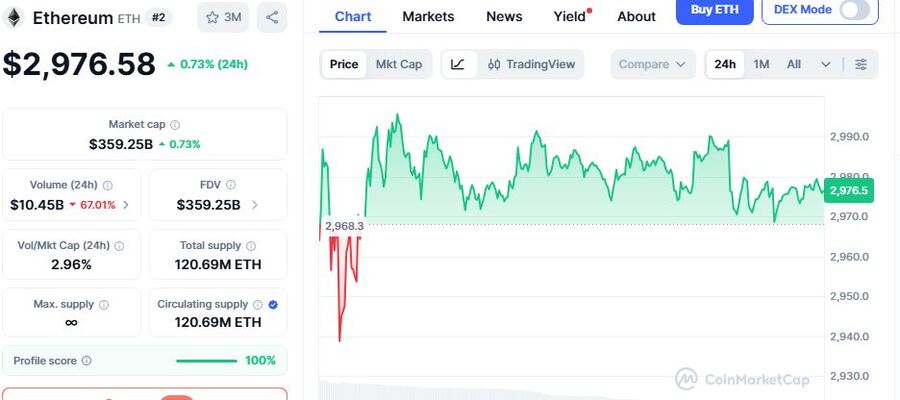

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum

Digital Renminbi Fraud Traps: How Scammers Push Wallet Schemes and How to Protect Your Funds