XRP News Today: Ripple Quietly Acquires Hidden Road: A Regulatory Gateway for Banks to Enter Blockchain

- Ripple acquires Hidden Road to integrate prime brokerage services, expanding its blockchain infrastructure for institutional finance. - The deal follows a partnership with BNY Mellon managing RLUSD, now valued at $898M, enabling stablecoin-driven cross-border solutions. - Critics question Ripple's regulatory viability, but the company defends its approach by aligning with traditional banks' digital asset strategies. - Ripple's pursuit of a U.S. bank charter and strategic acquisitions aims to bridge legac

Ripple, a leader in blockchain-based payments, has finalized its purchase of Hidden Road, aiming to incorporate prime brokerage capabilities into its digital ecosystem. This acquisition, which aligns with Ripple’s ongoing mission to connect conventional finance with blockchain innovation, highlights the increasing demand among institutions for regulated digital asset services. Utilizing Hidden Road’s strengths in custody and regulatory compliance, Ripple intends to deliver a comprehensive platform for banks and financial firms to facilitate international payments, stablecoin transactions, and asset tokenization, as reported by

This deal comes after Ripple’s July 2025 alliance with BNY Mellon to oversee its RLUSD stablecoin, a digital currency pegged to the U.S. dollar and built for instant settlements. The partnership has helped RLUSD become a significant force in the stablecoin market, with its total value recently exceeding $898 million—a growth rate that has surpassed tokens such as

Despite these advances, some remain unconvinced. Tom Zschach, SWIFT’s Chief Innovation Officer, has expressed doubts about Ripple’s capacity to earn client confidence and regulatory clearance, suggesting the company lacks the resources and infrastructure to rival established financial networks. Ripple has countered these claims, with crypto attorney Bill Morgan pointing out that Ripple’s strategy reflects the ongoing integration of digital assets by traditional banks. “Ripple is simply speeding up a movement that banks have already started,” Morgan remarked, referencing Hidden Road’s network of 1,000 institutional clients in 160 countries, as noted by Coinpedia.

Ripple’s goals go further than stablecoins. The company has submitted an application for a national banking license in the U.S., which would enable it to function as a fully regulated bank. This move follows a series of targeted acquisitions, such as Rail and Hidden Road, that have broadened Ripple’s expertise in treasury operations and compliance. CEO Brad Garlinghouse has highlighted the company’s mission to “bridge the gap between traditional finance and digital assets,” a vision that now includes prime brokerage services designed for institutional investors, according to Coinpedia.

The market’s response has been notable. RLUSD’s swift climb to 74th place among global cryptocurrencies signals robust institutional uptake, supported by partnerships with organizations like DBS and Franklin Templeton. These alliances facilitate tokenized asset trading and lending, further establishing Ripple’s influence in transforming international banking. With its custody solutions and regulatory focus, Ripple is positioning itself not only as a blockchain pioneer but also as a key architect of the future financial landscape, as highlighted by CoinCentral and Coinotag.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP and TRON Surge, But Apeing Takes the Lead as the Top Upcoming Crypto Nearing $0.0001

Here’s how Euro stablecoins hit $1B despite weak hype

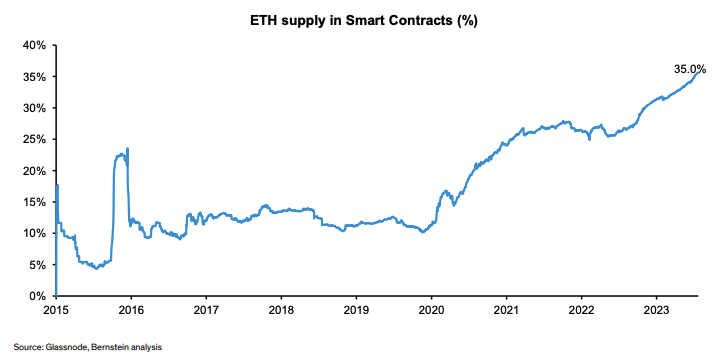

Prospect of spot ETFs not behind ether’s break above $3,000: Bernstein

Yuga Labs protects NFT royalties ahead of Magic Eden's Ethereum marketplace launch