Tether Seeks to Democratize AI, Returning Power to the People

- Tether launches QVAC Genesis I (41B-token synthetic dataset) and QVAC Workbench, aiming to decentralize STEM-focused AI development by enabling on-device training and reducing cloud dependency. - The tools prioritize data privacy through local processing, supporting open-source models like Llama and Medgemma while targeting improved AI precision in math, physics, and medicine. - CEO Paolo Ardoino emphasizes "returning intelligence to the people," aligning with Tether's blockchain expertise to shift AI in

Tether, a leading name in stablecoins, has made a significant entry into the artificial intelligence sector by launching QVAC Genesis I—a synthetic dataset containing 41 billion tokens, crafted to advance AI training in the STEM (science, technology, engineering, and mathematics) disciplines,

. Developed by Tether’s AI branch, QVAC, this dataset is intended to decentralize AI innovation by supporting model training and inference directly on users’ devices, thereby minimizing dependence on centralized cloud platforms.QVAC Genesis I is specifically designed to boost the accuracy and reasoning abilities of AI models in areas like mathematics, physics, biology, and medicine. According to benchmarks shared by

, the dataset demonstrates impressive results across these fields, making it a promising resource for developers aiming to create specialized AI solutions. Alongside the dataset, Tether has introduced QVAC Workbench, a local AI application that enables users to train and interact with models on their own devices. This tool is compatible with widely used open-source models such as Llama, Medgemma, Qwen, and Whisper, and it prioritizes privacy by ensuring all data processing remains on-device.

Paolo Ardoino, Tether’s CEO, highlighted the broader vision behind this move: to “give intelligence back to the people” by decentralizing both AI ownership and computation. He stressed that “intelligence should not be centralized,” underlining Tether’s dedication to moving AI infrastructure away from corporate-controlled clouds and onto personal devices. This initiative is part of Tether’s broader strategy to expand beyond stablecoins and position itself at the crossroads of cryptocurrency and decentralized AI technology.

This development mirrors a wider movement in technology to make AI development more accessible. By offering a large-scale synthetic dataset and an easy-to-use training platform, Tether seeks to reduce obstacles for developers and researchers who may not have access to costly cloud services. The emphasis on on-device computation with QVAC Workbench also tackles privacy issues by removing the need to send sensitive information to external servers.

Tether’s exploration of AI builds on its previous work in decentralized technologies. Last year, the company launched an open-source Wallet Development Kit (WDK) to support the creation of secure, self-custodial wallets for people, machines, and AI agents. This new project extends that groundwork, utilizing Tether’s blockchain expertise to foster a more inclusive AI environment.

Industry observers point out that the launch of QVAC comes at a time of growing enthusiasm for open-source AI and decentralized tech. By supplying a comprehensive dataset and supporting infrastructure, Tether may appeal to developers looking for alternatives to closed AI ecosystems. Nonetheless, the company still faces hurdles, such as proving the real-world effectiveness of models trained with QVAC Genesis I and encouraging widespread use of the Workbench application.

As artificial intelligence continues to develop, Tether’s strategy highlights a larger trend toward decentralization and broader access. With its established presence in stablecoins, Tether is well-positioned to drive new advancements in AI, potentially transforming how people and organizations engage with intelligent technologies.

: Tether Unveils Synthetic AI Dataset to Democratize STEM

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Current Correction Mirrors a Previous Bullish Fractal — Is a Reversal Ahead?

ADA Heads Toward $0.32 as BTC Sets the Tone for What Comes Next

BTC OG Insider Whale Holds $730M Long Across BTC, ETH, and SOL with $41M Unrealized Losses

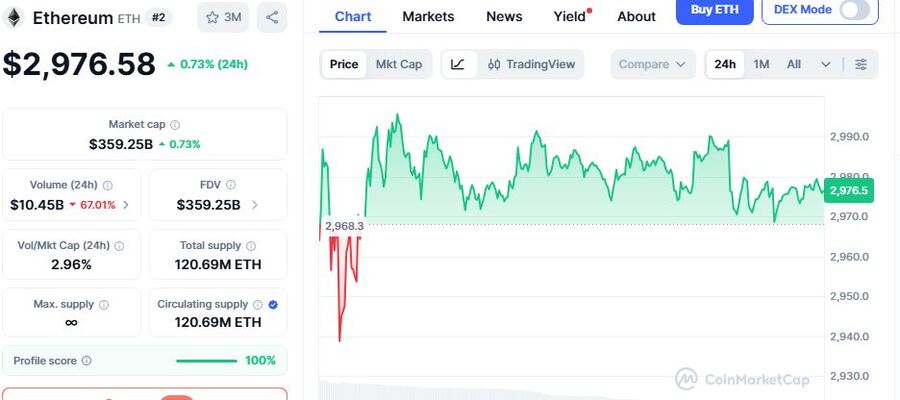

Ethereum New Wallet Addresses on Spike As ETH Consolidates at $2,977, Suggesting Looming Market Momentum