PBOC Leverages Technology in Financial Sector to Safeguard China's Economic Prospects

- China's PBOC prioritizes tech-driven finance, digital yuan (ECurrency), and "Five Major Articles" to align financial reforms with real economy needs. - Strategic focus supports semiconductors, EVs, AI, and clean energy sectors under the five-year plan to reduce foreign tech reliance and boost competitiveness. - Digital currency research aims to streamline transactions, enhance policy effectiveness, and position China as a CBDC innovation leader amid global trends. - Inclusive/green finance initiatives ad

The People's Bank of China (PBOC) has ramped up its initiatives to better integrate financial services with the broader economy, placing a strong emphasis on advancing technological innovation and the development of digital currency. During a recent Party Committee gathering, the central bank detailed its intentions to further financial supply-side structural reforms, with a particular focus on the "Five Major Articles": technological finance, green finance, inclusive finance, pension finance, and digital finance, as reported by a

The PBOC's objectives are in step with the broader national priorities set forth in China's latest five-year development blueprint, according to

The emphasis on technological finance is especially relevant as China seeks to lessen its dependence on imported technology and strengthen its domestic manufacturing capabilities. The PBOC's measures are anticipated to benefit industries such as artificial intelligence, biotechnology, and renewable energy—sectors identified in the five-year plan as crucial for sustaining global competitiveness, according to the UNN report. At the same time, the central bank's dedication to inclusive and green finance supports China's dual objectives of promoting social fairness and environmental responsibility.

Incorporating digital currency research into the PBOC's agenda underscores its resolve to upgrade the nation's financial systems. The ECurrency project, which represents China's digital yuan, aims to simplify transactions, improve the effectiveness of monetary policy, and lower systemic risks. This initiative is part of a global movement toward central bank digital currencies (CBDCs) and signals China's intent to be at the forefront of financial technology, as highlighted in the LookonChain report.

The PBOC's recent moves come as China faces a challenging economic climate, including a cooling property sector and demographic headwinds. While the five-year plan stresses "sustainable and healthy" development without specifying GDP targets, experts estimate that annual growth of about 4.5% will be required to double GDP by 2035 from 2020 levels, according to the UNN report. The central bank's policies are designed to reinforce domestic demand—a key focus of the plan—while tackling structural issues through targeted financial reforms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CPI Day Volatility Play: 5 Altcoins to Watch as Inflation Data Sparks Sharp Market Moves

XRP and TRON Surge, But Apeing Takes the Lead as the Top Upcoming Crypto Nearing $0.0001

Here’s how Euro stablecoins hit $1B despite weak hype

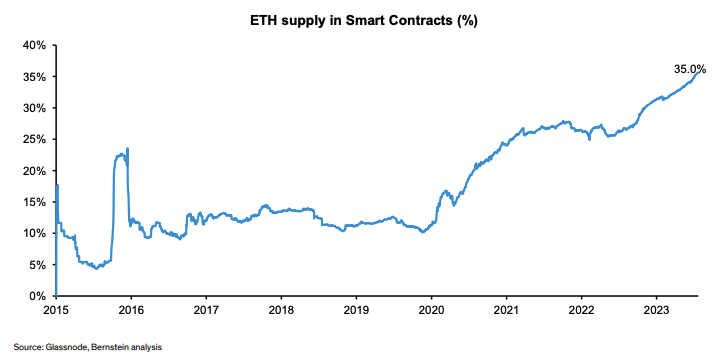

Prospect of spot ETFs not behind ether’s break above $3,000: Bernstein