Key Market Intelligence on October 23rd, how much did you miss?

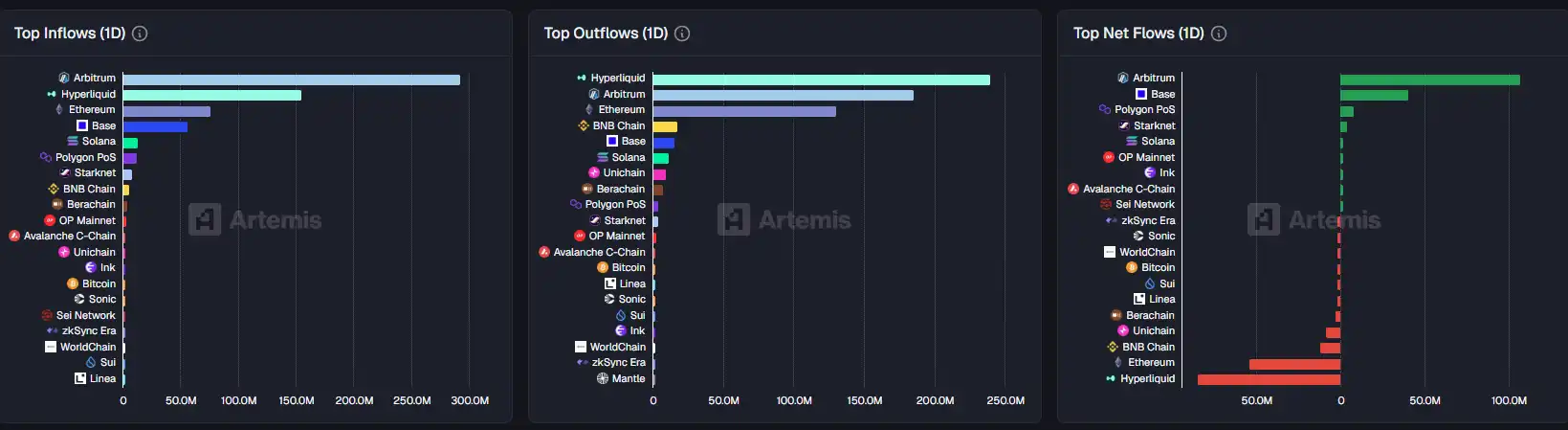

1. On-chain Funds: $107.2M USD inflow to Arbitrum today; $84.7M USD outflow from Hyperliquid 2. Largest Price Swings: $ORE, $LMTS 3. Top News: ORE Surges Over 110% in 24 Hours, Market Cap Reaches $51.1M USD

Top News

1. ORE Surges Over 110% in 24 Hours, Market Cap Reaches $50.11 Million

2. WLFI Reserve Company ALT5 Sigma CEO Suspended, Stock Price Down 83% from 52-Week High

3. Pre-market Crypto Concept Stocks in the US Soar, Quantum Computing Concept Stocks Rise

4. Binance Alpha Announces MET Token Airdrop Threshold, Minimum of 226 Points

5. Apollo Global, Jane Street, and Other Institutions Participate in Kraken's $500 Million Funding Round in September

Trending Topics

Source: Kaito

The following is the Chinese translation of the original content:

[MEGAETH]

MEGAETH has attracted widespread attention due to its upcoming public sale. The sale adopts a British auction format with a valuation cap of $9.99 billion. The project emphasizes broad distribution and community participation, introducing a unique U-shaped allocation mechanism in the event of oversubscription. The project has attracted well-known investors, including Dragonfly and Vitalik Buterin, and is discussed as a potentially significant blockchain project. Furthermore, MEGAETH has been listed on the Hyperliquid platform for leveraged trading, further fueling market interest and speculative enthusiasm.

[LIMITLESS]

Today, LIMITLESS ($LMTS) has drawn attention for its Token Generation Event (TGE) and subsequent trading launch, reaching a fully diluted valuation (FDV) of $4 billion. The event unfolded as a "blitz TGE," rewarding participants generously, with some receiving over $10,000. The project, backed by prominent institutions like Coinbase Ventures and 1confirmation, aims to reshape the short-term prediction market. Community discussions focus on its rapid growth, community engagement, and strategic marketing activities, including "stealth launches" and partnerships. Despite FUD (Fear, Uncertainty, Doubt) regarding liquidity distribution, the overall sentiment remains positive, with many users expressing excitement about the platform's potential and future opportunities.

[HYPERLIQUID]

The HYPERLIQUID project has received attention today due to several key developments. The platform has launched MEGA-USD hyperps, supporting leveraged trading of the yet-to-be-issued MEGAETH. Its subsidiary, HYPERLIQUID Strategies, has filed an S-1 document, aiming to raise up to $10 billion, possibly for purchasing HYPE tokens. The platform's daily revenue has seen a significant increase, and the AF is heavily accumulating HYPE tokens. In addition, the community is actively discussing the impact of AI trading agents and the automatic deleveraging mechanism during a market crash.

[THEO]

Today's discussion about THEO has focused on its involvement in RWA (Real World Asset) projects, especially the innovative approach through Theo Network to bring real-world assets into the crypto space. Tweets have emphasized the high rewards possible through participating in Theo activities, with users discussing how to optimize strategies to earn more points. Overall sentiment is positive, with the community eagerly anticipating upcoming developments and profit potential.

Featured Articles

1.《Like an Inscription's 30X Big Gold Dog, What Is the x402 Protocol?》

Yesterday, a special gold dog was born on Base, known as $PING. Calculated based on the cost of minting and the current coin price, a successful mint earns about 18 times the investment. What makes $PING special is that its minting process harks back to the inscriptions of two years ago. The cost of minting $PING once is approximately $1, and if successful, you can receive 5000 $PING. The minting page for $PING, like the inscriptions from years past, lacks a fancy frontend, appearing more hardcore. This is the first token issued through the x402 protocol. So, what is the x402 protocol? Why is the minting process of $PING so unique? And what is the current state of this protocol's ecosystem?

2.《MrBeast's Financial Gamble》

In October 2025, MrBeast submitted a trademark application titled 'MrBeast Financial' to the US Patent and Trademark Office. The 27-year-old young man, who in the real world has buried himself alive for video content and has 450 million fans in the virtual world, plans to expand his business footprint from fast food and snacks to banking, investment, and even cryptocurrency trading platforms.

On-chain Data

On-chain Fund Movement on October 23

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETFs are being launched in clusters, but coin prices are falling. Can ETF approval still be considered good news?

On one hand, Vanguard has opened Bitcoin ETF trading, while on the other hand, CoinShares has withdrawn its applications for XRP, Solana Staking, and Litecoin ETFs, highlighting a significant divergence in institutional attitudes toward ETFs for different cryptocurrencies.

ADP employment data "unexpectedly weak", is a Federal Reserve rate cut imminent?

Glassnode Report: Current Structure Strikingly Similar to Pre-Crash 2022, Beware of a Key Range!

Coinglass report interprets Bitcoin's "life-or-death line": 96K becomes the battleground between bulls and bears—Is the ETF capital withdrawal an opportunity or a trap?

Bitcoin's price remains stable above the real market mean, but the market structure is similar to Q1 2022, with 25% of supply currently at a loss. The key support range is between $96.1K and $106K; breaking below this range will increase downside risk. ETF capital flows are negative, demand in both spot and derivatives markets is weakening, and volatility in the options market is underestimated. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.