FalconX Acquires 21Shares, Expands Presence in Crypto Derivatives and Funds

- FalconX acquires 21Shares and expands its operations in crypto derivatives.

- New entity focuses on structured funds and regulated products.

- The deal comes amid a wave of mergers in the crypto sector.

Institutional cryptocurrency brokerage FalconX announced an agreement to acquire 21Shares, one of the industry's largest issuers of exchange-traded products (ETPs). While financial terms were not disclosed, the merger combines FalconX's trading infrastructure with 21Shares' expertise in distributing and developing digital asset-backed funds.

Second sources close to the agreement , the goal is to create an integrated platform that offers structured and derivative cryptocurrency products, going beyond traditional spot ETFs and ETPs. The combination aims to meet the growing institutional demand for regulated financial instruments that offer diversified exposure to crypto assets.

21Shares currently manages over $11 billion in assets, with a wide range of ETPs backed by Bitcoin, Ethereum, and other tokens, as well as thematic baskets available in Europe and other regions. This product base will enable FalconX to accelerate the global distribution of new crypto funds and explore staking and derivatives strategies under a regulated format.

The acquisition comes amid FalconX's rapid expansion into the derivatives market. In September, the company launched a 24-hour over-the-counter (OTC) options platform, supporting assets such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). The integration with 21Shares should bolster this front, enabling the launch of products that combine derivatives and direct token exposure.

The move reflects a broader trend of consolidation in the crypto sector in 2025, driven by a more favorable regulatory environment in the United States. In recent months, billion-dollar transactions have marked the reorganization of the institutional market: Coinbase acquired Deribit for $2,9 billion and the Echo platform for around $375 million, while Kraken expanded its derivatives presence by acquiring Small Exchange and NinjaTrader for $1,5 billion.

With the incorporation of 21Shares, FalconX is expected to strengthen its position as a leading provider of infrastructure for trading and managing digital assets, seeking to meet the growing demand from institutional investors for sophisticated and regulated solutions in the cryptocurrency sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Digital’s Head of Research Explains Why Bitcoin’s Outlook in 2026 Is So Uncertain

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

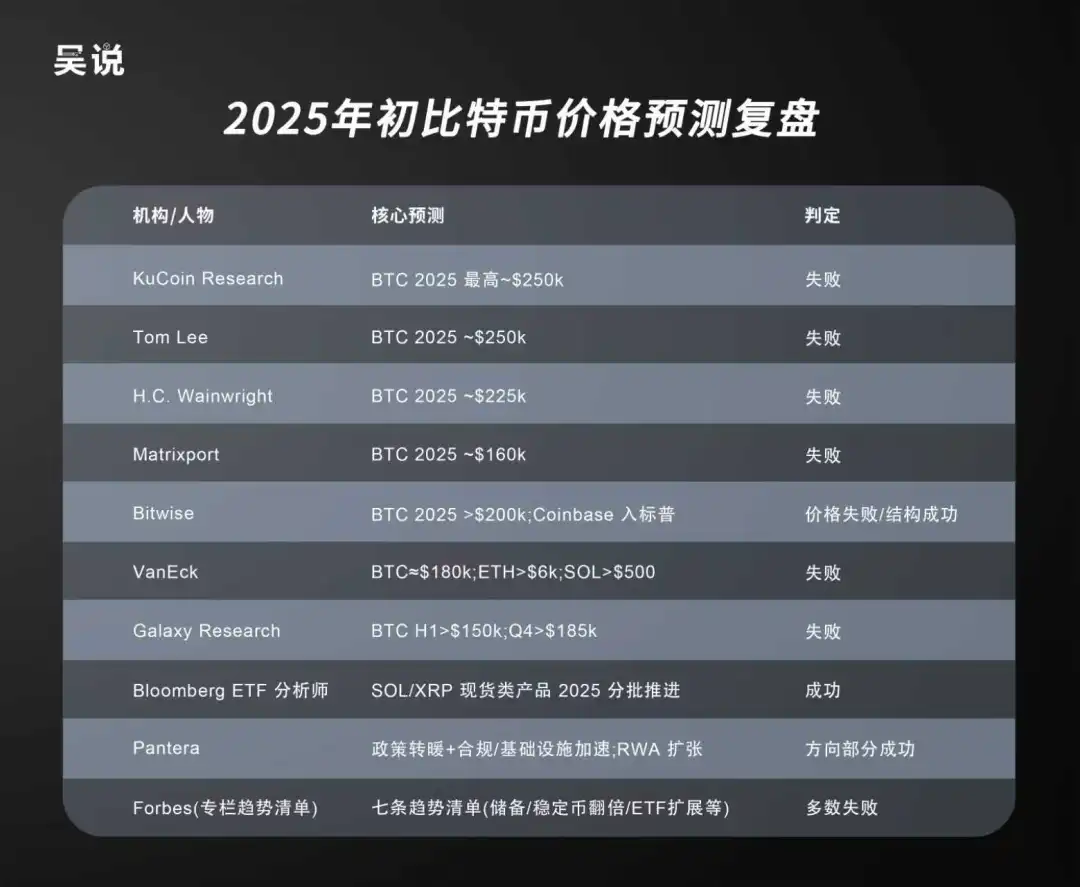

Revealing Insight: How Differing Views Shape Bitcoin Price Predictions at Fundstrat