Bitcoin News Today: Bears Caution About a Potential 50% Drop in Bitcoin While Bulls Anticipate a Surge to $250K

- Bitcoin faces "broadening top" warning from Peter Brandt, citing 1977 soybean crash parallels and potential 50% price drop. - MSTR's 10.13% stock decline highlights institutional risks as Bitcoin's 30-day price falls 5.32% amid supply-demand imbalances. - Traditional 4-year Bitcoin cycles break post-2024 halving, with analysts predicting 30-50% corrections instead of historical 70-80% crashes. - Market fear index hits 25 as bulls target $185K-$250K levels, while bears warn of prolonged downturns and Bitc

Bitcoin's latest price movements have sparked parallels with the soybean market crash of the 1970s. Seasoned trader Peter Brandt has highlighted that Bitcoin's current chart is developing a "broadening top" formation, a pattern often seen before major market peaks. Drawing on the 1977 soybean price collapse, Brandt warned that

This caution comes as Bitcoin's value has decreased by 5.32% over the past month, and

At the same time, the traditional four-year cycle in Bitcoin's price—historically driven by halving events—seems to be shifting. Matthew Hougan from Bitwise Asset Management observed that the 2024 halving did not produce the usual post-halving surge, as the introduction of spot Bitcoin ETFs and increased institutional investment have altered previous trends. This has led to a market more influenced by liquidity, with analysts such as Ryan Chow from

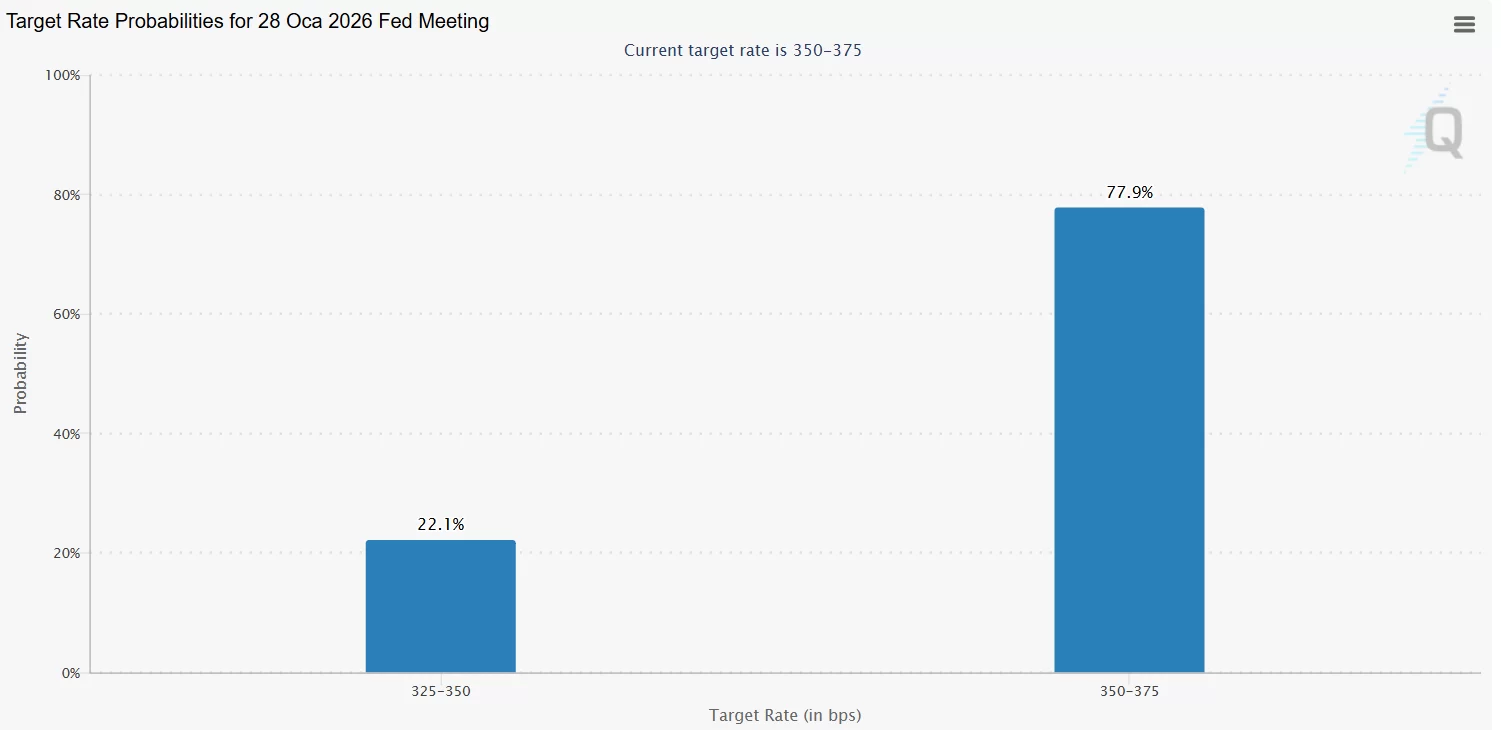

Market uncertainty is also evident in the , which reached an "Extreme Fear" level of 25 in late October. While some experts remain optimistic, predicting Bitcoin could climb to $250,000 or even $185,000, others foresee a drawn-out bear market. For example, Peter Schiff has forecast a "severe" downturn for companies holding large Bitcoin reserves, questioning whether any—including MSTR—will be able to weather the storm.

Gold's strong performance has added another layer to the discussion. With gold prices rising 33% in 2025, the BTC/XAU ratio—which shows how many ounces of gold are needed to buy one Bitcoin—has dropped from 40 in December 2024 to 31.2. Analysts like Joe Consorti point out that Bitcoin often trails gold by about 100 days, implying a possible rally for Bitcoin in the fourth quarter of 2025 if gold's momentum persists. Still, others, including Schiff, maintain that Bitcoin continues to lag behind gold as a reliable store of value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu Buyers Step In as Exchange Reserves Hit Low Levels

Cardano price eyes a 40% surge as Midnight’s NIGHT hits a $5b milestone

Bitcoin On-Chain Sentiment Rebounds as Sell-Off Addresses Decline and Futures Market Turns Bullish

Discover the Critical Week for Cryptocurrencies