Bloomberg Analyst Eric Balchunas Shares a Key List of Altcoin ETFs! Here Are the Details…

The government has been shut down in the US since the beginning of October, so official institutions are operating on a limited basis.

The government shutdown has affected all sectors, and cryptocurrency is one of them. The wave of ETF approvals for altcoins like XRP and Solana (SOL) expected in October has also been delayed.

At this point, it seems that the number of altcoin ETFs, whose final approval decisions have not been announced by the SEC due to the government shutdown in the US, will increase in the coming period.

Bloomberg senior ETF analyst Eric Balchunas predicted in his post that more than 200 crypto ETPs could be launched within a year.

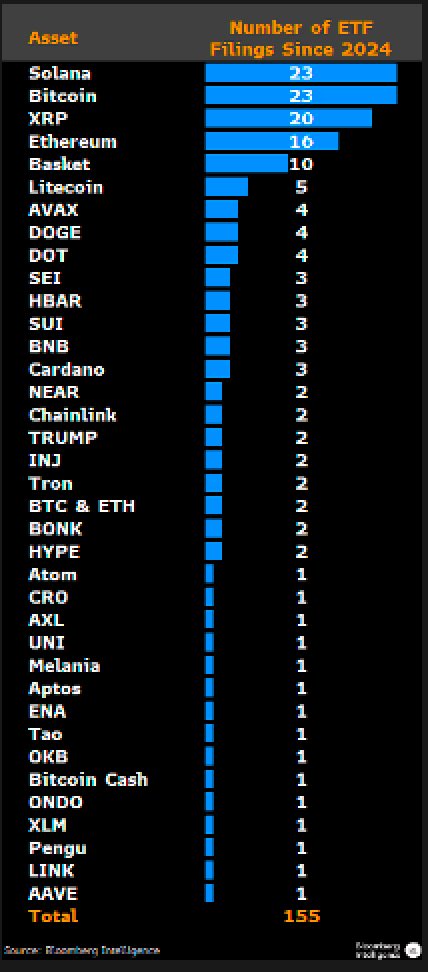

According to Eric Balchunas, there are currently 155 ETFs on the market that track 35 different cryptocurrencies.

Balchunas predicted that more than 200 ETFs are likely to launch in the next 12 months.

The cryptocurrencies with the most ETFs are Solana (SOL) and Bitcoin (BTC), followed by XRP and Ethereum (ETH).

Popular altcoins such as Litecoin (LTC), Avalanche (AVAX), and Dogecoin (DOGE) also top the list.

Analysts expect more institutional investors to enter the market with the SEC's approval of crypto ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu Buyers Step In as Exchange Reserves Hit Low Levels

Cardano price eyes a 40% surge as Midnight’s NIGHT hits a $5b milestone

Bitcoin On-Chain Sentiment Rebounds as Sell-Off Addresses Decline and Futures Market Turns Bullish

Discover the Critical Week for Cryptocurrencies