Bitwise Says Gold Shift Could Double Bitcoin’s Price

Bitcoin’s price trajectory continues to capture attention from analysts, but Bitwise’s latest insight offers a striking perspective. The firm suggests that a Bitcoin capital rotation of just 3–4% from global gold investments could double Bitcoin’s value from its current level.

This comparison highlights the massive size of the gold market, estimated at over $13 trillion globally. Its against Bitcoin’s much smaller market capitalization of around $1.2 trillion. The scale difference reveals how even a small reallocation from traditional safe-haven assets like gold could dramatically influence Bitcoin’s growth potential.

Institutional adoption is now expanding and the narrative around Bitcoin as “digital gold” is gaining momentum. The idea of a partial gold to Bitcoin shift becomes more realistic. This shift could mark the next stage of Bitcoin’s evolution as both a store of value and a strategic inflation hedge.

🔥 INSIGHT: Only 3-4% capital rotation from gold to Bitcoin could cause $BTC to double from current levels, per Bitwise. pic.twitter.com/K7LtB0yDLm

— Cointelegraph (@Cointelegraph) October 21, 2025

The Power of Minimal Capital Rotation

Bitwise’s research outlines a compelling scenario: if investors were to redirect just 3–4% of their gold holdings into Bitcoin. BTC’s market cap could rise enough to double its price. The math is simple but striking, the gold market’s massive value means even small movements carry huge implications for emerging assets like Bitcoin.

This concept rests on investor psychology and market momentum. Many long-term gold holders view it as a defense against inflation and market volatility, but younger investors increasingly see Bitcoin as offering similar protection with higher upside potential. The Bitcoin capital rotation thesis builds on this generational shift in asset preference.

Digital Gold Narrative Gains Strength

The comparison between gold and Bitcoin has been central to crypto discourse for years. Gold has a long-established track record as a store of value, while Bitcoin represents a digital, borderless alternative.

Bitwise analysts emphasize that Bitcoin’s finite supply, transparent monetary policy, and ease of transfer make it increasingly attractive compared to physical gold. As investors seek assets that can move freely across borders and adapt to a digital economy. Bitcoin capital rotation could accelerate naturally.

Moreover, with central banks diversifying reserves and inflation concerns persisting globally, the idea of digital scarcity has never felt more relevant. For many, Bitcoin now symbolizes not just a speculative asset but a modern counterpart to gold’s historical role.

What a Gold-to-Bitcoin Rotation Could Mean for Markets

A major takeaway from Bitwise’s projection is the scale of impact relative to the amount of capital involved. A small gold to Bitcoin shift could inject hundreds of billions into the crypto market, potentially doubling prices while also improving liquidity and stability.

This transition could also diversify global portfolios and change risk management strategies. Bitcoin’s asymmetric upside means that even small portfolio allocations can significantly affect returns. If traditional investors begin adopting this view, Bitcoin’s position within global finance could strengthen considerably.

Final Thoughts

Bitwise’s analysis highlights an essential truth about markets, size and momentum matter. With the gold market valued at over ten times Bitcoin’s, even a marginal reallocation can trigger powerful outcomes.

If the gold to Bitcoin shift gains traction among large investors, it could redefine asset allocation strategies. The world may soon witness not just a speculative rally, but a structural transition in how global capital perceives and stores value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Crypto Presale to Buy in December: DeepSnitch AI’s Clear Utility And 100X Stands Out, US Senate Appoints New CFTC Chair

The Role of Stablecoins in Building Modern Financial Systems

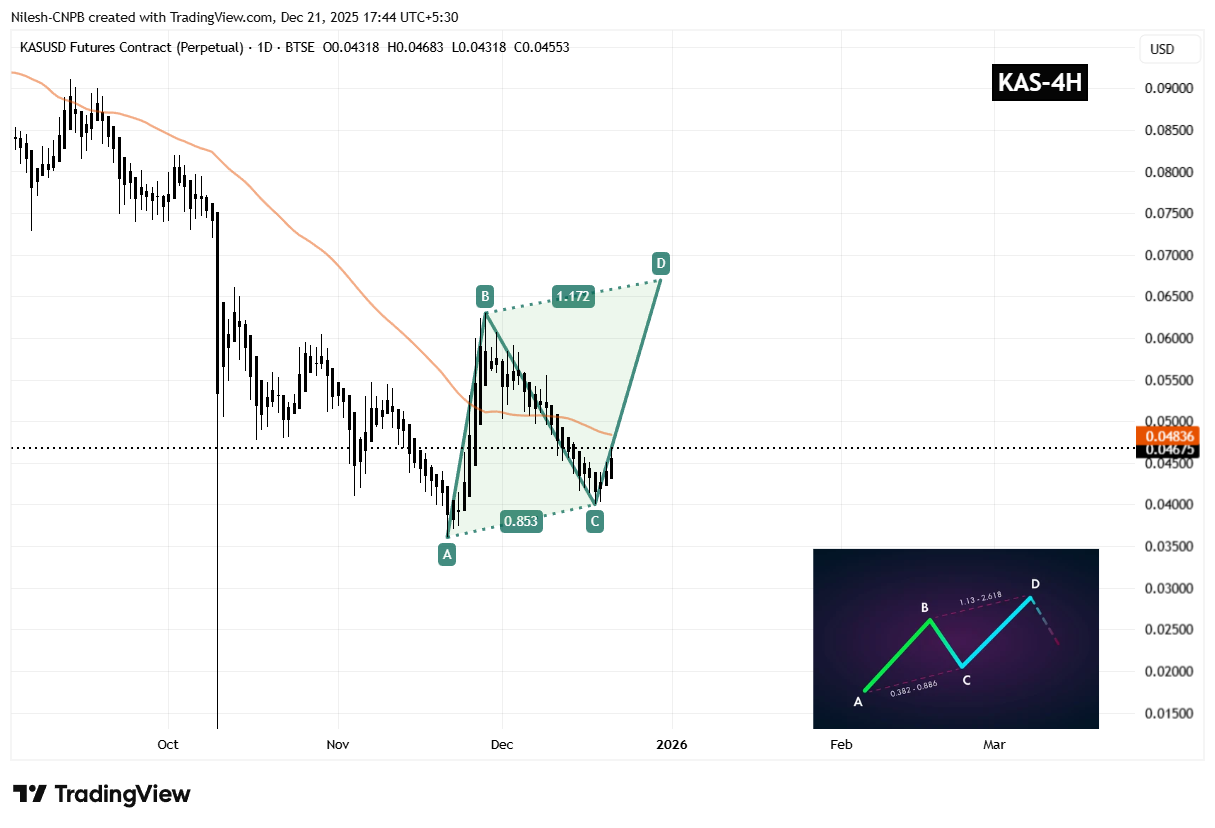

Kaspa (KAS) To Climb Higher — Key Emerging Pattern Formation Suggest So!