Institutional Investors Pour $434,900,000 Into Ethereum, Solana and XRP in One Week ��– While Selling $946,000,000 in Bitcoin

Institutional investors sold an overall total of $513 million in crypto assets in the last week, according to a new update from CoinShares.

This marks the second consecutive week of outflows, bringing net sales to $668 million since the Binance-fueled liquidity cascade on October 10th.

Bitcoin led the exodus with $946 million in outflows, bringing its year-to-date inflows down to $29.3 billion, well below last year’s $41.7 billion.

Ethereum bucked the trend, attracting $205 million in inflows as investors bought the dip.

A 2x leveraged Ethereum ETP alone drew $457 million, signaling strong conviction.

Solana and XRP also saw gains, with inflows of $156 million and $73.9 million respectively, fueled by hype around new ETP launches.

Regionally, the U.S. dominated outflows at $621 million.

In contrast, Germany, Switzerland, and Canada recorded inflows of $54.2 million, $48 million, and $42.4 million, viewing price weakness as an opportunity.

Overall exchange-traded product volumes rose to $51 billion, nearly double the yearly average, amid market gyrations.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MSCI’s crypto treasury rules could spur $15B of forced selling

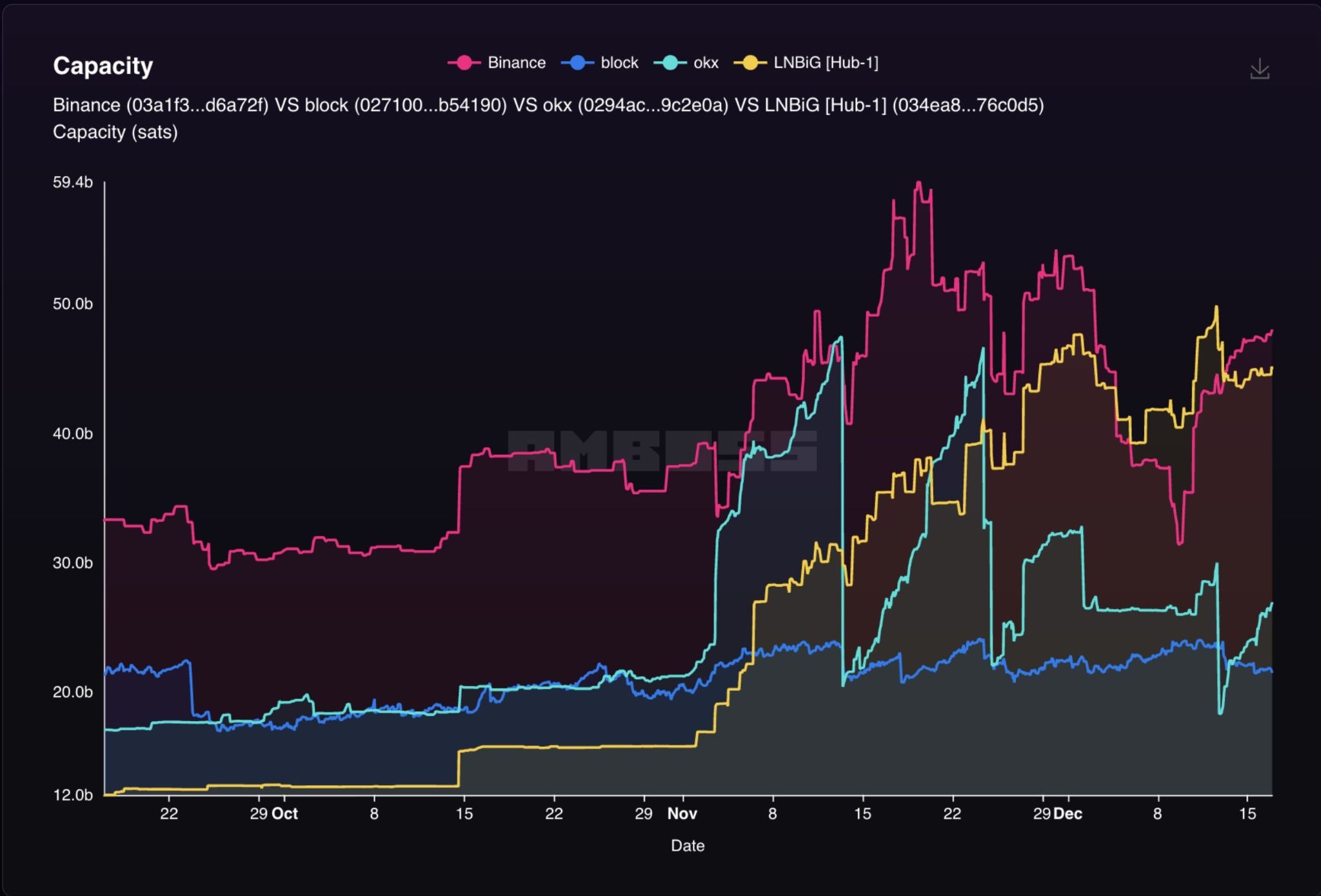

Lightning Network hits record capacity on crypto exchange adoption

Brazil Exchange B3 Plans Tokenization Platform, Stablecoin

Historic Uniswap Governance Vote: Final Decision on Burning 100 Million UNI Tokens