Powell hints at rate cuts and restarting QE, signaling the start of the next altcoin bull market

In early October, Jerome Powell's latest live speech

almost signaled a major turning point in U.S. monetary policy.

Rate cuts, QE (quantitative easing), and market reflation

are becoming the core themes of a new macro cycle.

I carefully analyzed every word, pause, and subtext of his speech,

and the answer is very clear: capital is about to flow back into risk assets, and the crypto market will be the biggest beneficiary.

❶ The Fed's Dilemma: Inflation vs. Recession

Over the past two weeks, signals from the U.S. economy have become increasingly complex:

Inflation data remains high;

The job market is clearly weakening;

The government “shutdown” crisis has resurfaced.

Powell and his team are balancing one thing:

How to avoid triggering a recession without letting inflation rebound.

And the answer they've found is—to slow the pace of tightening and gradually return to easing.

❷ “Balance Sheet Reduction Ending Soon” = Signal for QE Return

Powell mentioned in his speech:

“Balance sheet reduction (QT) may end in the coming months.”

This statement is extremely crucial.

QT ending = QE ready to restart.

This means:

Interest rates will be gradually lowered;

Liquidity will be released again;

Risk appetite will return to the market.

In other words, a new round of “liquidity easing” is being launched.

❸ The Fed's Goal Is Not to Save the Market, But to Save Jobs

The latest employment data is extremely weak:

Layoff rates are rising;

Job vacancies are decreasing;

New job creation has dropped significantly.

This has made the Fed realize:

Simply fighting inflation is no longer the top priority,

stabilizing the job market is now the most urgent task both politically and economically.

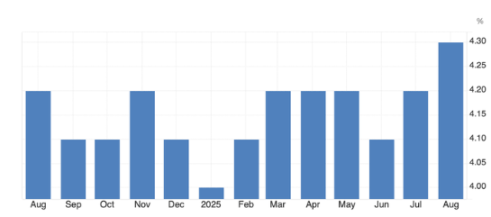

❹ Rate Cuts Are Now a Trend, It's Just a Matter of Pace

The first rate cut in September was a direct response to labor market weakness.

Based on current data, recession risks have not yet been eliminated,

which means—the coming months’ rate cuts will not be a one-off event.

Although Powell emphasized “caution and gradualism,”

the direction is set: easing will continue to intensify.

❺ What Does This Mean for the Crypto Market?

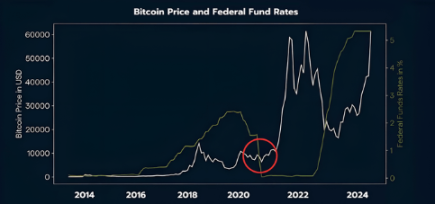

Recall the 2021 market:

That bull run was triggered by a combination of rate cuts + QE + pandemic stimulus.

At that time, the U.S. dollar index plummeted, and institutional capital was forced to seek new assets:

Limited supply, high potential, de-dollarized—bitcoin and crypto assets.

This time, the script is almost identical.

The only difference is:

Liquidity will no longer only push up BTC, but will flow into the altcoin sector even faster.

❻ Why Will Capital “Shift to Alts”?

Bitcoin is now heavily held by ETFs and institutions,

market expectations have stabilized, and volatility is limited.

But for capital seeking higher returns,

altcoins (Alts) offer a higher beta return space.

The typical capital migration path is:

U.S. dollar liquidity release → BTC rises → ETH starts moving → Alts rotate and explode.

When the Fed enters a substantial easing phase,

this “liquidity rotation” will quickly replay.

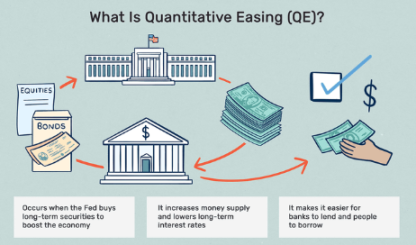

❼ The True Meaning of QE: Making Capital Take Risks Again

Quantitative easing is not simply “printing money,”

it is a systematic risk-stimulating mechanism.

When funding costs fall and liquidity overflows,

returns on traditional assets become limited,

and investors naturally flock to emerging high-growth markets—cryptocurrencies.

This was the logic of the 2021 bull market, and will also be the starting point for the 2025 cycle.

Conclusion:

Powell's speech

is not just another attempt to calm the market—

but an official signal of a monetary cycle shift.

Rate cuts = liquidity returns;

QE = asset price reflation;

Easing = a new round of risk appetite.

If 2021’s story was bitcoin’s stage,

then this time,

the protagonist of 2025 will be altcoins and new narrative sectors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreBitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low

Bitget US Stock Morning Brief | Fed Internal Divisions Widen; Trump Accelerates Space Militarization; Pharma Giants Accept Price Cuts for Tariff Relief (December 20, 2025)