What is EtherHiding? Google flags malware with crypto-stealing code in smart contracts

North Korean hackers have adopted a method of deploying malware designed to steal crypto and sensitive information by embedding malicious code into smart contracts on public blockchain networks, according to Google’s Threat Intelligence Group.

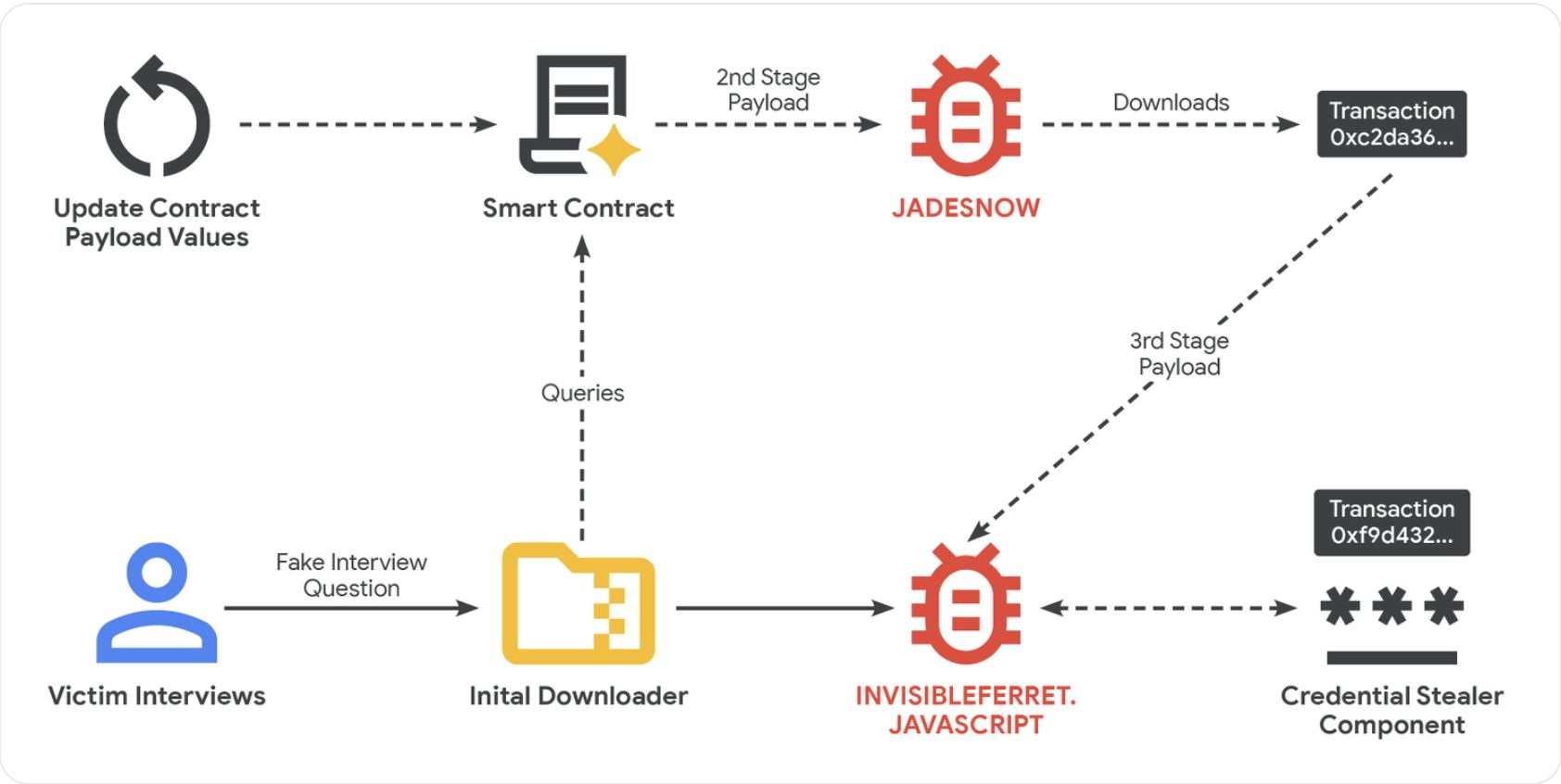

The technique, called “EtherHiding,” emerged in 2023 and is typically used in conjunction with social engineering techniques, such as reaching out to victims with fake employment offers and high-profile interviews, directing users to malicious websites or links, according to Google.

Hackers will take control of a legitimate website address through a Loader Script and embed JavaScript code into the website, triggering a separate malicious code package in a smart contract designed to steal funds and data once the user interacts with the compromised site.

The compromised website will communicate with the blockchain network using a “read-only” function that does not actually create a transaction on the ledger, allowing the threat actors to avoid detection and minimize transaction fees, Google researchers said.

The report highlights the need for vigilance in the crypto community to keep users safe from scams and hacks commonly employed by threat actors attempting to steal funds and valuable information from individuals and organizations alike.

Related: CZ’s Google account targeted by ‘government-backed’ hackers

Know the signs: North Korea social engineering campaign decoded

The threat actors will set up fake companies, recruitment agencies and profiles to target software and cryptocurrency developers with fake employment offers, according to Google.

After the initial pitch, the attackers move the communication to messaging platforms like Discord or Telegram and direct the victim to take an employment test or complete a coding task.

“The core of the attack occurs during a technical assessment phase,” Google Threat Intelligence said. During this phase, the victim is typically told to download malicious files from online code repositories like GitHub, where the malicious payload is stored.

In other instances, the attackers lure the victim into a video call, where a fake error message is displayed to the user, prompting them to download a patch to fix the error. This software patch also contains malicious code.

Once the malicious software is installed on a machine, second-stage JavaScript-based malware called “JADESNOW” is deployed to steal sensitive data.

A third stage is sometimes deployed for high-value targets, allowing the attackers long-term access to a compromised machine and other systems connected to its network, Google warned.

Magazine: Inside a 30,000 phone bot farm stealing crypto airdrops from real users

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Strategy increases USD reserve fund to $2.19B – Enough to clear ‘insolvency FUD?’

XRP Price Trims Upside, Slow Decline Signals Seller Dominance

Here's Why This Bitcoin Bounce Is Designed To Hurt The Most

CLARITY Act Leaves DeFi Rules Open for Debate