$1 Billion XRP Bought This Week, But Bitcoin Is Dragging Price Down

XRP saw $1.25 billion in accumulation as exchange balances hit a five-year low, yet Bitcoin’s downturn continues to cap XRP’s recovery potential.

XRP price continues to face downward pressure even as investors display strong accumulation activity. The altcoin has struggled to recover despite market stabilization and renewed investor interest.

While accumulation has reached record levels, the broader market’s weakness and Bitcoin’s volatility continue to suppress XRP’s bullish potential.

XRP Investors Are Buying

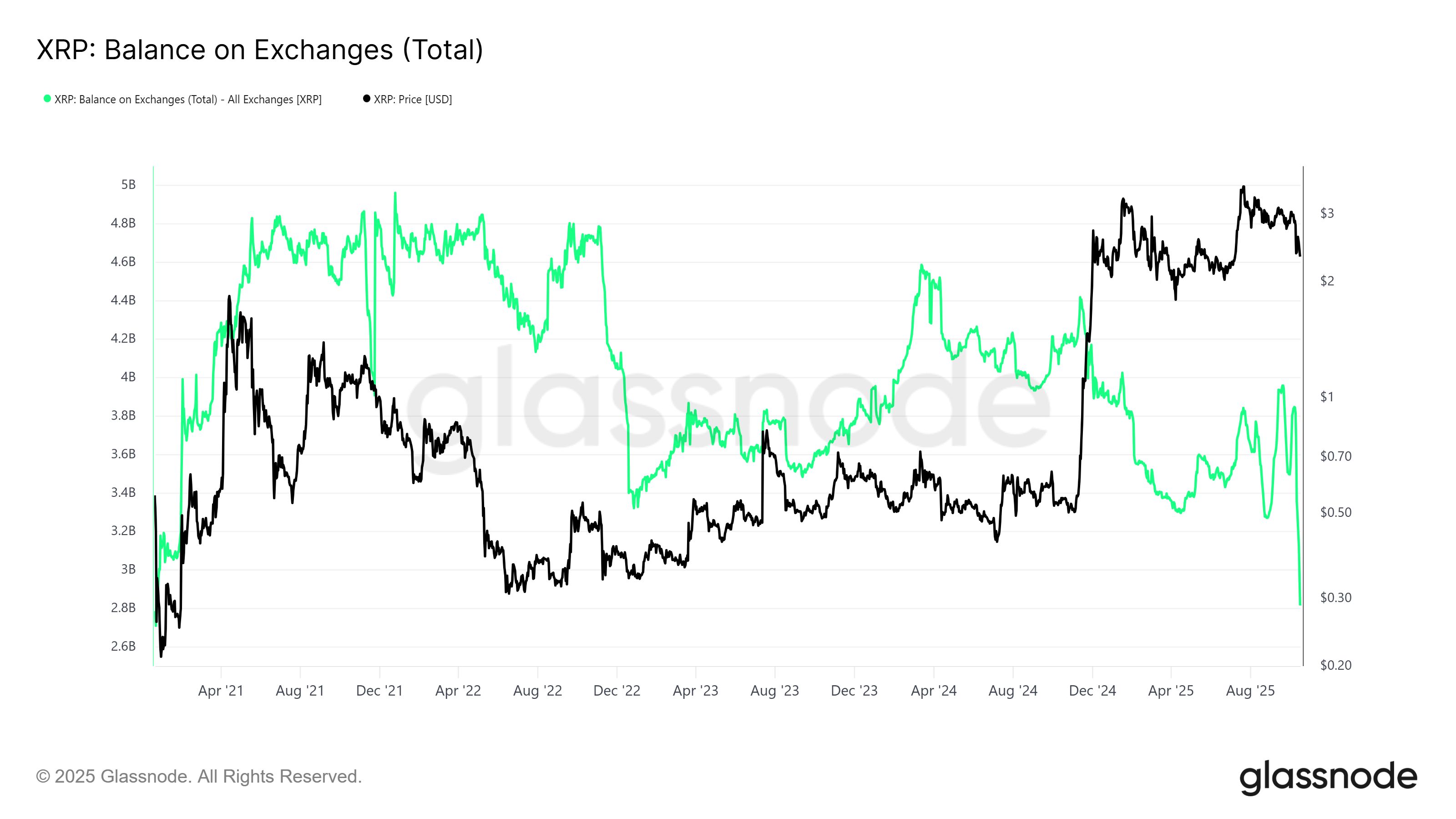

The exchange balance for XRP has dropped to a five-year low, signaling extensive accumulation by investors. In the past week alone, roughly 500 million XRP—worth more than $1.25 billion—was withdrawn from exchanges. This surge in accumulation shows investors’ confidence in XRP’s long-term potential and their attempt to buy at low prices.

However, the price impact of this accumulation has yet to materialize. Despite the significant buying activity, XRP’s lack of strong market momentum limits upward movement.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

XRP Exchange Balance. Source:

Glassnode

XRP Exchange Balance. Source:

Glassnode

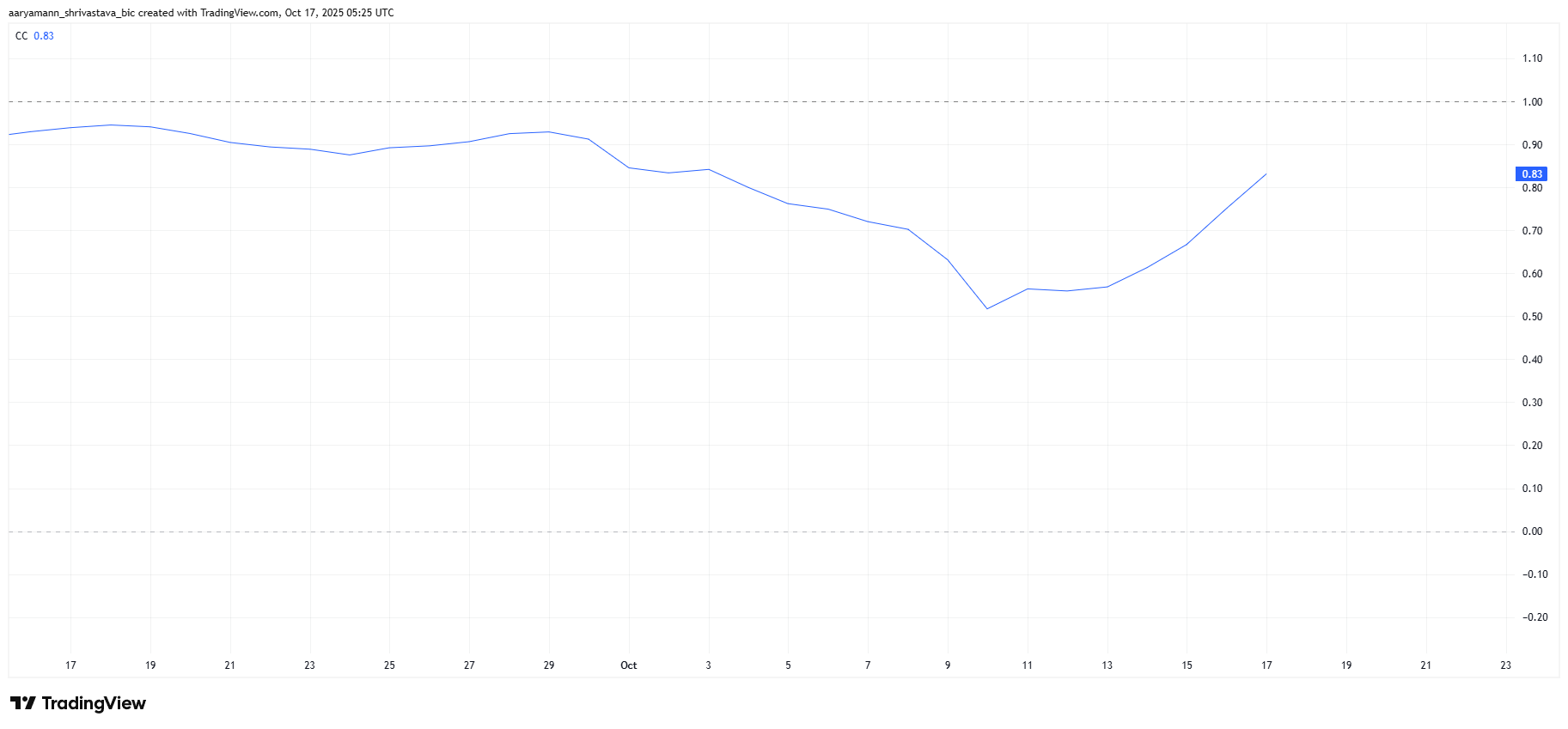

XRP’s correlation with Bitcoin currently sits at 0.82, reflecting a high degree of price dependence on the crypto market leader. While such alignment is common, it becomes a challenge when Bitcoin shows weakness. With BTC under pressure, XRP mirrors this trend, preventing it from establishing an independent uptrend.

This correlation means XRP’s short-term trajectory is largely tied to Bitcoin’s market behavior. If BTC fails to stabilize or recover meaningfully, XRP could continue its decline, despite the strong accumulation from investors.

XRP Correlation To Bitcoin. Source:

TradingView

XRP Correlation To Bitcoin. Source:

TradingView

XRP Price May Face A Decline

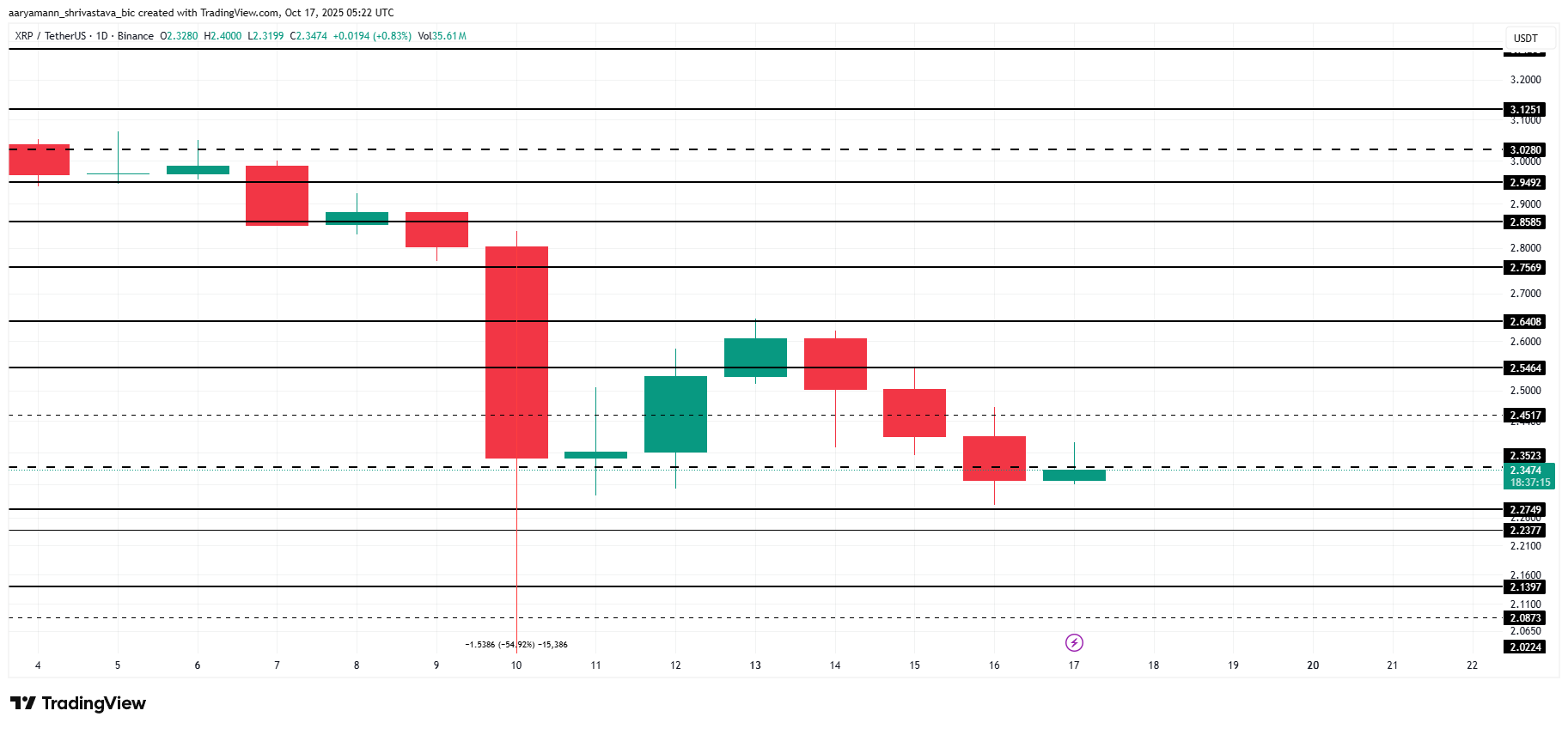

XRP price currently sits at $2.34, hovering just above the $2.35 support level. The altcoin remains vulnerable, and a drop below $2.27 could increase bearish pressure.

If Bitcoin continues its correction, XRP could fall further toward $2.13 or even $2.00. This could worsen the already bearish impact on XRP holders, potentially undermining investor confidence.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if accumulation translates into sustained buying, XRP could bounce off $2.35, climbing above $2.54 to target $2.64. Such a recovery would invalidate the bearish outlook and restore market optimism.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.

x402 V2 Released: As AI Agents Begin to Have "Credit Cards", Which Projects Will Be Revalued?

Still waters run deep, subtly reviving the narrative thread of 402.

When Belief Becomes a Cage: The Sunk Cost Trap in the Crypto Era

You’d better honestly ask yourself: which side are you on? Do you like cryptocurrency?