Roughly a year ago, analysts at Goldman Sachs ( GS -1.38%) projected that the S&P 500 ( ^GSPC -0.63%) would deliver lackluster returns over the coming decade. Their reasoning centered on historically high stock prices and the heavy concentration of major holdings in cap-weighted indexes. As a result, Goldman’s experts recommended investors consider stepping away from the S&P 500 for a period. Rather than sticking solely with traditional index funds like the SPDR S&P 500 Trust ( SPY -0.72%) and Vanguard S&P 500 ETF ( VOO -0.71%), they suggested looking at equal-weighted options, such as the Invesco S&P 500 Equal Weight ETF ( RSP -0.95%).

Now, let’s review how Goldman's cautious outlook has played out after a year.

Image credit: Getty Images.

How the S&P 500 has fared since Goldman Sachs issued its warning

In the 51 weeks following Goldman’s report, the S&P 500 became even more top-heavy.

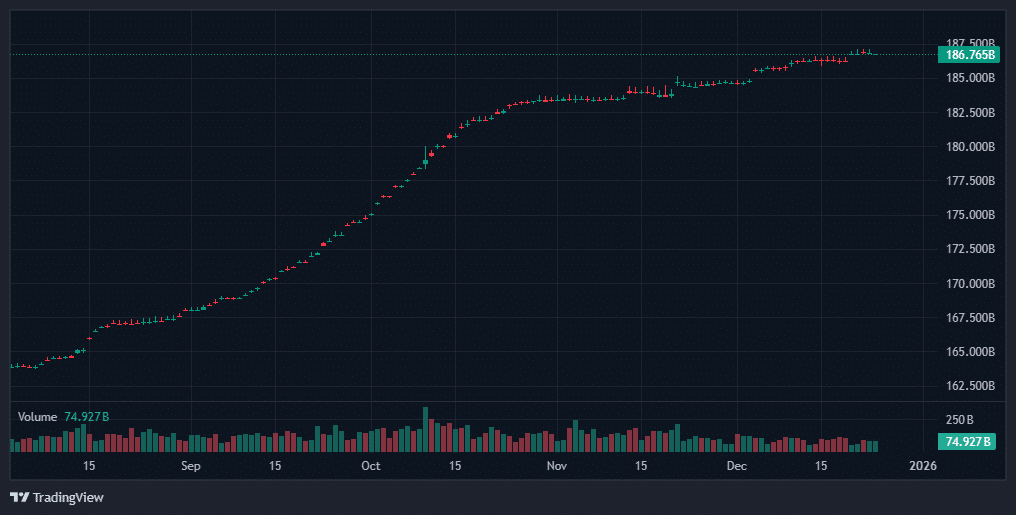

From the time of the downbeat forecast to October 14, 2025, the index delivered a total return of 14.9%. Over the same stretch, an equal-weighted S&P 500 fund rose by 4.5%, while the Roundhill Magnificent Seven ETF ( MAGS -0.44%) soared by 36.6%:

VOO Total Return Level data via YCharts

The market hasn’t shifted direction since October 2024. In fact, the Magnificent 7 have reached new records, fueled by the ongoing surge in artificial intelligence (AI) that continues to dominate Wall Street’s story. Nvidia ( NVDA 1.04%), a leader in AI hardware, now holds the title of the world’s most valuable company with a $4.37 trillion market cap, well ahead of Apple ( AAPL -0.81%), which sits at $3.82 trillion.

Meanwhile, the market’s nearly 15% return far exceeds the long-term average of about 3% that was forecasted. So far, Goldman’s prediction has not matched reality.

Why Goldman Sachs could still be proven right in the long run

However, Goldman’s analysts weren’t aiming to predict the market’s path for 2025 specifically. Their report was intended as a refreshed long-term outlook, spanning a decade. Should a downturn, recession, or bear market occur in the next several years, their warning might ultimately prove accurate. It’s too soon to make a final call.

On that note, I find myself agreeing with much of Goldman’s reasoning. The current stock market is being propelled by an extraordinary AI boom, with a handful of companies gaining dominance over smaller competitors. This trend may persist for a few more years, but it’s unlikely to last indefinitely. If and when the rapid AI-driven growth slows, I’d personally prefer to hold equal-weighted funds rather than cap-weighted ones.

My approach to the S&P 500 situation in my own investments

In fact, I found Goldman’s perspective compelling enough that I started making similar moves about a month ago. To be clear, I reached these conclusions independently, without referencing the Goldman report—the issues of valuation and concentration were simply too apparent.

Up to now, my small position in the Invesco S&P 500 Equal Weight fund has tracked closely with the cap-weighted version. It’s a relatively minor holding, as the Vanguard S&P 500 ETF remains one of my largest investments. Still, last Friday offered a glimpse of a potential bear market, and the equal-weighted fund experienced a slightly smaller loss that day.

I’m not suggesting these differences are dramatic. The Vanguard S&P 500 fund continues to be one of the best vehicles for long-term exposure to the broad market, regardless of economic fluctuations. Historically, if you hold both types of funds for a decade or longer, the cap-weighted version tends to outperform by a modest amount.

Both funds are solid choices. But if you’re adding new money to the market right now, it’s worth considering picking up some equal-weighted shares. Whether or not Goldman’s pessimistic outlook proves entirely correct, I prefer to be ready for a range of possible long-term market scenarios.