Florida Moves to Legalize Bitcoin Investments in State Funds

Florida has introduced HB 183 to authorize Bitcoin investments in public funds, signaling the state’s growing embrace of digital assets and fintech innovation through strong regulatory, financial, and technological frameworks

Florida lawmakers have launched the 2026 legislative session with a proposal to integrate Bitcoin into the state’s official investment strategy.

The measure, filed on October 15, could make Florida one of the first US states to manage digital assets as part of its public reserves.

Lawmakers Push for Crypto Reserve Strategy

The initiative, filed as House Bill 183 by Representative Webster Barnaby, authorizes the state’s Chief Financial Officer to allocate up to 10% of specific funds—including the General Revenue Fund and the Budget Stabilization Fund—into Bitcoin and other digital-asset products.

The bill defines digital assets broadly, encompassing Bitcoin, tokenized securities, and NFTs. It also extends similar authority to the State Board of Administration, allowing the Florida Retirement System to invest up to 10% of its System Trust Fund in digital assets.

“HB 183” introduced in the state legislature / Source:

Florida Senate

“HB 183” introduced in the state legislature / Source:

Florida Senate

The measure requires strict custody rules, permitting holdings only through the CFO, a licensed custodian, or an SEC-registered ETF. Supporters say this framework ensures compliance with federal standards and institutional-grade security.

“States are seeking to modernize their balance sheets,” said Julian Fahrer, founder of tracking platform Bitcoin Laws.

“More than 50 digital-asset reserve bills have been introduced across the US this year, and Florida is clearly moving early,” he added.

HB 183 also allows residents to pay certain taxes and fees in digital assets. These payments would be automatically converted to US dollars and deposited into state accounts. The bill’s effective date is set for July 1, 2026.

The proposal cites a March 2025 White House executive order establishing a federal “Strategic Bitcoin Reserve,” which uses seized digital assets as part of national holdings. Lawmakers view this as validation for states to explore Bitcoin as a store of value and inflation hedge.

— MartyParty (@martypartymusic)Policy Signal for Wider Adoption

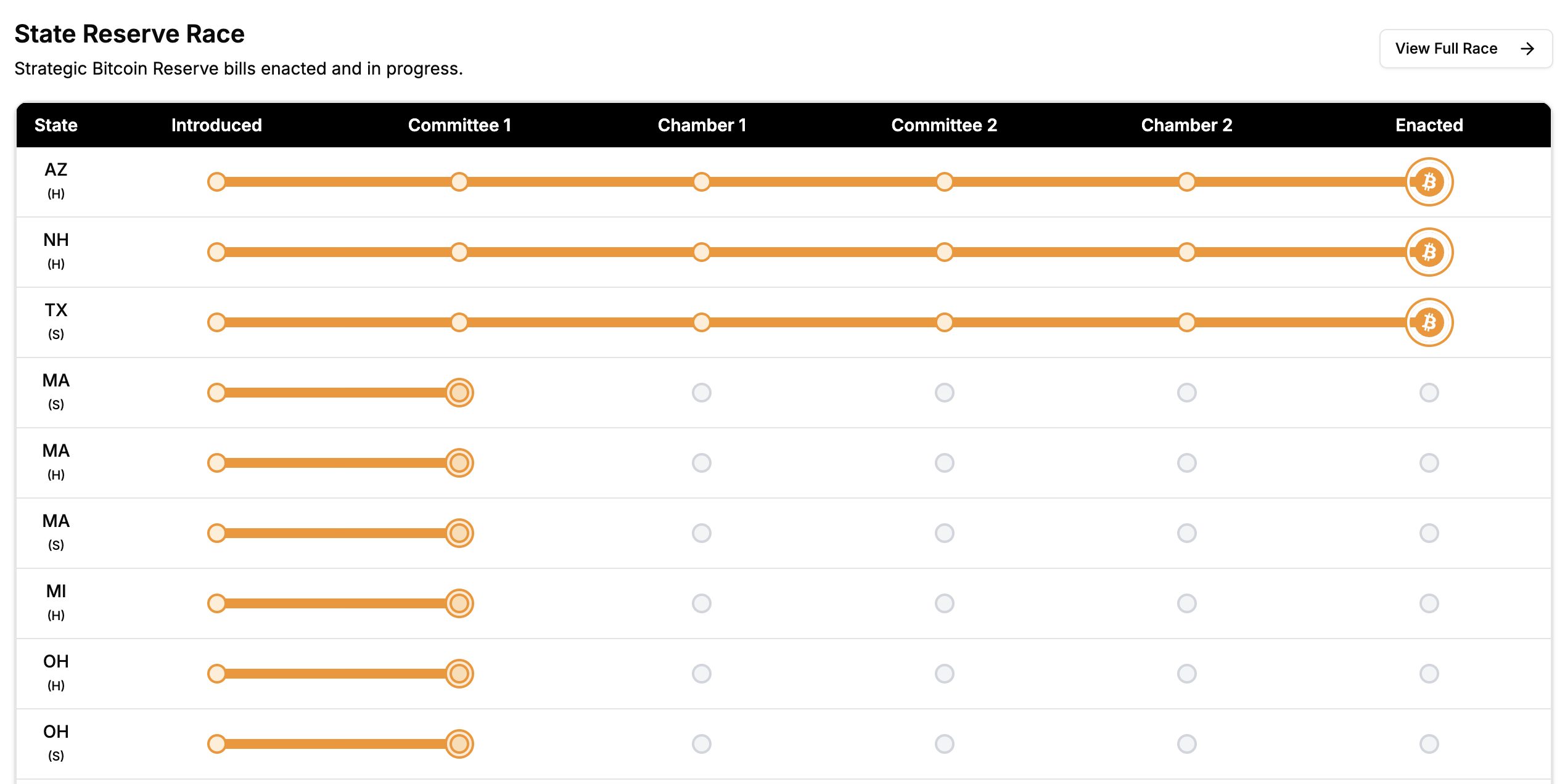

Florida’s move comes as Arizona, New Hampshire, and Texas have already enacted similar frameworks, while others prepare for new sessions in early 2026. Analysts say the momentum could accelerate competition among states seeking to attract digital-finance investment.

Strategic Bitcoin Reserve bills enacted and in progress / Source:

Bitcoin Laws

Strategic Bitcoin Reserve bills enacted and in progress / Source:

Bitcoin Laws

If approved, HB 183 could mark a shift in public-fund management and inspire further policy innovation. State-level integration of Bitcoin may also create a model for municipal treasuries and pension funds nationwide.

Florida has already positioned itself as a crypto-forward state through a series of pioneering policies. In 2023, the state established the Office of Fintech Policy and launched a Financial Technology Sandbox program in 2025 to test innovative digital finance solutions. These moves have attracted crypto startups and investors, boosting Florida’s standing as a regional fintech hub.

Analysts note that combining these initiatives with HB 183 could amplify Florida’s policy continuity and market appeal. A clear legal framework and pro-innovation stance may accelerate capital inflows and enterprise formation, positioning Florida as one of the most competitive crypto jurisdictions in the United States.

HB 183 now awaits committee hearings in the Florida House before advancing to the Senate for debate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Whales Sell 70M, Retail Investors Drive Price Up by Absorbing Supply

- XRP whales sold 70M tokens in two weeks, yet price rose to $2.55 amid retail/institutional buying. - Whale holdings increased (12.65% at 1M-10M range) while futures funding rates turned positive, signaling bullish sentiment. - Technical indicators show bullish reversal patterns, but price remains below 50-day SMA and faces $2.60 resistance. - Regulatory delays (SEC ETF decisions) and macro risks persist, though institutional demand stabilizes via Evernorth's $1B Nasdaq listing plan.

Solana Latest Updates: Optimism for Solana ETF Faces Challenges Amid Waning Momentum as $200 Approaches

- Solana's price hovers near $183 amid speculation about potential U.S. spot-SOL ETF approval following Hong Kong's regulatory green light. - Technical analysis shows mixed signals: a $200 breakout could drive momentum toward $230–$300, while support below $175 risks a pullback to $160–$165. - Despite 85% bullish community sentiment and institutional adoption potential, declining on-chain activity and regulatory uncertainties cloud near-term outlook. - Upcoming Solana Breakpoint conference in December will

LinkedIn co-founder Reid Hoffman acquires CryptoPunk PFP

XRP News Today: SEC Closure Delays Crypto ETFs Amid Rising Institutional Interest

- SEC's prolonged silence on crypto ETFs, including XRP and ADA, delays approvals amid government shutdown. - ProShares files diversified crypto ETF using swaps, reflecting growing institutional demand for regulated products. - Shutdown freezes critical reviews, leaving over 20 ETP filings in regulatory limbo despite market demand. - Analysts predict post-shutdown ETF surge but warn SEC's tokenization delays and governance risks persist.