ASTER drops 135.47% within 24 hours as market volatility intensifies

- ASTER plunged 538.92% in 24 hours to $1.43 on Oct 15, 2025, reversing prior 7-day 764.57% gains. - Analysts link the crash to market corrections and sentiment shifts, but no official cause has been disclosed. - Technical indicators show oversold RSI and bearish MACD divergence, signaling potential continued decline. - A backtest hypothesis is proposed to analyze historical recovery patterns after extreme drawdowns like -31.10%.

On October 15, 2025,

This significant drop occurred after a period of rapid appreciation, which had led to heightened expectations for continued growth. Experts suggest that the abrupt reversal may be attributed to market corrections and changing investor sentiment. Nevertheless, the exact reasons behind this movement remain uncertain, as neither the issuer nor related parties have released an official statement. The scale of the decline has sparked concerns about the durability of earlier gains and the overall condition of the asset class.

From a technical analysis standpoint, major indicators have shifted alongside the price movement. The Relative Strength Index (RSI) has entered oversold levels, while the Moving Average Convergence Divergence (MACD) is showing divergence, hinting at possible bearish momentum. While these technical signals could point to a continued downward trend, they do not necessarily indicate a prolonged bearish phase.

Backtest Hypothesis

To analyze how assets have historically behaved after similar price swings, it is important to develop a clear backtesting hypothesis. The initial step involves defining a universe of tickers, which might include a single stock or a broader market index. Given the severity of the decline—approximated as a –31.10% drawdown for practical analysis—the criteria for such an event must be explicit. For example, an “event” could be defined as any month-end where a stock drops below a specified threshold, followed by measuring returns over the subsequent 1, 3, and 6 months. Setting the backtest period from 2022 to the current date ensures a robust dataset to evaluate recovery potential or further losses after such events. With these parameters established, relevant data can be gathered, event dates pinpointed, and an event-study backtest performed to guide future investment strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ozak AI presale nears completion, analysts project potential 700× returns by 2027

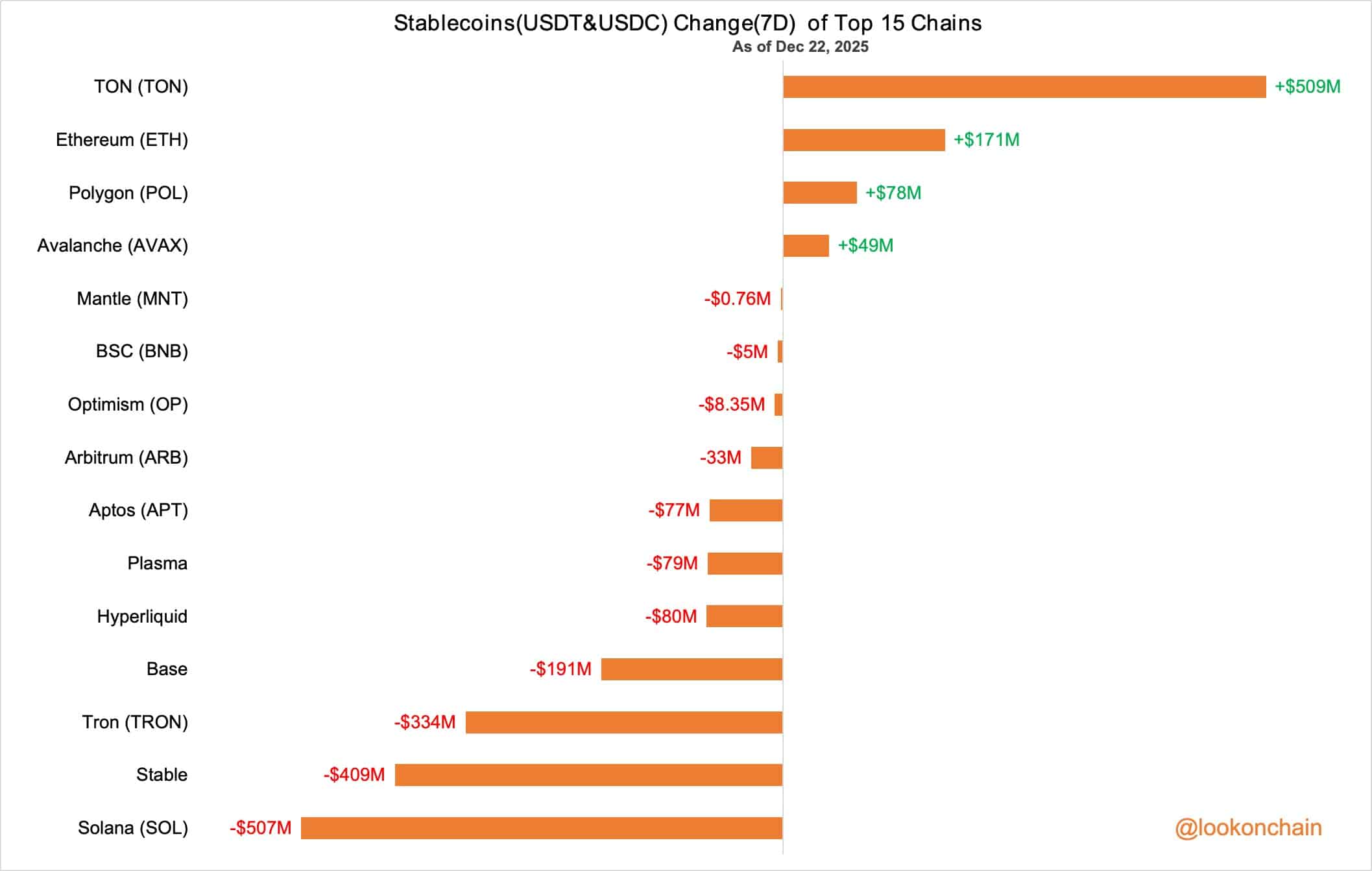

Stablecoins are leaving exchanges – and traders aren’t buying the dip

Three Financial Giants Predict Why Crypto Faces Its Hardest Test Yet in 2026

Ethereum Nears $3,000 as Bitmine Expands Holdings to 4 Million ETH