Pi Coin Holders Attempt to Recover From Painful 33% Price Collapse

Pi Coin investors regain confidence as technical indicators turn bullish. Holding above $0.200 could spark recovery toward $0.256 in the short term.

Pi Coin investors are finally seeing signs of relief after enduring one of the steepest declines in recent weeks. The cryptocurrency fell to a new all-time low last week following a 33% crash, but is now attempting a recovery.

Encouraging technical signals suggest that the downward pressure may soon ease as investors re-enter the market.

Pi Coin Holders Show Optimism

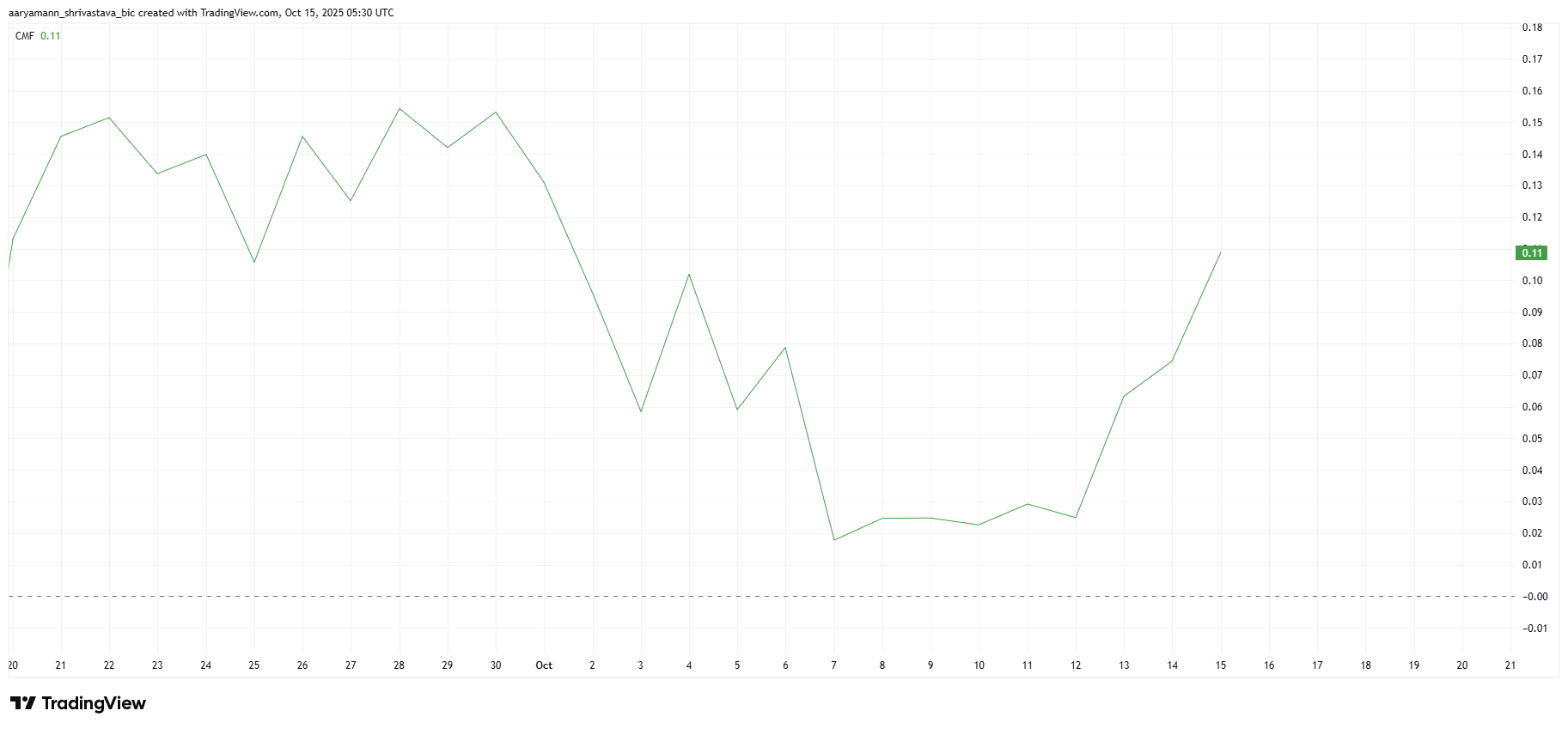

The Chaikin Money Flow (CMF) indicator is showing a strong uptick this week, reflecting renewed investor confidence. Capital inflows are rising quickly as traders take advantage of lower prices, pushing Pi Coin toward a potential reversal.

The surge in buying interest suggests that accumulation is underway, reinforcing bullish sentiment in the short term. This increase in inflows is crucial for Pi Coin’s recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

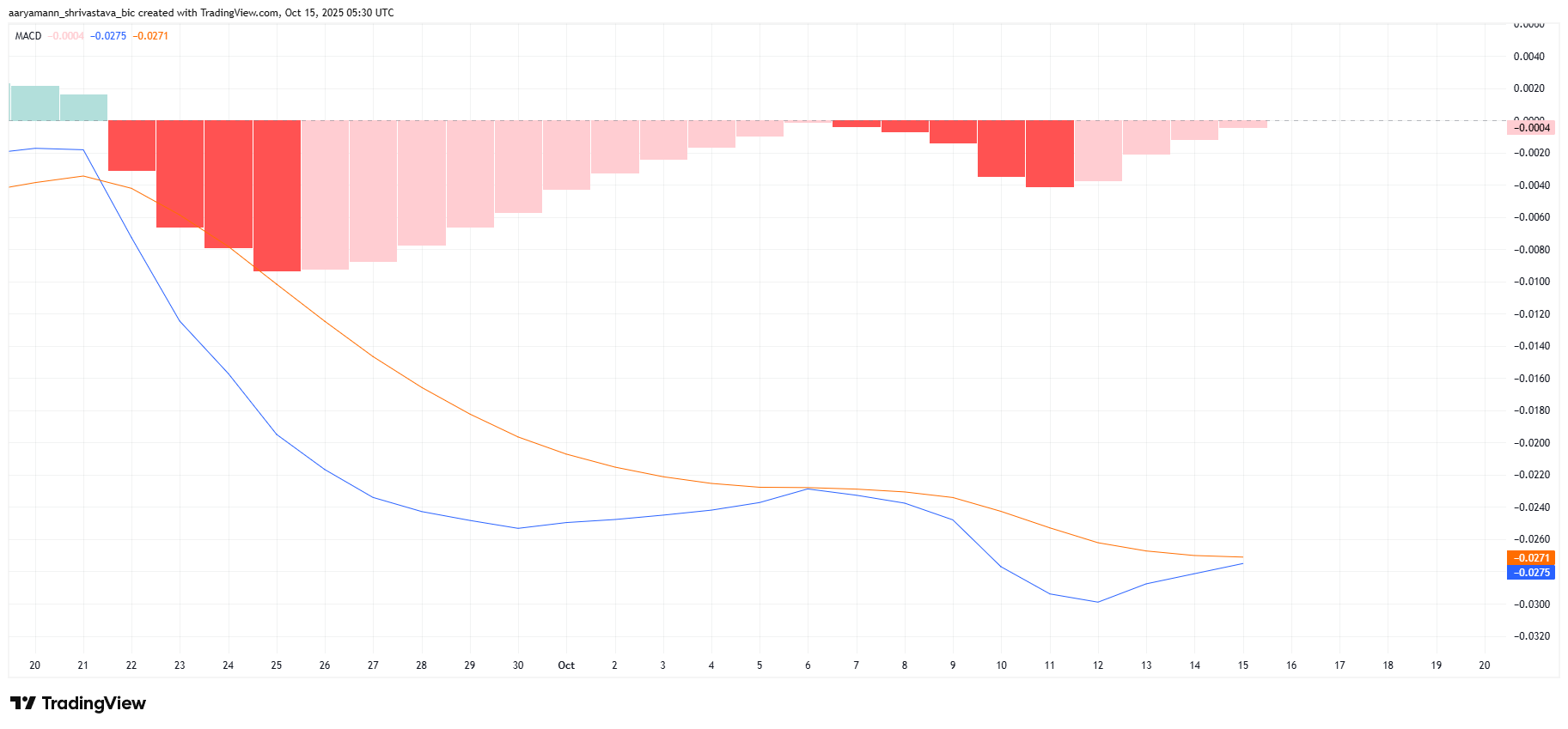

From a technical perspective, Pi Coin’s Moving Average Convergence Divergence (MACD) indicator is on the verge of a bullish crossover. This would mark the second attempt this month, indicating that buying momentum is returning.

A successful crossover could validate the renewed optimism and set the tone for a potential trend reversal after a month of bearish pressure. This would likely attract additional market participants, increasing both liquidity and trading activity.

Pi Coin MACD. Source:

TradingView

Pi Coin MACD. Source:

TradingView

PI Price Needs A Boost

At the time of writing, Pi Coin’s price stands at $0.214, slightly below the $0.229 resistance level. The altcoin is holding firmly above its $0.200 support, which serves as a critical base for recovery.

While Pi Coin has rebounded from its all-time low of $0.153, it still needs to reclaim significant ground to reverse the 33% crash. A decisive move above $0.229, supported by bullish technical indicators and investor confidence, could push the price to $0.256.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

However, losing the $0.200 support would expose Pi Coin to renewed selling pressure. If that happens, the price could drop toward $0.180 or lower. This would invalidate the bullish outlook and signal continued vulnerability in the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The era of permanent quantitative easing by the Federal Reserve is coming—where are the opportunities for ordinary people?

The article analyzes the background of the Federal Reserve potentially ending quantitative tightening and shifting towards quantitative easing, explores the current liquidity crisis facing the financial system, compares the differences between 2019 and the present, and suggests that investors hold gold and bitcoin to cope with possible monetary expansion. Summary generated by Mars AI. This summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

The Lives of Korean Retail Investors: 14 Million "Ants" Flock to Cryptocurrency and Leverage

The article discusses the high-risk investment behavior of retail investors in South Korea, including going all-in on stocks, leveraged ETFs, and cryptocurrencies. It also examines the socio-economic pressures behind this behavior and its impact on individuals and the financial system. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Was Bitcoin "stolen" or "seized"? The mysterious connection between $14 billion worth of Lubian old coins and the US government

Wallets related to suspected fraudster Chen Zhi have transferred nearly $2 billion worth of bitcoin. The U.S. Department of Justice has accused him of involvement in a $14 billion crypto fraud case. Chen Zhi is currently at large, and some of the bitcoin has been seized by the U.S. government. Summary generated by Mars AI.

Fed loses access to "small non-farm payroll" data