BNB’s Big Rally Looks Shaky: Are Quick Sellers Lining Up?

BNB’s rally may be losing steam as short-term holders eye profits. A fall below $1,136 could deepen losses, while a rebound above $1,308 may revive bullish momentum.

BNB has remained one of the few major cryptocurrencies to form a new all-time high (ATH) even as the broader market struggled.

However, after a strong rally, the Binance ecosystem token may face turbulence. A growing number of short-term holders appear poised to take profits, signaling potential volatility ahead.

BNB Holders Susceptible To Selling

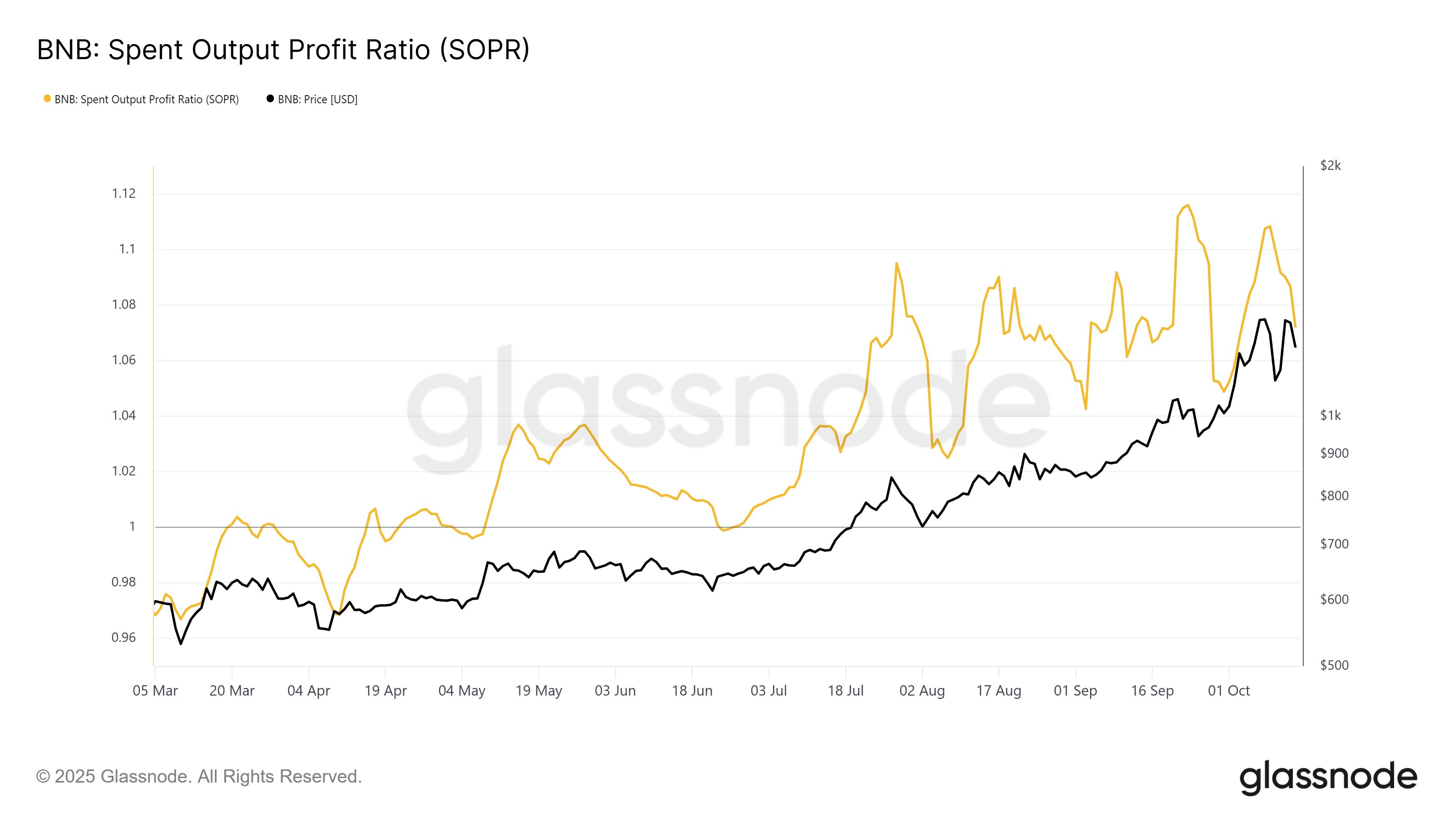

The Spent Output Profit Ratio (SOPR) is reflecting early signs of waning profitability among BNB investors. The most recent readings are hovering near the neutral 1.0 level, indicating that holders are realizing minimal profits. While this does not yet imply losses, it highglights that BNB’s profit margins are tightening.

If the SOPR dips below 1.0, it would signal that investors are selling at a loss. Historically, this tends to trigger selling fatigue, often allowing prices to stabilize and recover. However, BNB’s current position above this mark suggests that profit-taking remains active, leaving the altcoin vulnerable to continued downward pressure.

BNB SOPR. Source:

Glassnode

BNB SOPR. Source:

Glassnode

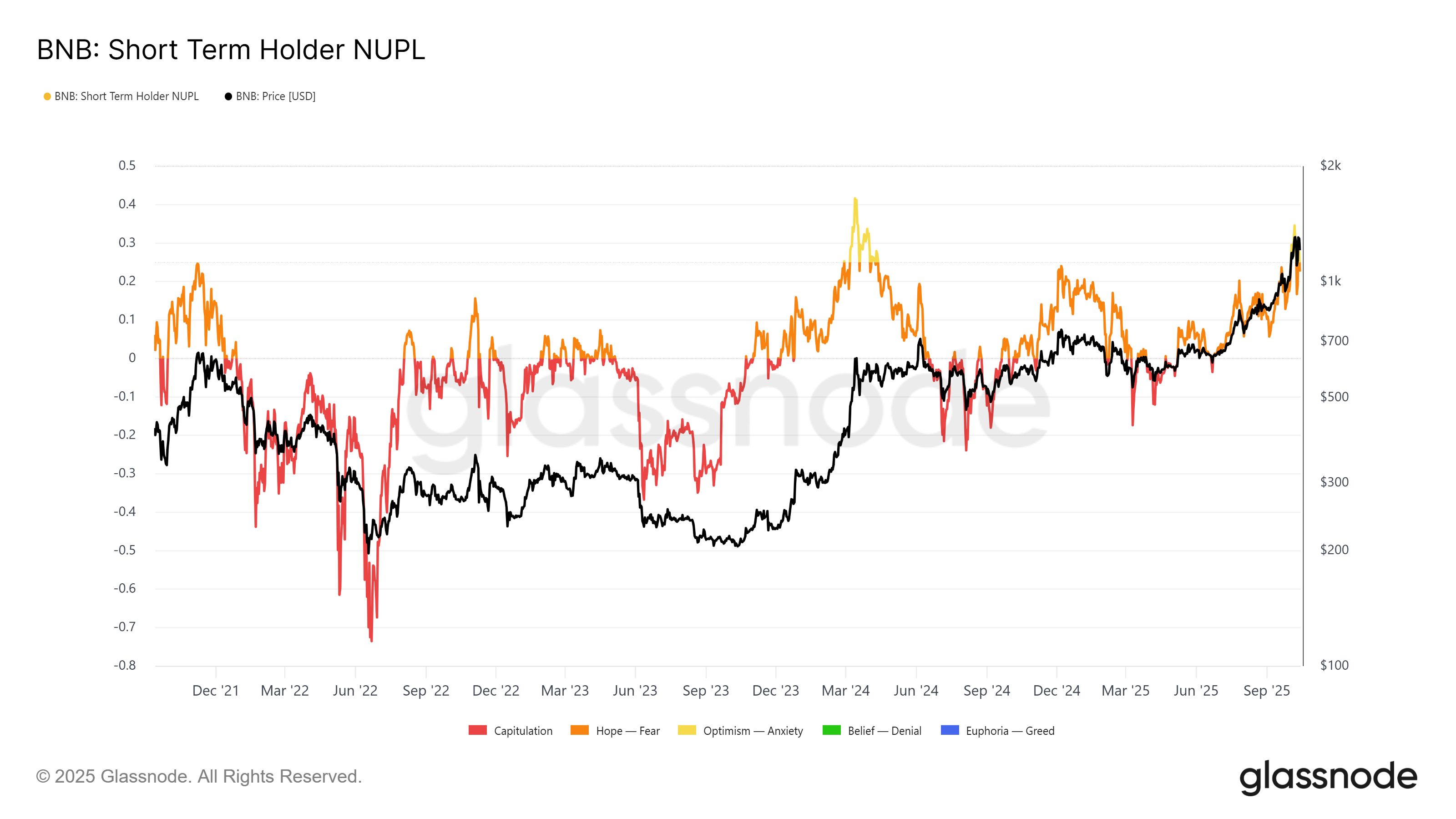

BNB’s short-term holder Net Unrealized Profit/Loss (STH NUPL) has recently spiked above the 0.25 threshold, historically a warning signal. Breaching this level has often preceded a saturation of profits among short-term investors, leading to waves of selling and subsequent price reversals.

The current NUPL data suggests that many short-term holders are sitting on sizable gains, increasing the likelihood of sell-offs in the near term. With no clear bullish indicators emerging on the macro front, BNB could be entering a cooling phase, where consolidation or correction becomes increasingly probable.

BNB STH NUPL. Source:

Glassnode

BNB STH NUPL. Source:

Glassnode

BNB Price Could See Further Decline

At the time of writing, BNB is trading at $1,181, maintaining a fragile position above its key $1,136 support level. Given the weakening sentiment and increased selling pressure from short-term holders, this support could soon be tested.

If bearish momentum intensifies, BNB may fall toward $1,046. Losing this critical level could open the door to a deeper correction, potentially driving the price down to the psychological support zone at $1,000. Such a decline could erase much of the token’s recent gains.

BNB Price Analysis. Source:

TradingView

BNB Price Analysis. Source:

TradingView

Conversely, if BNB manages to hold above $1,136 and attract renewed buying interest, a rebound toward $1,308 is possible. A decisive break above this resistance could reignite bullish momentum and bring the token closer to retesting its $1,375 all-time high.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Mobile ended Saga security patches, exposing owners to a critical wallet risk you can’t ignore

DTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button