Key Market Information Discrepancy on October 15th - A Must-Read! | Alpha Morning Report

1.Top新闻:鲍威尔暗示支持进一步降息,因美国就业市场降温 2.代币解锁:$SEI

Top News

1.Powell Suggests Support for Further Rate Cuts as U.S. Job Market Cools

2.BNB Chain and Four.Meme's First Batch of "Rebirth Support" Airdrop Has Been Successfully Distributed

3.Farcaster Announces Suspension of Deposit Bonus Event Registration

4.Binance Denies Allegations of Charging Listing Fees and Dumping Tokens

5.Over $697 Million Liquidated Across the Network in the Past 24 Hours, Over 200,000 People Liquidated

Articles & Threads

1. "The Enrichment of Those Who Quietly Get Rich Through Arbitrage on Polymarket"

After receiving a $2 billion investment, Polymarket is valued at $9 billion, one of the highest funding amounts a project in the Crypto space has received in recent years. For those who know how to truly make money on Polymarket, this is a golden age. While most people treat Polymarket as a gambling den, smart money sees it as an arbitrage tool. In the following in-depth article, BlockBeats interviewed three seasoned Polymarket players to dissect their money-making strategies.

2. "Can We Still Call the Coins We Are Speculating on Meme Coins?"

The "1011" flash crash came so suddenly that upon waking up, everyone's attention followed the market's bloodbath. Nevertheless, despite this, with the market quickly recovering, especially with $BNB hitting an all-time high, the BSC meme market remains very active. The various discussions about the BSC meme coin market, although no longer the top hot topic where "gods are fighting", are still worth further consideration.

Market Data

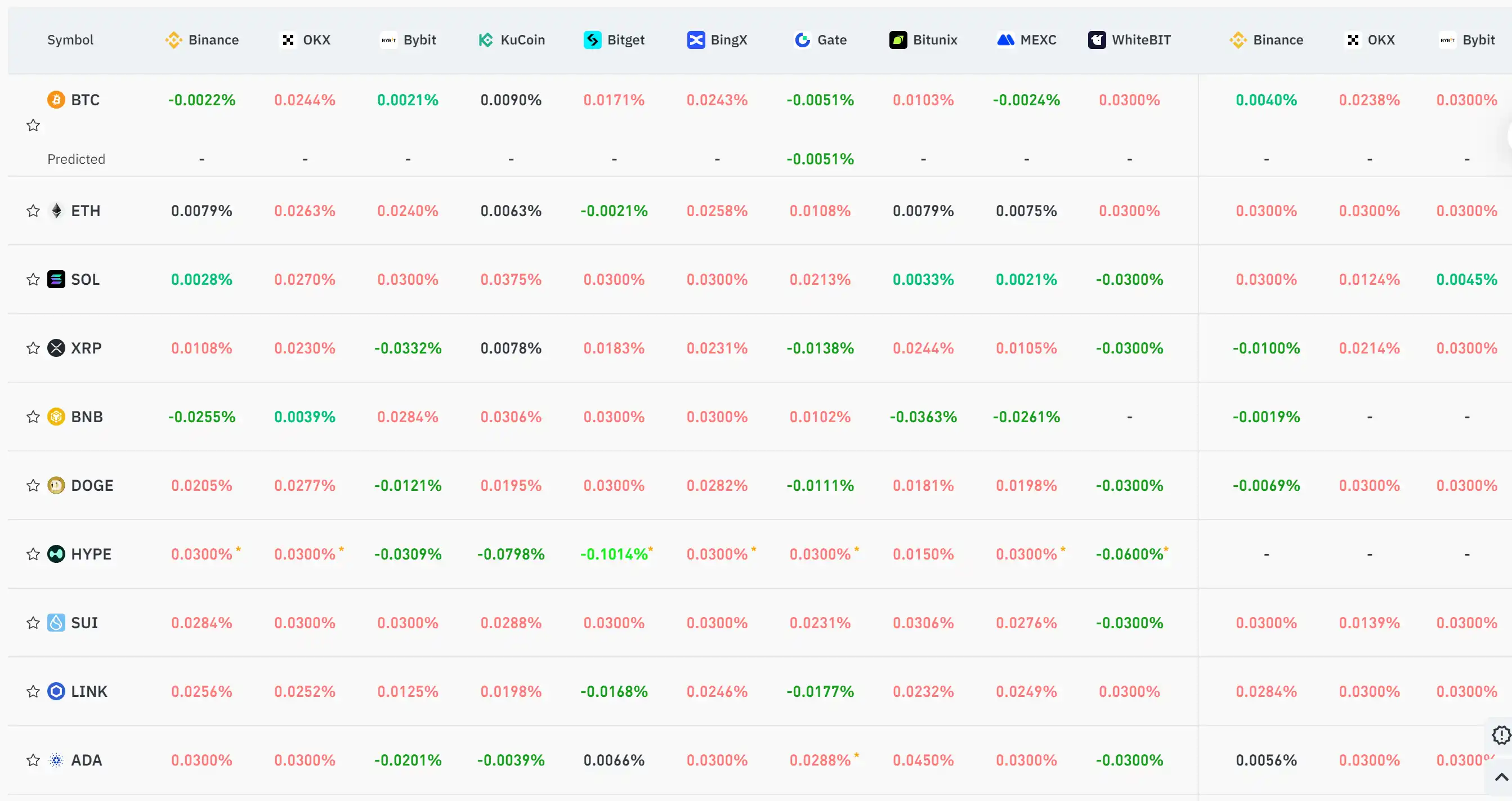

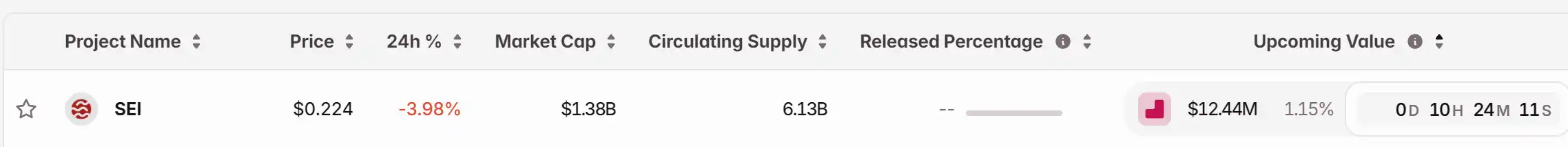

Daily Market Overall Capital Heat (reflected by funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana's Sharp Drop: Causes Behind the Fall and Future Prospects for Investors

- Solana's 30% price drop in late 2025 contrasts with strong on-chain metrics like 400ms finality and $35.9B DEX volume, but declining user engagement and rising NVT ratios signaled overvaluation. - Macroeconomic factors including high interest rates and institutional caution reduced speculative demand, with ETF inflows favoring staking products over direct price support. - Whale accumulation and RWA growth (up 350% YoY) suggest strategic buying during dips, though active address recovery and NVT normaliza

The Increasing Expenses of Dementia Treatment and Their Influence on Healthcare Investment Prospects

- Global dementia cases surge to 55M in 2025, projected to triple to 139M by 2050 due to aging populations and Alzheimer's rise. - U.S. dementia costs hit $781B in 2025, with Medicare/Medicaid covering $164B and families paying $52B out-of-pocket. - Home healthcare and AI caregiver tech markets grow rapidly (10-17% CAGR), reaching $381B and $5.3B by 2033-2032 respectively. - Dementia biotech faces risks but attracts $3.1B in Q3 2025 venture funding (+70.9% QoQ), despite $161M losses at Alector/Denali. - St

Bitcoin Leverage Liquidation: Is This a Warning Sign for Individual Investors?

- Q3 2025 saw record $73.59B in crypto leverage, with $19B wiped in single-day Bitcoin liquidations on Oct 10. - Over-leveraging driven by FOMO and social media hype triggered panic selling via ADL mechanisms on major exchanges. - Automated risk controls prevented insolvency but exposed systemic fragility amid rapid price swings and emotional trading. - Experts urge retail investors to adopt strict leverage limits, stop-loss orders, and AI-driven analytics for disciplined risk management. - Regulatory scru