Economist: Inflation Is No Longer the Main Risk, the Federal Reserve Should Focus on Economic Growth

Jinse Finance reported that Neil Dutta, Chief Economist at Renaissance Macro, wrote that although inflation remains above the Federal Reserve's 2% target, the trend of cooling prices is already very clear. Therefore, the Fed should fully shift its focus to supporting the weakening economy. He stated that energy prices are declining, which will lead to lower gasoline costs and help curb inflation expectations. In addition, slack in the labor market has increased, and rental housing inflation is also slowing down. "In short, inflation is no longer an issue. Policymakers should make it clear that maintaining economic growth should be the top priority at present."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Foundation sets strict 128-bit encryption rules for 2026

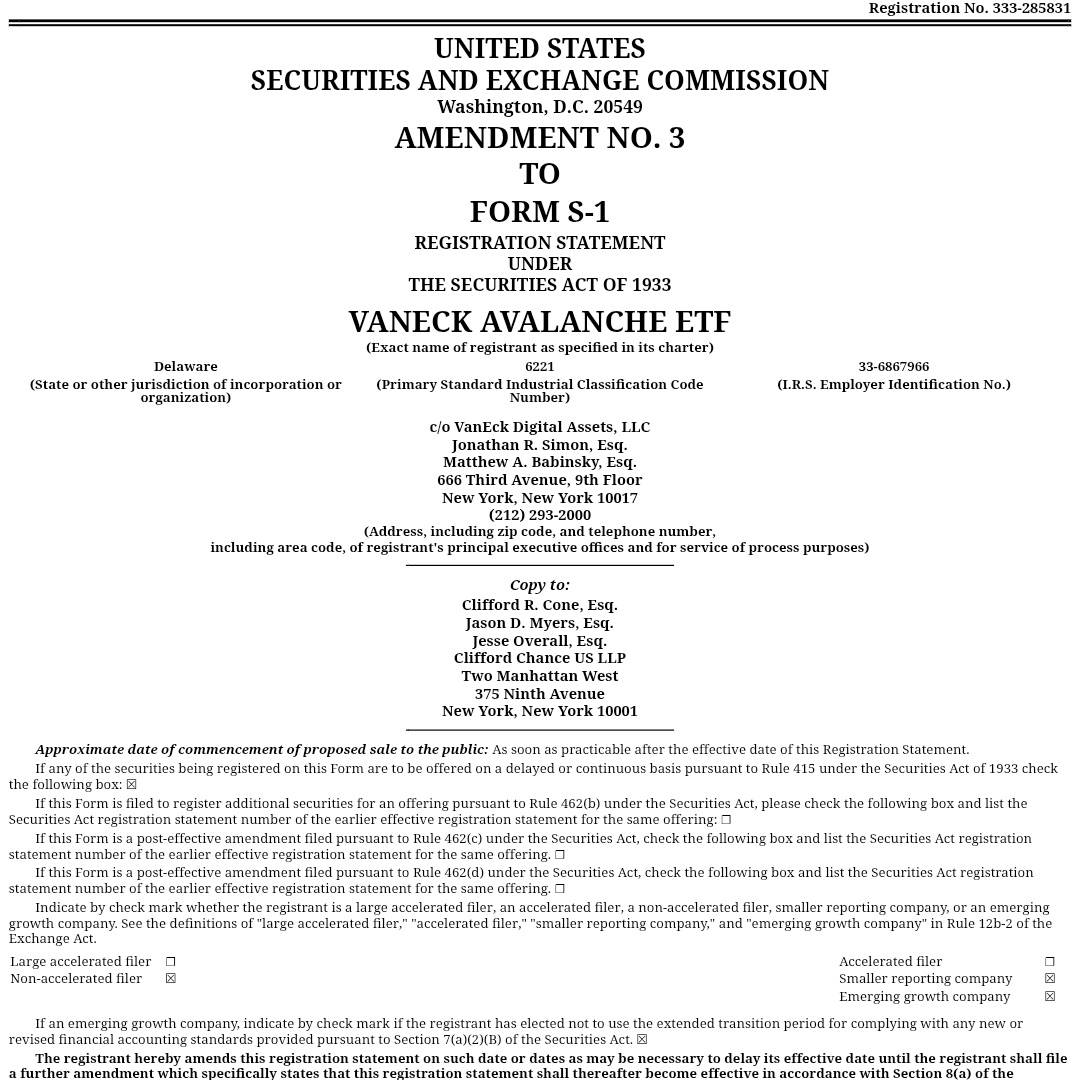

VanEck updates Avalanche ETF application to include staking rewards

VanEck submits spot AVAX ETF application to US SEC

Pi Network updates DEX and AMM features and launches holiday event