XRP Rebounds 8% After Recent Drop

The cryptocurrencies XRP and Solana defy economic turbulences with spectacular rebounds. While Sino-US trade tensions shake the markets, these assets attract institutional investors. A breakdown of the dynamics at play and ambitious price targets.

In brief

- XRP jumps 8%, recovers 30 billion dollars and targets $3.60 by the end of October 2025.

- Solana is up 11% and targets $240–260 this month, with potential of $400 by the end of 2025.

- Massive flows and ETF speculation redefine crypto resilience amid geopolitical crises.

Crypto — XRP: a spectacular rebound after the customs tariff storm

The crypto XRP recorded a sharp 8% rise in 24 hours, recovering 30 billion dollars in market capitalization. After the chaos related to the customs tariff announcements between the United States and China , the price moved from 2.37 dollars to 2.58 dollars, driven by a massive influx of institutional volumes.

This 8% rebound in XRP confirms an aggressive “dip-buying” strategy, where crypto investors take advantage of dips to strengthen their positions. Now, traders anticipate major macroeconomic developments, while analysts watch for a record weekly close above 3.12 dollars. Such performance would mark the strongest candle in XRP history, a strong signal for the coming months.

Despite a risky global context, with stock indices sharply down such as Dow -900 and Nasdaq -820, Ripple (XRP) manages to attract selective capital. This rebound therefore illustrates the resilience of cryptos in the face of geopolitical crises. Investors certainly see in XRP a relative safe haven, capable of outperforming even in times of uncertainty.

Solana (SOL): recovery underway and the $260 target in sight

Solana recorded an 11% rise in 24 hours, moving from $177.11 to $196.60, according to the latest data. This rebound fits into a recovery dynamic after a volatile week, where the price had reached a peak of $228.78 before correcting. Analysts highlight that SOL is currently trading around $233, after regaining its key moving averages (20 days at $219.96 and 50 days at $211.29), which now serve as immediate supports.

Technical forecasts indicate a major resistance between $240 and $245. If Solana manages to break this threshold, crypto analysts anticipate a push towards $253, even $260, a level that would mark a return to its all-time high of $294.85 recorded in January 2025.

Speculation around a potential Solana ETF and growing activity in the DeFi and NFT sectors reinforce this optimism. However, a drop below $220 could trigger a retest of the $197–$200 range.

The rebounds of XRP and Solana show that cryptos remain fertile ground for opportunities, even in times of crisis. While institutional investors take positions, one question remains: are these increases sustainable or merely speculative moves?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes Claims to Those Waiting for the Altcoin Season: “The Altcoin Season Never Ended Anyway”

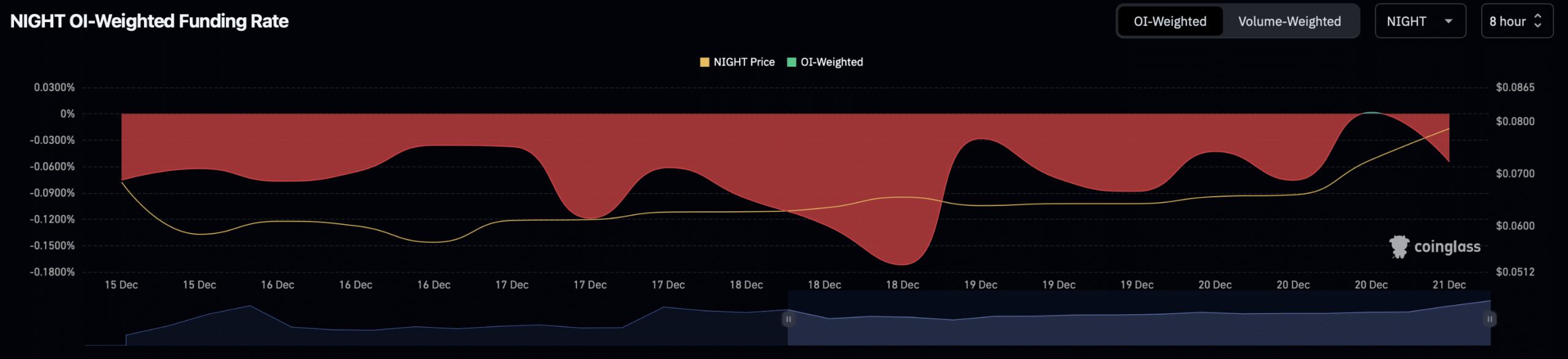

NIGHT rallies 24% as traders rush in ahead of AirDrop, but risks remain

Pundit: XRP Will Have to be Extremely Expensive Once This Happens

Best Meme Coins to Buy – Pudgy Penguins Price Prediction