Crypto investment totals $3,17 billion in inflows despite historic sell-off

- Crypto funds attract US$3,17 billion in net income

- Record liquidations cause billion-dollar evictions

- Cumulative flows for 2025 reach US$48,7 billion

Last week, cryptocurrency investment products saw net inflows of $3,17 billion globally, according to CoinShares data This movement raised the year-to-date total to US$48,7 billion, surpassing previous records even in the face of market turbulence.

Although prices corrected after the US president's tariff threats against China, the impact was limited in terms of capital outflows.

“Despite the significant price correction caused by US tariff threats against China, there was little reaction on Friday, with insignificant outflows of $159 million,”

said James Butterfill, head of research at CoinShares, in a report released Monday.

Trading volumes in digital asset exchange-traded products (ETPs) also hit a record, reaching $53 billion for the week, more than double the weekly average for 2025. On Friday alone, $15,3 billion in daily trades were transacted. Still, total assets under management (AUM) fell about 7% from its recent peak, reaching $242 billion, impacted by the turmoil caused by the tariff measures.

On the day of the largest liquidation, it is estimated that at least $20 billion in positions were wiped out, with some cryptocurrencies briefly reaching zero value—a historic selloff in US dollar terms. Official data, however, is notoriously inaccurate: while Bybit publishes complete data, platforms like Binance and OKEx underreport during periods of high volatility, suggesting that the true value of liquidations may be even higher.

Despite this, the major cryptocurrencies showed some resilience. Bitcoin fell about 6,8% this week, and Ethereum fell about 8,3%, indicating that the market sought to recalibrate prices rather than generate widespread panic.

Geographically, US-based products led inflows with US$3,01 billion net. In Europe, cryptocurrency funds based in Switzerland and Germany also performed well, with inflows of US$132 million and US$53,5 million, respectively. On the other hand, markets such as Brazil, Sweden, and Hong Kong saw capital outflows.

In terms of asset types, crypto equity funds delivered the best performance, raising $2,67 billion and bringing the year-to-date total to $30,2 billion. US spot Bitcoin ETFs accounted for $2,71 billion of these inflows, with minimal outflows on Friday. Spot Ethereum ETFs raised $488,2 million during the week, although they suffered withdrawals of $174,9 million on the most volatile day.

Meanwhile, ETPs tied to Solana and XRP saw inflows of $93,3 million and $61,6 million, respectively, reflecting continued interest in diversification within the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top Crypto Market News Today: Gnosis Executes Hard Fork While DeepSnitch AI Rallies 96%

Experienced Analyst Predicts When Bitcoin’s Decline Will Stop

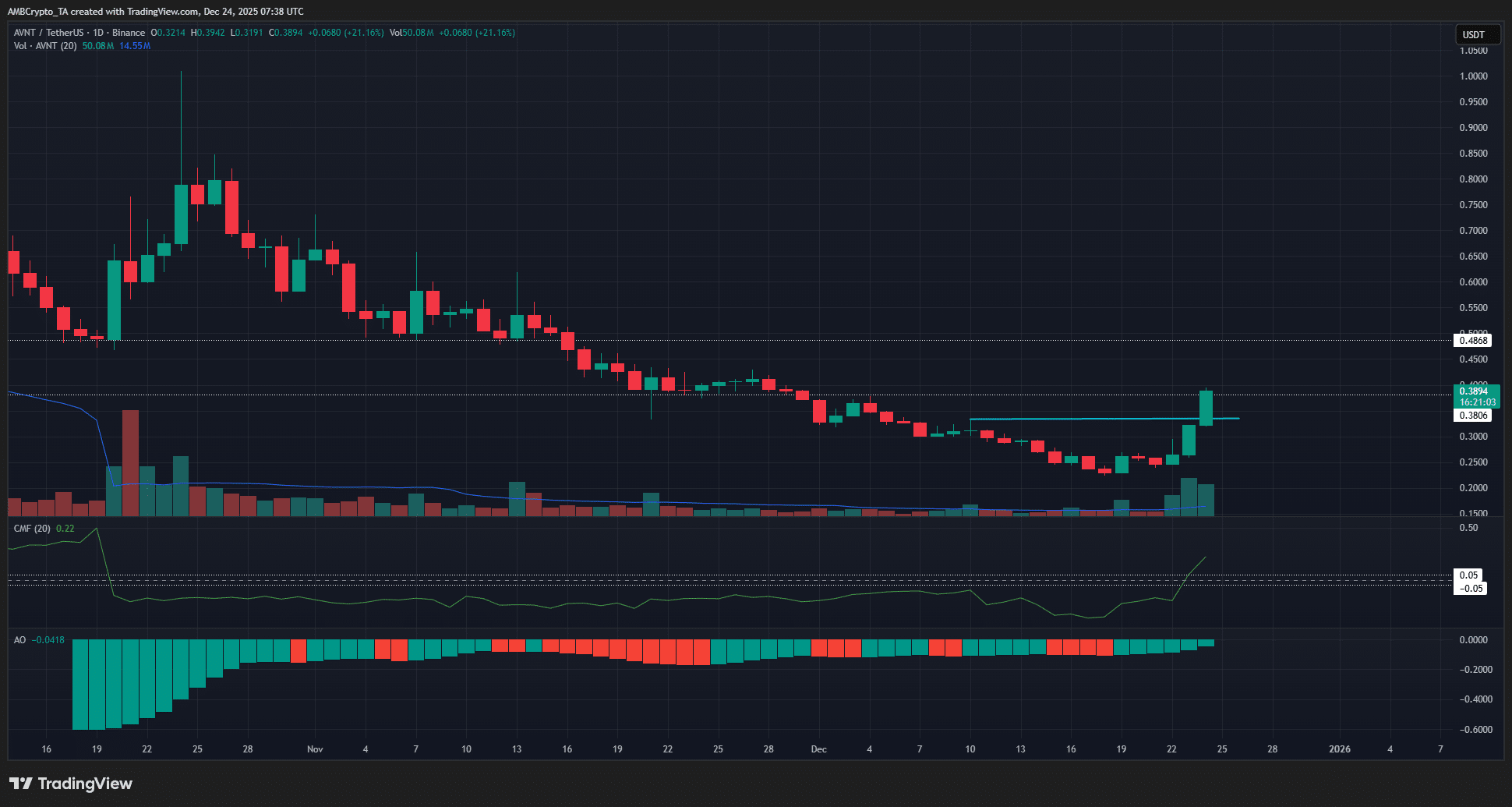

Avantis rallies 24% in a day – Can AVNT squeeze toward $0.40?

Mt. Gox–Linked Wallets Move 1,300 BTC to Exchanges as Analyst Flags New Outflows