HBAR Price Hops on the Rebound Train as Selling Pressure Eases 88% — Is $0.25 Next?

Hedera (HBAR) is showing one of the cleanest recovery setups among altcoins after the market crash. Exchange inflows have dropped by 88%, CMF shows whales are buying, and RSI signals a possible trend reversal. HBAR now faces key resistance at $0.22 that could decide whether its rebound continues toward $0.25 or higher.

Hedera (HBAR) has joined the list of altcoins bouncing back after the recent crypto market crash. HBAR price is up more than 9% in the past 24 hours, trimming part of its 15% weekly loss.

While HBAR is still down 20% over the past three months (adopting a downtrend), the latest technical and on-chain readings suggest the trend may be shifting from decline to early recovery.

Whales Step In as Selling Pressure Fades

HBAR’s selling pressure has cooled sharply since October 11. Exchange inflows — which show coins being sent for selling — have fallen from $4.43 million to just $517,000, marking an 88% drop at press time. This means fewer traders are offloading tokens, and short-term panic has likely eased.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

HBAR Exchange Inflows Have Eased:

HBAR Exchange Inflows Have Eased:

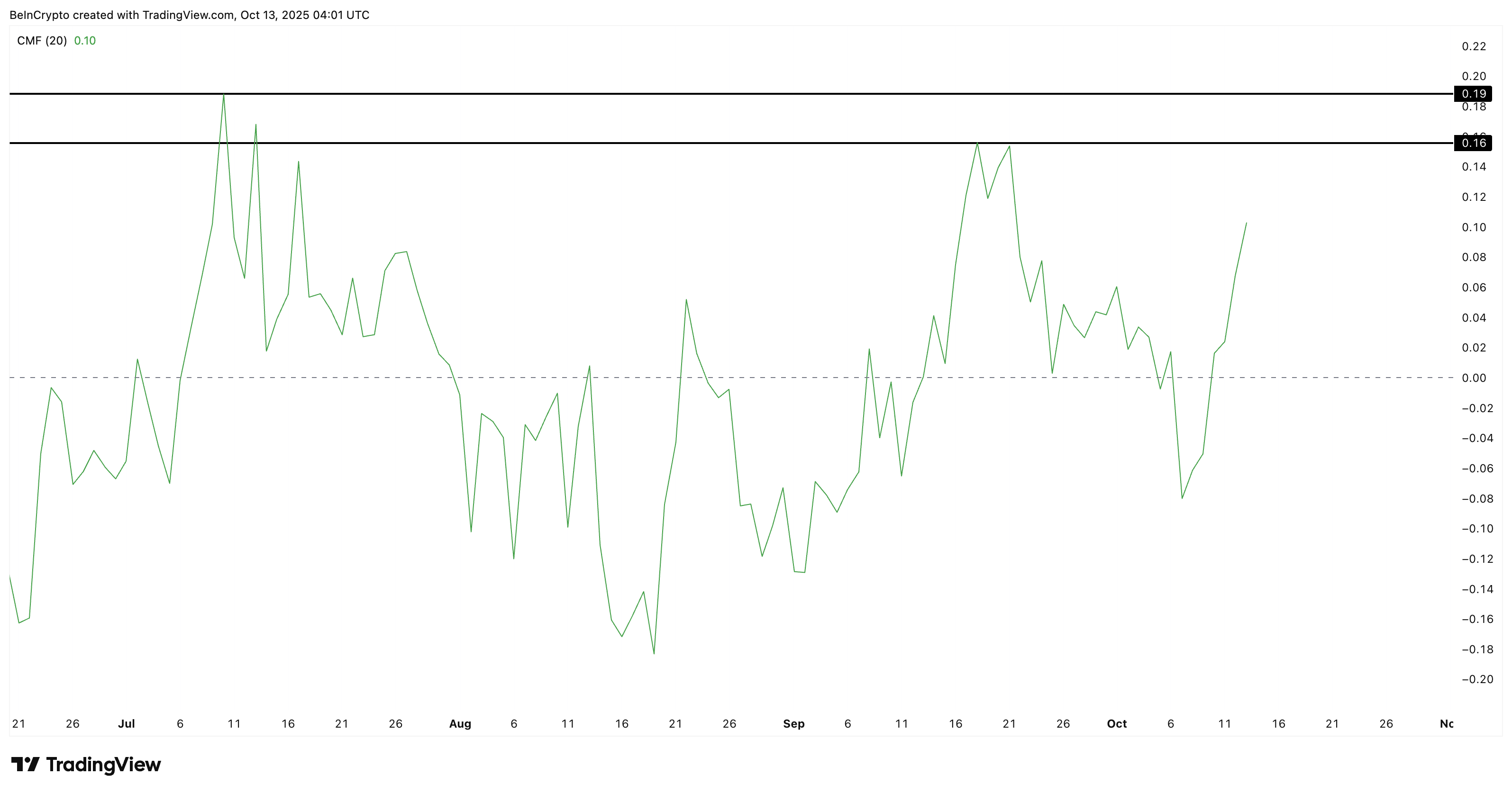

The Chaikin Money Flow (CMF), which tracks larger wallet movements, has also turned strongly positive, now around 0.10, confirming that whales are adding capital rather than exiting. Notably, CMF began rising around October 7 and didn’t fall through the HBAR price crash— showing that large holders stayed confident through the crash.

Big HBAR Wallets Still Optimistic:

Big HBAR Wallets Still Optimistic:

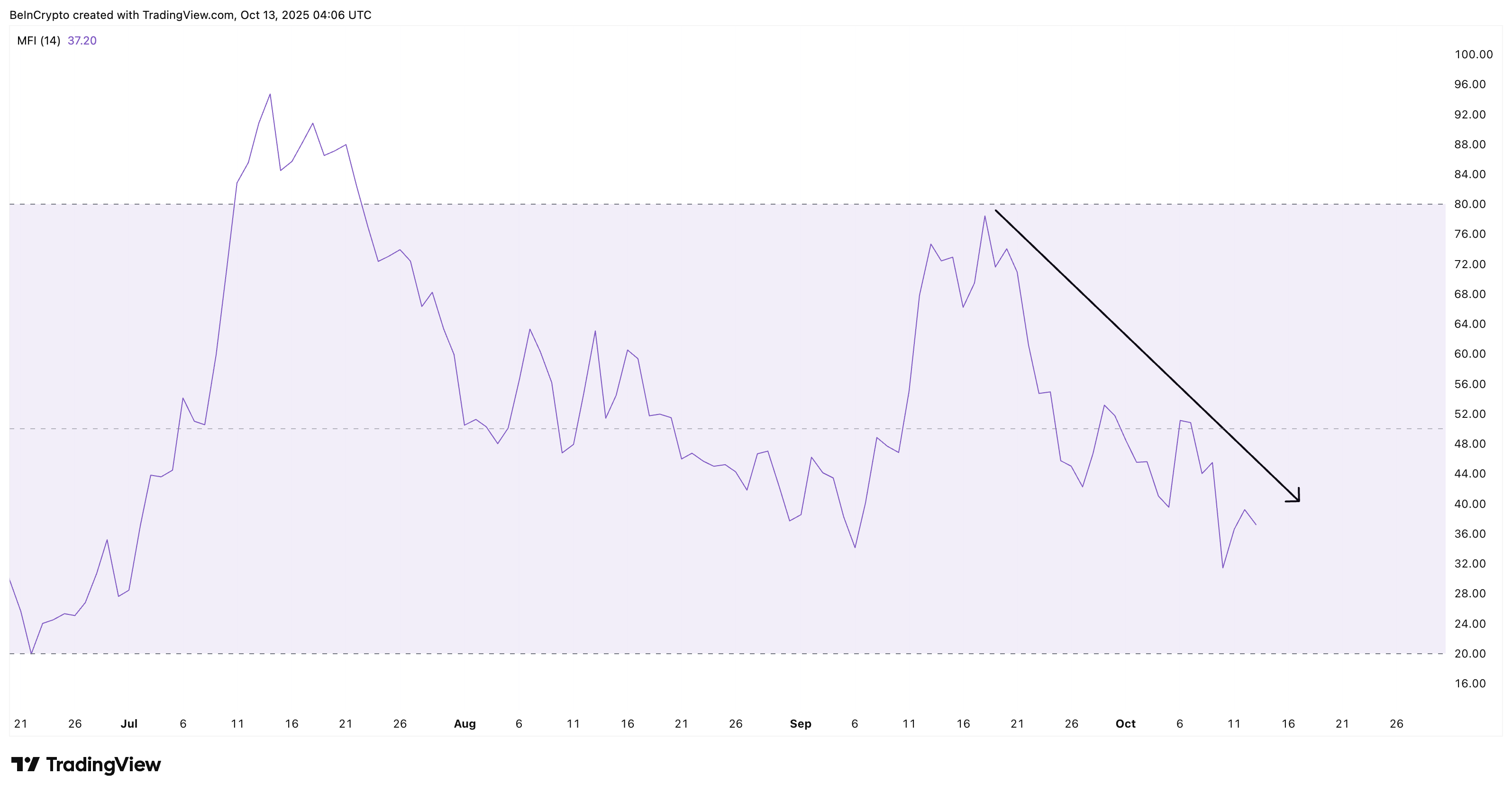

Meanwhile, the Money Flow Index (MFI), which reflects overall trading activity and retail flows, is trending lower. This points to weaker retail participation and suggests that whales might be the main force offsetting selling pressure for now.

HBAR Retail Hasn’t Joined In:

HBAR Retail Hasn’t Joined In:

Together, easing exchange inflows, rising CMF, and a softer MFI point to early-stage accumulation — one likely driven by large wallets preparing for a longer recovery phase. If retail joins in over the next few days, the HBAR price rebound narrative might gain some more steam.

Bullish Divergence Hints at a Possible HBAR Price Turnaround

The improving on-chain picture is now beginning to show up on the HBAR price charts, too. After weeks of selling pressure, HBAR’s three-month, 20% downtrend appears to be slowing. Prices are still moving under a descending trendline, but early signals suggest that bearish momentum may be fading — and that a recovery could be taking shape.

The Relative Strength Index (RSI), which measures the strength of price moves, is showing bullish divergence — one of the first technical signs of reversal. Between June 22 and October 10, HBAR’s price made a lower low (courtesy of the crash), but the RSI made a higher low. This pattern means that while prices kept falling, the pace of selling was weakening.

The pressure that once drove the HBAR price lower is easing, likely in line with whales starting to absorb supply.

If this shift continues, the next confirmation will come with a Hedera (HBAR) price breakout above $0.22, a resistance zone that has capped multiple recovery attempts in recent months. A successful move beyond it could allow HBAR to push toward $0.25, and if momentum holds, even $0.30 in the near term.

HBAR Price Analysis:

HBAR Price Analysis:

However, the structure remains fragile as long as the HBAR price trades below that descending trendline. A drop under $0.16 could invalidate the rebound setup, exposing the next major support at $0.14, where buyers would need to step back in to prevent deeper losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple CEO Declares ‘Nobody Can Manipulate XRP Prices’ amid December Volatility. Here’s Why.

Expert to XRP Holders: This Will Be One of the Biggest Fakeouts in History If This Happens

BTC price outlook: short-term bounce inside a larger downtrend

Best Solana Wallets as Visa Chooses Solana and USDC for US Bank Settlements