Data: Ethereum spot ETFs saw a net inflow of $488 million last week, with BlackRock's ETHA leading at a net inflow of $638 million.

According to ChainCatcher, citing SoSoValue data, during last week's trading days (Eastern US time, October 6 to October 10), Ethereum spot ETFs saw a net inflow of $488 million for the week.

The Ethereum spot ETF with the highest weekly net inflow last week was Blackrock's ETF ETHA, with a weekly net inflow of $638 million. The historical total net inflow for ETHA has reached $14.49 billion. The second highest was Grayscale's Ethereum Mini Trust ETF ETH, with a weekly net inflow of $11.75 million, and a historical total net inflow of $1.53 billion for ETH.

The Ethereum spot ETF with the largest weekly net outflow last week was Fidelity's ETF FETH, with a weekly net outflow of $126 million. The historical total net inflow for FETH has reached $2.69 billion.

As of press time, the total net asset value of Ethereum spot ETFs stands at $27.51 billion, with the ETF net asset ratio (market cap as a percentage of Ethereum's total market cap) at 5.89%. The historical cumulative net inflow has reached $14.91 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Foundation sets strict 128-bit encryption rules for 2026

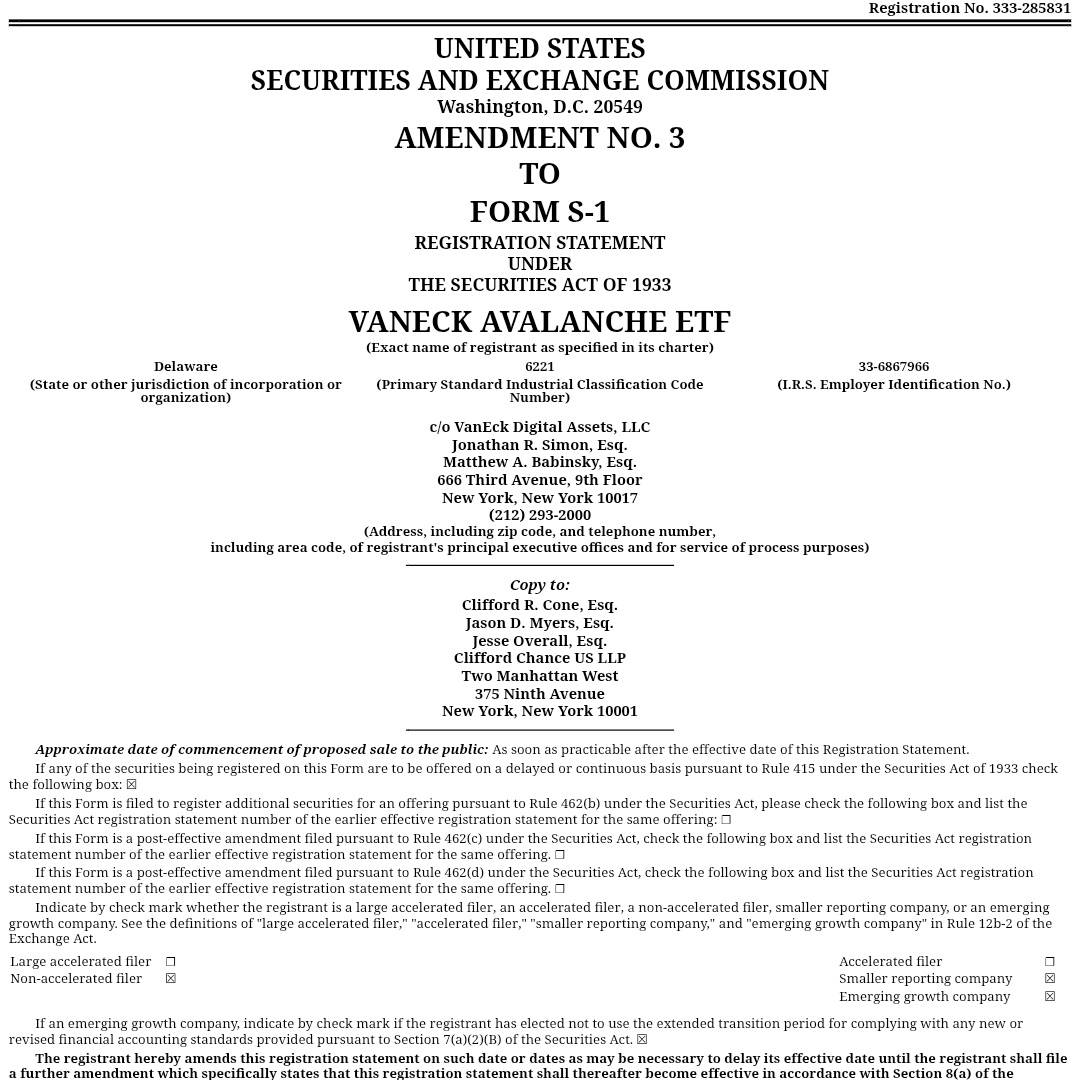

VanEck updates Avalanche ETF application to include staking rewards

VanEck submits spot AVAX ETF application to US SEC

Pi Network updates DEX and AMM features and launches holiday event