October 13 Key Market Insights, A Must-Read! | Alpha Morning Report

Featured News

1.Due to Trump's Moderate Speech, Cryptocurrency and Major U.S. Stock Index Futures Rebound

2.Binance Has Compensated $283 Million to Users Affected by USDE and Other Assets' De-pegging, Spot "Zero Price" Only a Display Issue

3.$216 Million Liquidated Across the Network in the Past Hour, Mainly Short Positions

4.Cryptocurrency Total Market Cap Rebounds Above $4 Trillion, 24-hour Increase of 5.6%

5.Macro Outlook for the Week: Powell Speech on Tuesday Night

Articles & Threads

1.《Weekly Review | Epic Cryptocurrency Market Crash Leads to 1.6 Million Liquidations; Monad Airdrop Claim Portal to Open on October 14》

After hitting a historic high of $126,000, Bitcoin experienced an epic crash. The U.S. Bureau of Labor Statistics is expected to release the CPI report during the government shutdown, and Binance Alpha launched various Chinese narrative meme coins on the contract platform.

2.《Traders' View | Why Did This Epic Market Crash Happen, and When Is the Right Time to Buy the Dip?》

October 11, 2025, a day that will be engraved in crypto history. Influenced by U.S. President Trump's announcement of restarting the trade war, the global market instantly entered panic mode. Starting at 5 a.m., Bitcoin began a nearly unsupported cliff-like decline, which quickly spread throughout the entire crypto market. However, why was this liquidation so intense? Has the market bottomed out? ReLive BlockBeats compiled perspectives from multiple market traders and well-known KOLs, analyzing this epic liquidation from the macro environment, liquidity, market sentiment, and other perspectives, for reference only.

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

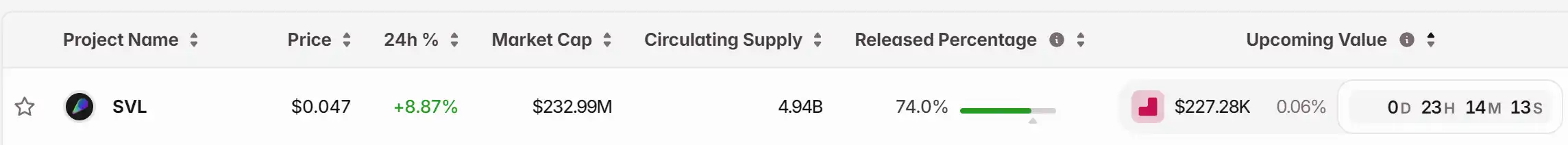

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve Strategies and the Rising Worth of Solana: How Changes in Monetary Policy Propel Institutions Toward High-Performance Blockchain Adoption

- Fed's 2025 rate cuts and QT halt injected $72.35B liquidity, coinciding with a 3.01% Solana price surge. - Institutional capital shifted toward Solana due to infrastructure upgrades and accommodative monetary policy. - Regulatory frameworks like MiCA and GENIUS Act boosted Solana's institutional appeal despite macroeconomic volatility. - Fed's policy normalization accelerated blockchain adoption, positioning Solana as a long-term investment amid uncertainty.

ICP Caffeine AI's Rapid Growth and What It Means for Cryptocurrency Markets Powered by AI

- DFINITY's ICP Caffeine AI (launched July 2025) merges AI app development with low-code/no-code accessibility via chain-of-chains architecture. - Platform's $237B TVL by Q3 2025 signals institutional confidence in financial sector applications despite 22.4% dApp activity decline. - Token price volatility (11% drop by 2025) and reverse-gas mechanism raise concerns about adoption sustainability and valuation stability. - Analysts project $4.4-$20.2 price range for ICP in 2025, emphasizing need for $6.50+ pr

SOL Price Forecast for Early 2025: Network Enhancements and Growing Institutional Interest Transform Solana’s Core Dynamics

- Solana's 2025 advancements in scalability (65k TPS) and sub-150ms finality position it as a leading blockchain for institutional finance. - Institutional adoption by Franklin Templeton, Securitize, and Société Générale accelerates asset tokenization and cross-border payment solutions. - Marinade Select's $436M TVL and Bitwise/Grayscale ETFs drive institutional capital inflows, supporting bullish SOL price forecasts ($150–$300 in 2025). - Regulatory clarity and partnerships with Visa/Coinbase reinforce So

Reddit is currently experimenting with verification badges