How Did Zcash Defy The Crypto Market Crash To Hit An All-Time High?

Zcash (ZEC) defied a $20 billion crypto liquidation wave, soaring 450% in a month to reach a four-year high.

Zcash (ZEC) has emerged as one of the few digital assets to rally amid one of the harshest liquidation waves in recent crypto history.

As nearly $20 billion in leveraged positions vanished following President Trump’s unexpected tariff announcement, the privacy-focused cryptocurrency surged to a four-year high.

Why is Zcash Price Rising?

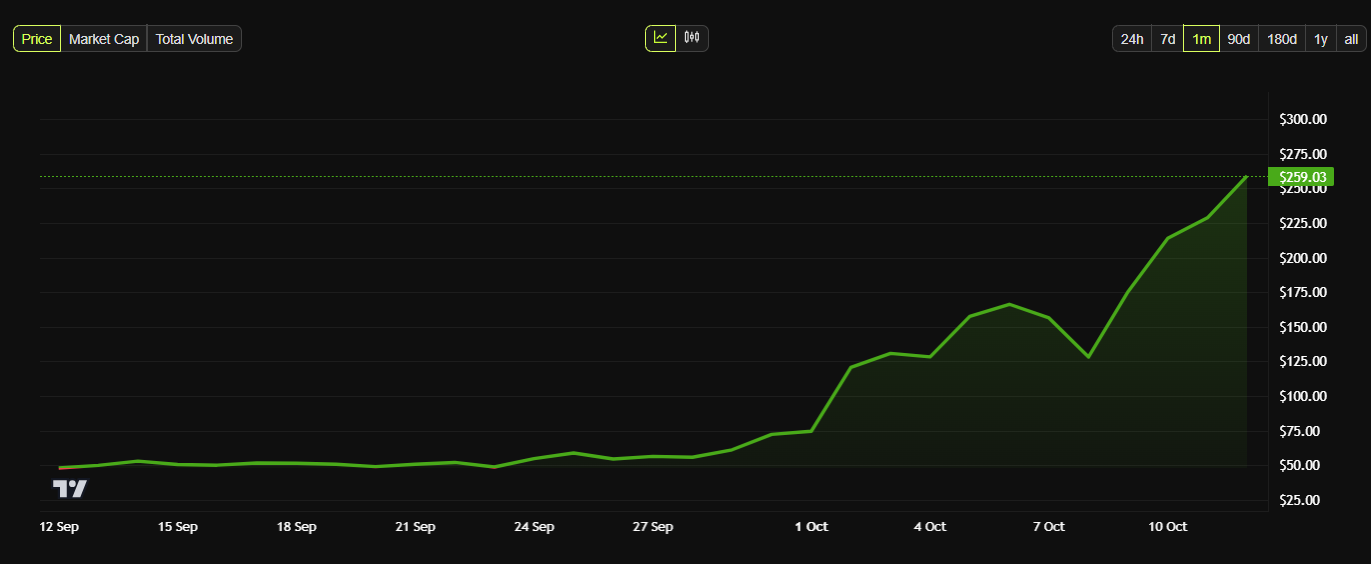

Data from BeInCrypto showed ZEC price briefly touching $282.59 on October 11 before easing to about $257.96. Even after that pullback, the token posted a 15% daily gain—its strongest since late 2021, when it last traded near $295.

This continues an upward movement for a digital asset that has climbed over 100% this week and nearly 450% in the past month.

Zcash’s Price Performance in the Last 30 Days. Source:

Zcash

Zcash’s Price Performance in the Last 30 Days. Source:

Zcash

Zcash’s rally has been aided by crypto traders’ rotation into privacy-centric projects following increased financial surveillance by global authorities.

Moreover, the token’s positive performance has been amplified by industry figures such as Barry Silbert, founder of Digital Currency Group. Notably, he has reshared multiple Zcash-related updates in recent days.

Outside of that, some community members have pointed out that Zcash remains undervalued relative to its fundamentals.

Mert Mumtaz, CEO of Helius Labs, argued that ZEC has operated as a proof-of-work, fully distributed network for nine years.

According to him, the project offers user sovereignty, advanced encryption, and Bitcoin-like tokenomics at a fraction of the market capitalization of peers such as Litecoin or Cardano.

Mumtaz also cited a “renaissance” of developer activity, with new contributors focusing on performance improvements and exchange integrations.

Considering this, he argued that the token “is the most obvious mispricing in crypto,” while adding that:

“The community using the power of crypto and public markets to breathe life back into the project,” Mumtaz said.

Launched in 2016, Zcash uses zero-knowledge proofs to enable private transactions without revealing the sender, receiver, or amount. These features are missing in top cryptocurrencies like Bitcoin and Ethereum.

So, as governments worldwide increase financial surveillance, Zcash’s shielded-transaction model is regaining relevance among privacy-minded users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why is the COAI Index Plummeting in Late 2025? Investor Confidence, Policy Changes, and What Lies Ahead for AI-Powered Learning

- COAI Index collapsed 96% in late 2025 due to governance failures, regulatory ambiguity, and AI-generated misinformation. - Centralized token distribution (97% in 10 wallets) and C3 AI's $116.8M loss exposed systemic vulnerabilities in AI-driven crypto assets. - AI-generated deepfakes and fake news triggered panic selling, accelerating the crash in emerging markets like Indonesia. - Post-crash, investors are prioritizing STEM/vocational education over speculative crypto, but funding delays and infrastruct

The Rise of MMT Token: Analyzing Driving Forces and Assessing Its Sustainability in the Cryptocurrency Market

- Momentum (MMT) token surged 1,300% in November 2025, driven by product innovation, regulatory clarity, and institutional investment. - Strategic moves included a Sui-based perpetual futures DEX, CLARITY Act/MiCA 2.0 compliance, and $10M funding for cross-chain expansion. - Institutional holdings rose 84.7%, while on-chain activity showed growing utility in real-world asset tokenization and governance models. - Risks persist: 3M tokens moved to OKX, $109M in liquidations, and 20.41% circulating supply cre

The Financial Wellness Aspect: The Influence of Investor Actions on Market Results

- Behavioral economics integrates psychology to explain how emotional, intellectual, and environmental wellness shape investor decisions and market outcomes. - Emotional resilience reduces cognitive biases like loss aversion, while intellectual engagement through AI tools improves long-term investment returns according to 2024-2025 studies. - Environmental factors such as ESG frameworks and workplace wellness programs demonstrate measurable economic benefits, including 20% higher productivity and reduced f

Regulatory Changes in U.S. Agriculture: The Impact of USDA Policy Decisions on Long-Term Investments in Livestock and Poultry Industries

- USDA’s 2023–2025 Organic Livestock and Poultry Standards (OLPS) impose stricter animal welfare rules, with phased compliance until 2029 to ease small producers’ adjustments. - Compliance costs for organic producers are high initially but projected to yield $59.1–$78.1 million annual benefits via enhanced consumer trust and premium pricing. - Investors favor scalable, tech-driven operations amid OLPS-driven capital shifts, though small producers face compliance challenges and market exit risks in poultry