October 11th Market Key Intelligence, How Much Did You Miss?

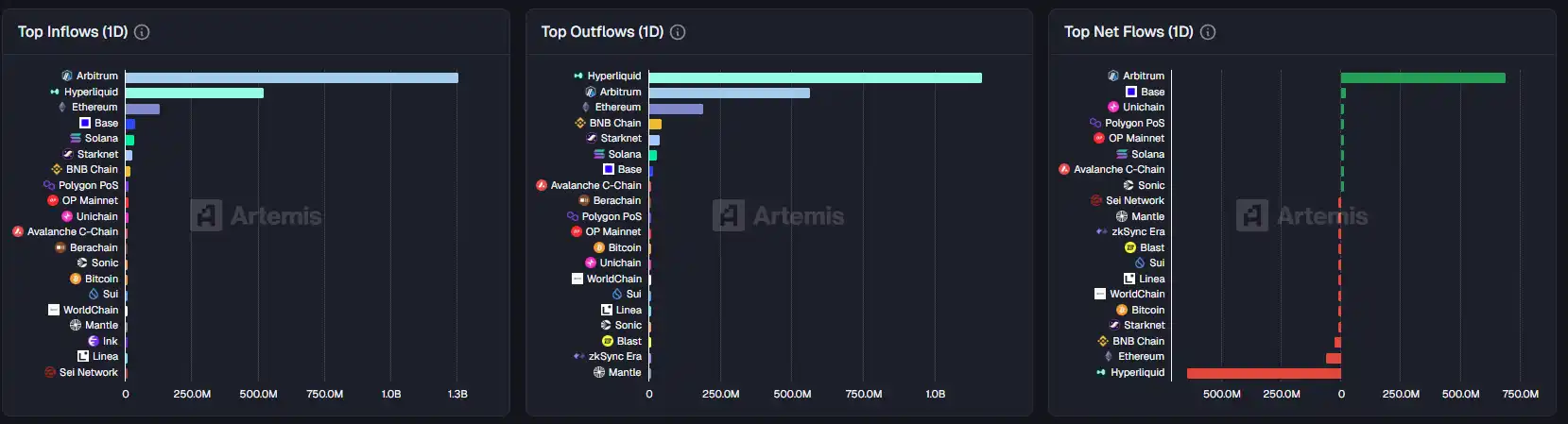

1. On-chain Flows: $691.7M USD inflow to Arbitrum today; $642.5M USD outflow from Hyperliquid 2. Largest Price Swings: $HAQIMI, $TRADOOR 3. Top News: Hyperliquid launches DEX-based live streaming platform "Based Streams," going live today at 8:30 PM

Featured News

1. Chinese Meme Token "Hakimi" Surpasses $87 Million in Market Cap with a 160% 24-hour Gain

2. Privacy Token ZEC Breaks Through $275 Against the Trend, with a Nearly 352% Gain in the Past 2 Weeks

3. US Crypto Stocks Experienced a Universal Decline Last Night, with CRCL and BMNR Dropping Over 10%

4. ZeroBase Founder States They Did Not Convert Stablecoins to USDe Nor Pledge USDe

5. Binance Indicates Review of Compensation Plan for De-pegging Incidents of Tokens like USDE, Will Strengthen Risk Management Mechanisms in the Future

Featured Articles

1. "Is This the Real Reason Behind the $20 Billion Liquidation in the Crypto Market?"

October 11, 2025, a day that will forever haunt crypto investors worldwide. Bitcoin's price plummeted from a high of $117,000, breaking below $110,000 within hours. Ethereum saw an even more brutal drop of 16%. Panic spread like wildfire in the market, with numerous altcoins crashing 80-90% in an instant, followed by a slight rebound but generally down 20% to 30%. In just a few hours, the global crypto market lost billions of dollars in market capitalization. On social media, cries of despair echoed worldwide, various languages melding into one collective elegy. Beneath the facade of panic, the true underlying chain of transmission was far more complex than it appeared.

2. "Trader's Insight: Why Did This Market Experience an Epic Plunge, and When Is the Right Time to Buy the Dip?"

On October 11, 2025, this day will be engraved in the annals of crypto history. Influenced by the announcement of the resumption of the trade war by U.S. President Trump, the global market instantly entered panic mode. Starting at 5 a.m., Bitcoin began a nearly unsupported cliff-like drop, and the chain reaction quickly spread throughout the entire crypto market. According to Coinglass data, in the past 24 hours, the total amount of liquidations across the network reached as high as $19.1 billion, with over 1.6 million liquidated accounts—both in terms of amount and number of people, this event has set a new record in the ten-year history of cryptocurrency contract trading.

On-chain Data

On-chain fund flow on October 11

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: SEC Guidelines Allow Cryptocurrencies to Achieve Commodity Classification

- SEC Chair Paul Atkins proposed a crypto regulatory framework exempting ETH, SOL, and XRP from securities classification using the Howey Test to clarify market roles. - The framework categorizes crypto assets into four groups, allowing tokens to "graduate" from securities to commodities as ecosystems decentralize and utility emerges. - It introduces "super apps" for mixed-asset trading and a six-month compliance grace period, aiming to balance innovation with fraud prevention and reduce regulatory fragmen

Zcash News Today: Privacy-Focused Zcash Transforms Cryptocurrency Landscape as Institutions Adopt Shielded Technology

- Zcash (ZEC) surged to $667 in early 2025, driven by privacy demand, institutional adoption, and regulatory clarity. - Institutional investors like Cypherpunk Technologies acquired 203,775 ZEC, boosting shielded pool adoption as a compliance-friendly privacy asset. - ZEC's RSI hit 94.24, signaling overbought conditions and potential 45%-90% corrections, amid 37% daily volatility and self-custody warnings. - Privacy coins like Zcash gain traction as alternatives to stagnant mainstream crypto, aligning with

Dogecoin News Update: Is DOGE's $0.17 Support a Saving Grace or a Final Blow for Memecoins?

- Dogecoin (DOGE) and NEAR Protocol (NEAR) face bearish pressure as crypto markets decline, with DOGE below $0.1730 and NEAR testing support levels. - DOGE's on-chain metrics show increased token turnover and reduced futures open interest, signaling speculative de-risking and potential further losses. - NEAR shows early stabilization signs with rising TVL ($182.1M) and positive funding rates, suggesting possible rebounds if key resistance levels hold. - Market analysts highlight critical junctures for both

Ethereum Updates: BitMine’s Fresh Leadership Fuels Ethereum Growth, Striving to Connect Wall Street with the Crypto World

- BitMine appoints Chi Tsang as CEO amid strategic overhaul, adding 3 board members to strengthen governance. - Company boosts ETH holdings by 34% to $12.5B, aiming to control 5% of Ethereum's supply through aggressive accumulation. - Institutional Ethereum buying accelerates as exchange balances hit multi-year lows, with BitMine trailing only Bitcoin-focused rivals. - Despite 35% stock decline and 13.4% ETH price drop, $398M cash reserves signal long-term blockchain asset tokenization bets.