Bitget Daily Digest(October 11)|Trump Announces 100% Tariffs on China, Triggering Market Turmoil; Crypto Industry Liquidations Exceed $19.1 Billion in 24 Hours, Setting New Record.

Today’s Preview

-

The Future Blockchain Summit 2025 will be held in Dubai, UAE from October 12 to October 15, 2025, focusing on the development and application of blockchain technology.

-

Aptos (APT) will unlock 11.3 million tokens on October 12, 2025, worth approximately $48.02 million.

-

Bittensor (TAO) will unlock 49.44 million tokens on October 12, 2025.

Macro & Hot Topics

-

U.S. President Donald Trump announced a 100% tariff on China effective November 1, reigniting the trade war and triggering a sharp market selloff across crypto and U.S. stocks. The U.S. federal government is in its 10th day of shutdown and has begun layoffs.

-

State Street Bank expects institutional crypto holdings to double by 2028; Deutsche Bank predicts bitcoin could be included in global central bank reserves by 2030.

-

Zcash (ZEC) price surged 220% in two weeks, hitting a new record high as increased attention to privacy coins followed the reopening of Grayscale Trust and major investor commentary.

-

The Monetary Authority of Singapore (MAS) plans to delay the implementation of new Basel crypto asset capital requirements until January 1, 2027, or later. Banks must continue to communicate with MAS on crypto asset risk exposure.

Market Updates

-

BTC and ETH suffered intraday plunges exceeding 10%. In the past 24 hours, over $19.2 billion in positions were liquidated, with longs being dominant. Market sentiment remains fragile.

-

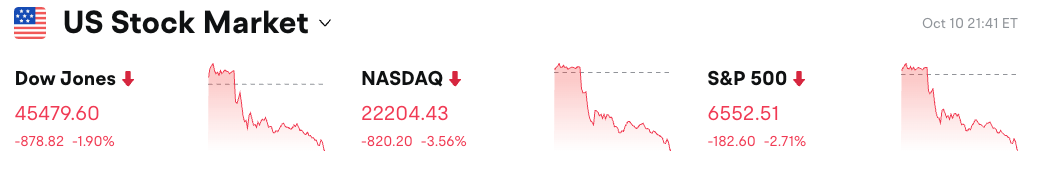

U.S. stocks tumbled on Friday: the Dow fell nearly 900 points, the Nasdaq plunged over 3.5%, and the S&P 500 dropped more than 2.7%, all three major indexes closing lower.

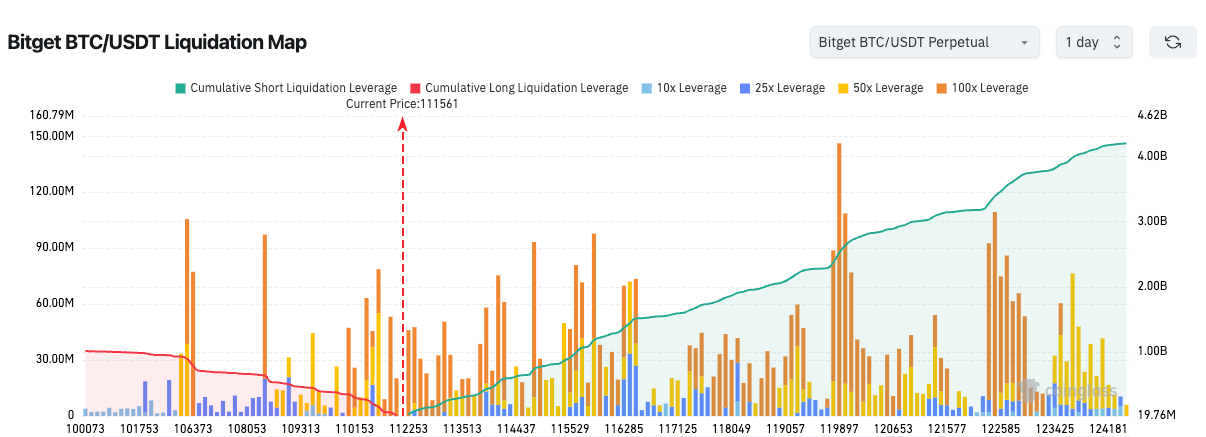

3、Bitget’s BTC/USDT liquidation map shows the current price at 111,561 USDT. High-leverage long liquidations are prominent. Short-term price swings are significant; be alert for further long liquidations.

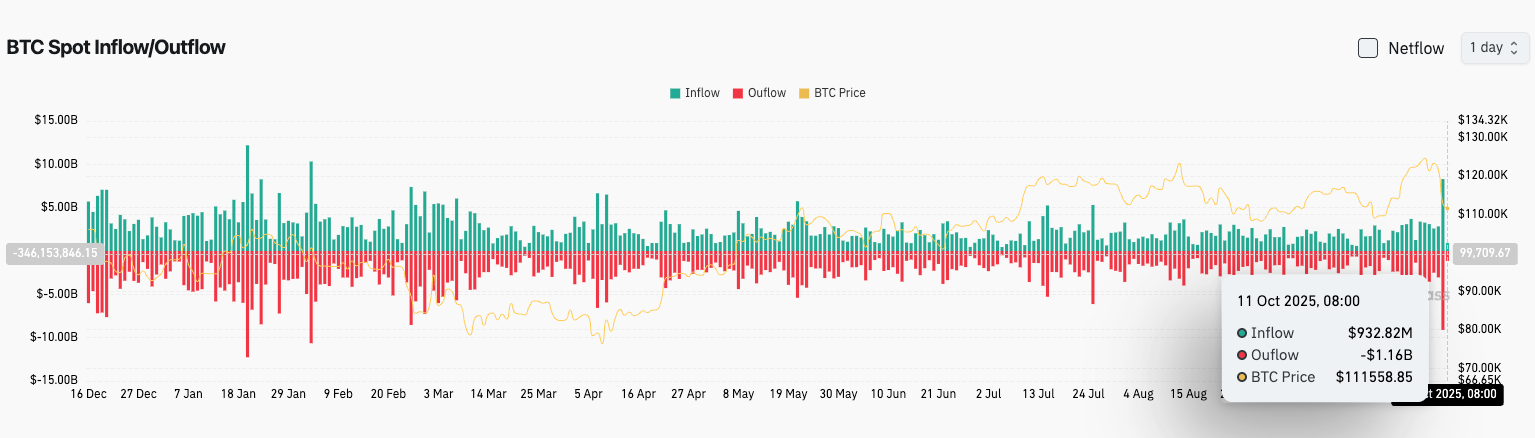

4、In the past 24 hours, BTC spot inflows were $1.28 billion, outflows at $1.445 billion, with a net outflow of $227 million.

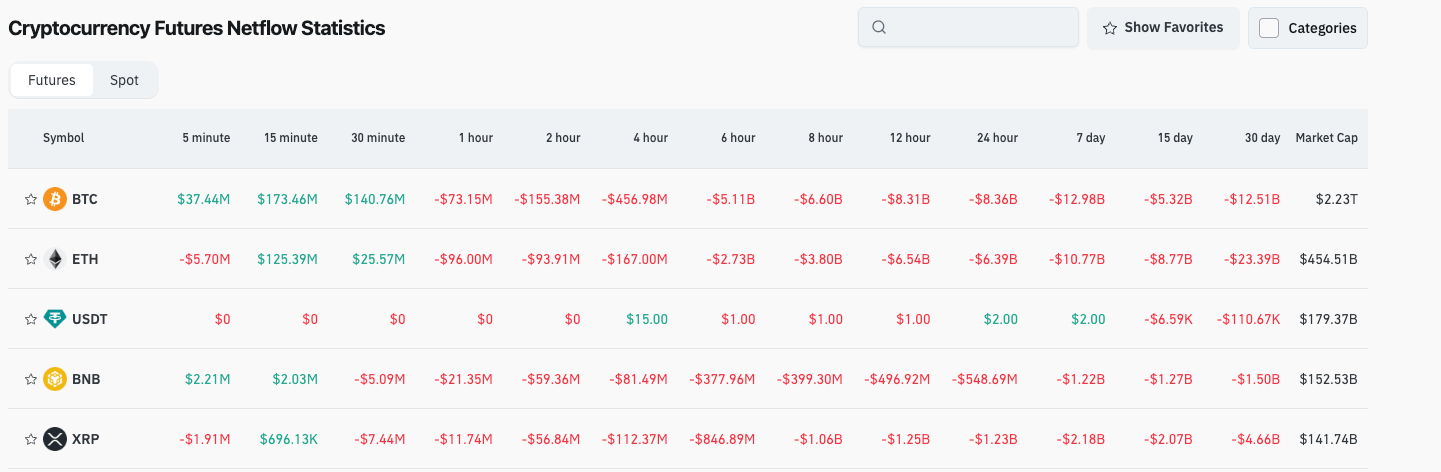

5、in the past 24 hours, contract trading in BTC, ETH, BNB, and XRP led the pack in net outflows, suggesting potential trading opportunities.

5、in the past 24 hours, contract trading in BTC, ETH, BNB, and XRP led the pack in net outflows, suggesting potential trading opportunities.

News Highlights

-

The crypto industry saw over $19.1 billion in liquidations in 24 hours, with more than 1.6 million traders liquidated—the highest in the decade-long history of derivatives trading. On the Hyperliquid platform alone, liquidations reached $9.297 billion.

-

USDe experienced a severe depeg this morning; Ethena confirmed minting and redemptions are operating normally with assets remaining over-collateralized.

-

The UK has officially lifted the ban on retail investors trading crypto ETNs, allowing individuals to purchase listed crypto ETN products.

-

Grayscale released the latest list of crypto assets included and under consideration for future and current investment products.

Project Developments

-

The Pi Network hackathon is nearing its end, with new projects being released.

-

Binance Wallet announced its first project, offering investor opportunities.

-

Major banks are exploring the issuance of G7 currency-pegged stablecoins.

-

Grayscale's decision deadline for Solana and Litecoin trust conversions is due.

-

MoonBull presale launches as a new crypto project.

-

MAGACOIN FINANCE announced a $16 million presale milestone.

-

XRP ETF speculation aligns with Ethereum growth.

-

Monad announced its airdrop claim portal will open on October 14.

-

DeFi’s total value locked (TVL) in Q3 reached $237 billion, a new record high.

-

MetaMask launched a rewards program, with approximately $30 million LINEA tokens to be distributed in Q1.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreDTCC and JPMorgan just set the on-chain schedule, but the pilot relies on a controversial “undo” button

Bitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low