Ripple’s Stablecoin Inches Closer To The $1 Billion Mark After New RLSUD Expansion

Ripple’s new partnership in Bahrain aims to expand Web3 infrastructure and boost RLUSD adoption. As the stablecoin nears $1 billion in liquidity, Ripple’s global reach continues to grow across key financial hubs.

Ripple just announced a new partnership in Bahrain, agreeing to help expand the kingdom’s Web3 infrastructure with pilot projects, participation in industry events, and more.

This could be a golden opportunity for the firm to expand its RLUSD user base, which is still rather tiny. However, the stablecoin’s liquidity is growing quickly and could potentially reach the $1 billion mark soon.

Ripple’s Bahrain Deal

Ripple has been making significant progress in expanding its RLUSD stablecoin recently; in the last few months, new partnerships have expanded its market access in Europe, East Asia, and across the African continent.

Today, Ripple is gaining further global exposure thanks to a new partnership in Bahrain:

Next up → the Kingdom of Bahrain. 🇧🇭 We're expanding our presence in the Middle East through a partnership with Bahrain @FinTechBay: Building on our Dubai regulatory license, this move reinforces our commitment to the MENA region.Together, we'll…

— Ripple (@Ripple) October 9, 2025

To be clear, Bahrain isn’t Ripple’s only expansion target at the moment; the firm also conducted top-level meetings in Luxembourg today. Still, this Bahrain deal has been finalized, and it offers many advantages.

The firm is partnering with Bahrain Fintech Bay, a financial incubator and ecosystem builder with important government partnerships.

Ripple hopes to expand Bahrain’s Web3 ecosystem in a variety of ways, supporting pilot programs and agreeing to take part in future industry conferences.

RLUSD isn’t a centerpiece of this agreement, but it does play a notable role, as Ripple will integrate it with Bahrain’s financial institutions. Furthermore, this partnership comes at an interesting moment for the firm and its stablecoin.

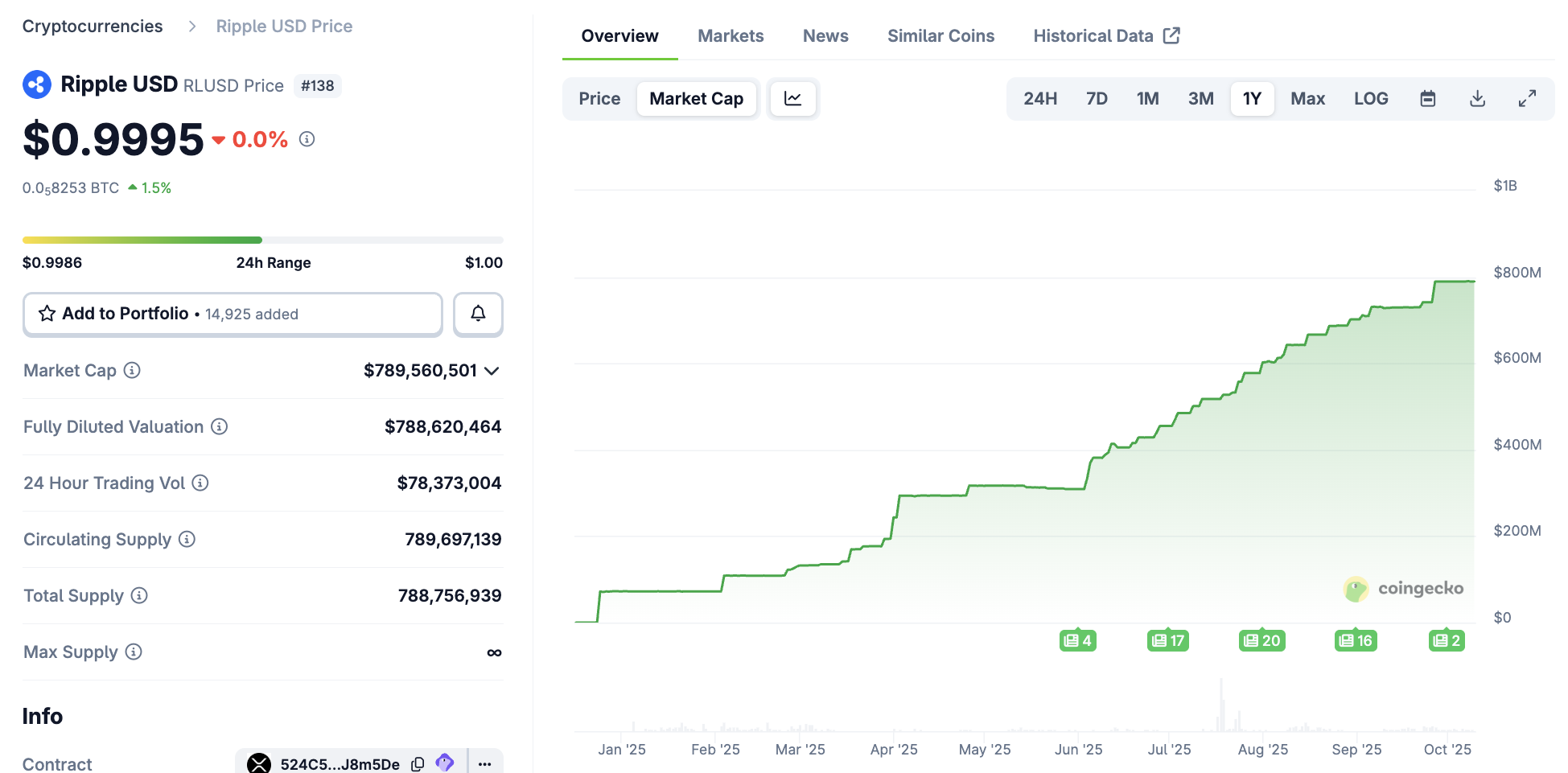

Ripple hasn’t just pursued regulatory acceptance for this token; it’s been continually building liquidity for several months. RLUSD’s market cap is rapidly approaching $1 billion, an impressive milestone:

RLUSD Market Cap. Source:

CoinGecko

RLUSD Market Cap. Source:

CoinGecko

Despite this impressive liquidity, however, RLUSD’s actual user activity is lagging far behind.

On-chain data currently shows that average daily users hover around 500, and it hasn’t hit 700 in the last 12 months. In other words, actual adoption in regions like Bahrain could be very critical to Ripple’s long-term success with RLUSD.

With a daily transaction volume of roughly $80 million, Ripple has a lot of work ahead of it if the firm wishes to seize a piece of the lucrative stablecoin market.

Hopefully, this Bahrain expansion can help it achieve these goals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What’s the Latest on Bitcoin (BTC)? What Are the Big Whales Doing? Analysis Firm Takes a Deep Dive

Nvidia and AMD Just Got Some Interesting News About the China Market