Aave and Blockdaemon partner to advance institutional access to DeFi

Blockdaemon, a leading staking provider for institutions, and Aave Labs, a key contributor to the Aave protocol, have joined forces in a strategic partnership aimed at boosting access to decentralized finance opportunities for institutions.

- Aave Labs and Blockdaemon say the partnershio aims at expanding institutional access to DeFi.

- Blockdaemon Earn Stack customers can now earn further by putting staking rewards and idle balances to work.

- The integration includes support for Bitcoin, Ethereum and stablecoins.

Aave Labs and Blockdaemon are eyeing institutional-grade access to Aave’s decentralized finance markets and are tapping into Blockdaemon’s Earn Stack and Aave Vaults to unlock this.

Per an announcement on October 9, 2025, the integration opens new opportunities for institutions.

Why is this big for Aave?

According to details, Aave ( AAVE ) is set to be the exclusive primary lending provider for Blockdaemon Earn Stack, a non-custodial platform that offers staking services across more than 50 protocols.

The integration will leverage Aave Vaults to allow institutional clients to access staking rewards. Providing access to on-chain markets unlocks over $70 billion in liquidity and allows institutional investors to tap into secure yield opportunities.

Aave is a leading DeFi lending protocol and the integration further expands this.

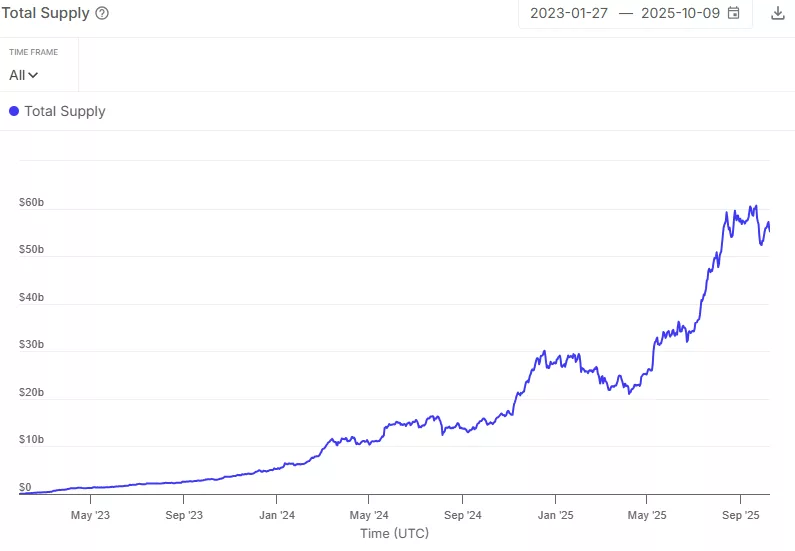

Aave supply growth chart. Source: Sentora on X

Aave supply growth chart. Source: Sentora on X

Importantly, Blockdaemon customers can now put staking rewards and their idle balances to work across DeFi markets. Furthermore, they retain full control of their assets.

“With this strategic partnership, institutions can now gain direct access to Aave’s DeFi markets through Blockdaemon’s market-leading infrastructure, opening new avenues for growth across top crypto assets and stablecoins,” said Konstantin Richter, founder and chief executive officer of Blockdaemon.

Bitcoin, Ethereum support

As noted, Blockdaemon has picked Aave as its primary lending provider given the DeFi protocol’s long-trusted operations and robust risk controls. Blockdaemon customers and the broader DeFi community will have access to a range of supported cryptocurrencies. This includes Bitcoin, Ethereum, and stablecoins.

Support also includes assets on Horizon, an institutional market for borrowing against real-world assets. Tokenized RWAs are currently one of the sectors witnessing strong growth.

Data shows the Horizon RWA market size has surpassed $200 million, with over $54 million borrows. The platform launched in August 2025.

Users supply stablecoins such as Ripple USD, USDC, and GHO Token, and tokenized assets like Superstate’s USTB and Janus Henderson’s JTRSY into RWA pools. Deposited tokenized assets serve as collateral for users looking to borrow USDC, RLUSD, or GHO.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?

Crucial Decision: Trump’s Final Interviews for Federal Reserve Chair Could Reshape Markets