Ocean Protocol Exits ASI Alliance: What It Means for the Project and Token Holders

Ocean Protocol’s exit from the ASI Alliance marks a strategic shift toward rebuilding its data-centric identity. With OCEAN down 75%, new buyback plans could help restore investor confidence and exchange support.

The Ocean Protocol Foundation (OPF) has officially withdrawn from the Artificial Superintelligence Alliance (ASI Alliance). The alliance previously united leading AI and Web3 projects such as Fetch.ai and SingularityNET.

Behind this abrupt and decisive move lies a deeper question: was this the result of diverging visions that eroded community trust and contributed to the sharp decline in OCEAN’s price?

OCEAN Breaks Away from ASI

According to the official announcement, Ocean Protocol Foundation has withdrawn all its directors and membership positions within the ASI Alliance, effectively ending its role in the decentralized AI coalition.

The team did not specify a concrete reason for the sudden withdrawal. However, the immediate enforcement of this decision raised major concerns about internal collaboration and trust among ASI members over the past year.

Some community members accused Ocean of benefiting from the alliance without adding value. At the same time, others mocked the project as a “Trojan horse” that disrupted the ASI ecosystem from within.

Ocean Protocol officially joined the ASI Alliance in March 2024. And by July 2024, about 81% of the total OCEAN supply had been swapped for FET. However, around 270 million OCEAN tokens — held by over 37,000 wallets — remain unconverted.

This may have been a key factor in the decision to leave: a large portion of the Ocean community apparently preferred to stay within the original ecosystem rather than merge into the unified ASI token structure. The withdrawal could help preserve Ocean’s native community. It may also prevent the project’s identity from being “diluted” within a larger, shared economy.

Another plausible explanation for the split lies in diverging long-term visions.

Fetch.ai and SingularityNET focus on building an “AI Agents + AGI token economy,” developing autonomous AI networks and an economy centered around AGI tokens. In contrast, Ocean Protocol aims to refocus on its original mission of building a decentralized data infrastructure. This disagreement may have delayed the merger process in the past.

This strategic divergence highlights Ocean’s intent to return to its foundational strength, empowering open, secure, and user-owned data layers for the AI economy. Ocean temporarily lost its focus and investor confidence by joining the ASI Alliance. By stepping away, the project may seek to regain both.

Can the OCEAN Token Recover?

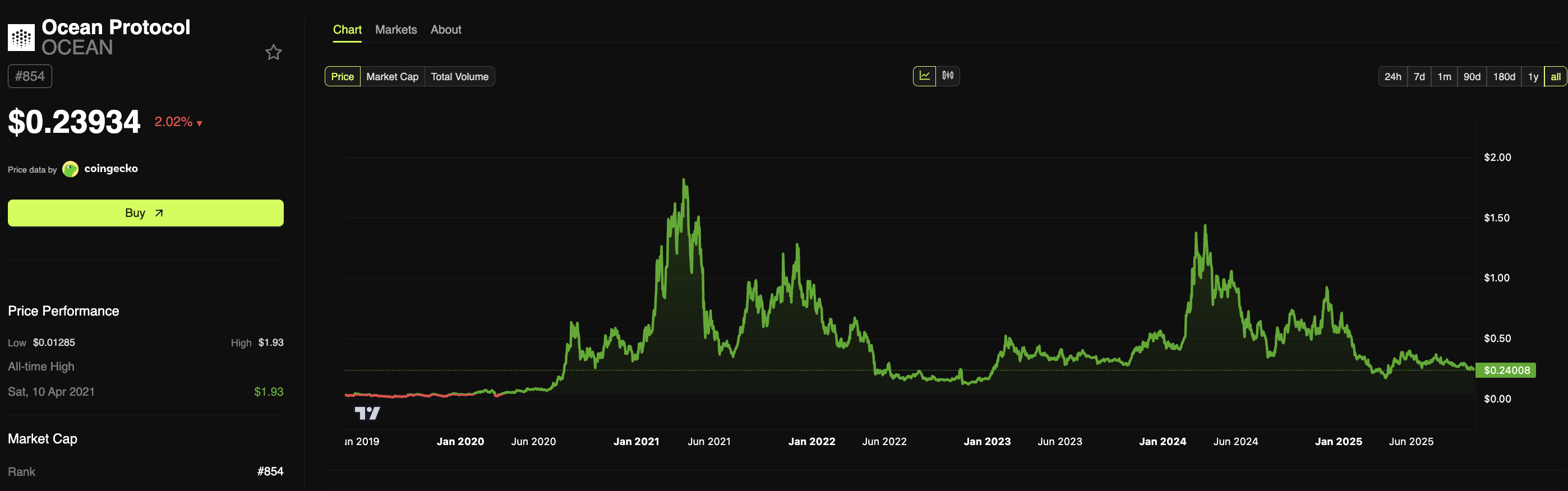

Data from BeInCrypto shows that OCEAN has fallen sharply from its March 2024 peak of over $1.00 to around $0.23934, marking a fourfold drop.

Major exchanges such as Bitget, and contributed to the decline by delisting or refusing to support the ASI token merger.

OCEAN’s price chart. Source:

BeInCrypto

OCEAN’s price chart. Source:

BeInCrypto

Following the withdrawal, the foundation announced that profits generated from Ocean-derived technologies will be used to buy back and burn OCEAN. This mechanism ensures a permanent and continuous reduction in the token’s circulating supply.

Simultaneously, Ocean invited delisted exchanges to consider re-listing OCEAN.

“Any exchange that has de-listed $OCEAN may assess whether they would like to re-list the $OCEAN token. Acquirors can currently exchange for $OCEAN on Coinbase, Kraken, UpBit, Binance US, Uniswap and SushiSwap,” the protocol stated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Critical Week For Bitcoin? Options Pressure and ETF Incentives Converge | US Crypto News

Pi Coin’s Obsession With $0.21 Is Holding Back The Upside — Here’s Why

Oil price collapse signals a dangerous liquidity trap and Bitcoin isn’t safe just because inflation is down

Eden Miner Launches Limited Christmas Cloud Mining Contracts Amid Year-End Promotions