Vitalik Buterin receives $1.01M worth of STRK from token unlock

On-chain sleuths discover Vitalik Buterin recently received an 6.29 million STRK from an airdrop that just unlocked after a year. The tokens are now worth $1.01 million.

- Vitalik Buterin received a token unlock from Starknet, amounting to 6.29 million STRK from an airdrop that rewarded early supporter with locked token allocations last year.

- STRK now occupies the second largest portion of Buterin’s portfolio, representing $1.01 million of his crypto wallet holdings.

Ethereum co-founder Vitalik Buterin has recently been rewarded for being one of the early supporters of the Starknet project. On Oct. 9, on-chain analyst Ai Yi revealed that Buterin’s wallet had received around 6.20 million STRK in an airdrop unlock that took place a year after the tokens were allocated.

According to Ai Yi’s post , the airdrop likely originates from a seed financing round for the project back in January 2018. This was when Starknet ( STRK ) was still in its early phases, therefore Buterin is considered one of its early supporters. A year ago, upon receiving the locked tokens, Buterin deposited them into Binance.

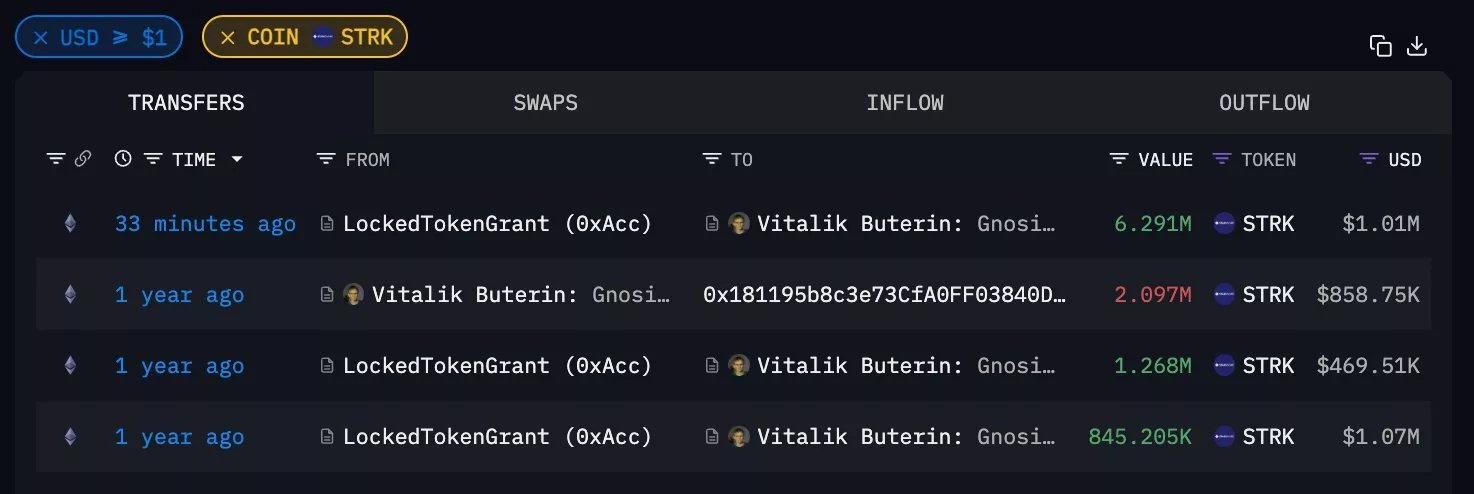

Vitalik Buterin’s crypto wallet receives 6.29 million STRK from an airdrop unlock | Source: Arkham Intelligence

Vitalik Buterin’s crypto wallet receives 6.29 million STRK from an airdrop unlock | Source: Arkham Intelligence

The unlocked tokens are currently worth around $1.01 million. Compared to the previous year, STRK has gone down in value by nearly 60% according to CoinGecko . In February 2024, the token reached its last all-time high at $4.41. However, it has yet to return to such heights following several downtrends over the year.

According to data from Arkham Intelligence, STRK represents the second largest holdings on Vitalik Buterin’s wallet. Valued at $0.16, the token has yielded a value of $1.01 million. Meanwhile, most of Buterin’s crypto wealth is stored in Ethereum ( ETH ). On Oct. 9, Buterin’s ETH holdings have reached around 240,000 ETH, valued at $1.06 billion.

Vitalik Buterin’s history with Starknet

In January 2018, Vitalik Buterin participated as an individual investor in StarkWare’s Starknet project seed financing round. The seed round amounted granted the project $6 million in funding, which was enough to get the project off the ground.

Starknet is a zero knowledge-rollup Layer2 solution built on Ethereum, aiming to improve scalability and reduce transaction costs by batching transactions off-chain and using STARK proofs for validity.

Over the years, Vitalik Buterin has been publicly supportive of Starknet, having praised the project on its technical progress. For example, last year he complimented Starknet on its efforts to improve data-efficiency, such as its v0.13.3 update which significantly reduced “blob” gas costs, a major factor in L2 scaling.

Aside from the current airdrop, Buterin has also participated in other past STRK token unlocks and events. In September 2024, he withdrew 1.26 million STRK, which pushed his total holdings to more than 2.11 million STRK at the time.

In May 2024, Buterin unlocked 2.11 million STRK, which was valued at around $1.07 million. He is also known to have moved STRK around to other wallets and deposit them into exchanges, possibly for custody or privacy reasons.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Reports Spark Questions About Bitmain Leadership and Internal Disputes

VetKeys Enhances Data Security by Enabling the Application Fully OnChain

Avalanche (AVAX) Targets Institutions for Growth, yet Top Traders Favor GeeFi (GEE) After Raising $180K in 24H

Bitcoin Outlook Discord: Tom Lee Breaks Down Fundstrat’s Position