Before the introduction of crypto ETF approvals, Grayscale was leading in issuing the world’s largest crypto investment products. These trusts were not ETFs but provided institutional investors with a safer means to invest in cryptocurrencies, a trend that continues to generate interest. Recently, the company announced updates to its crypto investment baskets.

DeFi and AI Crypto Basket Updates

According to Grayscale’s latest announcement, the company’s crypto baskets have been updated. The DeFi fund now includes Aerodrome Finance (AERO), while the AI crypto basket has added Story (IP). This restructuring signifies Grayscale’s ongoing commitment to responding to evolving market dynamics and investor interests.

Grayscale updated the DEFG portfolio by selling MakerDAO (MKR) and adjusting the holdings proportionally to integrate Aerodrome Finance (AERO), replacing MKR with AERO. This strategic decision aims to realign resources while adapting to the current DeFi and AI market paradigms, suggesting a potential reshaping of investment strategies.

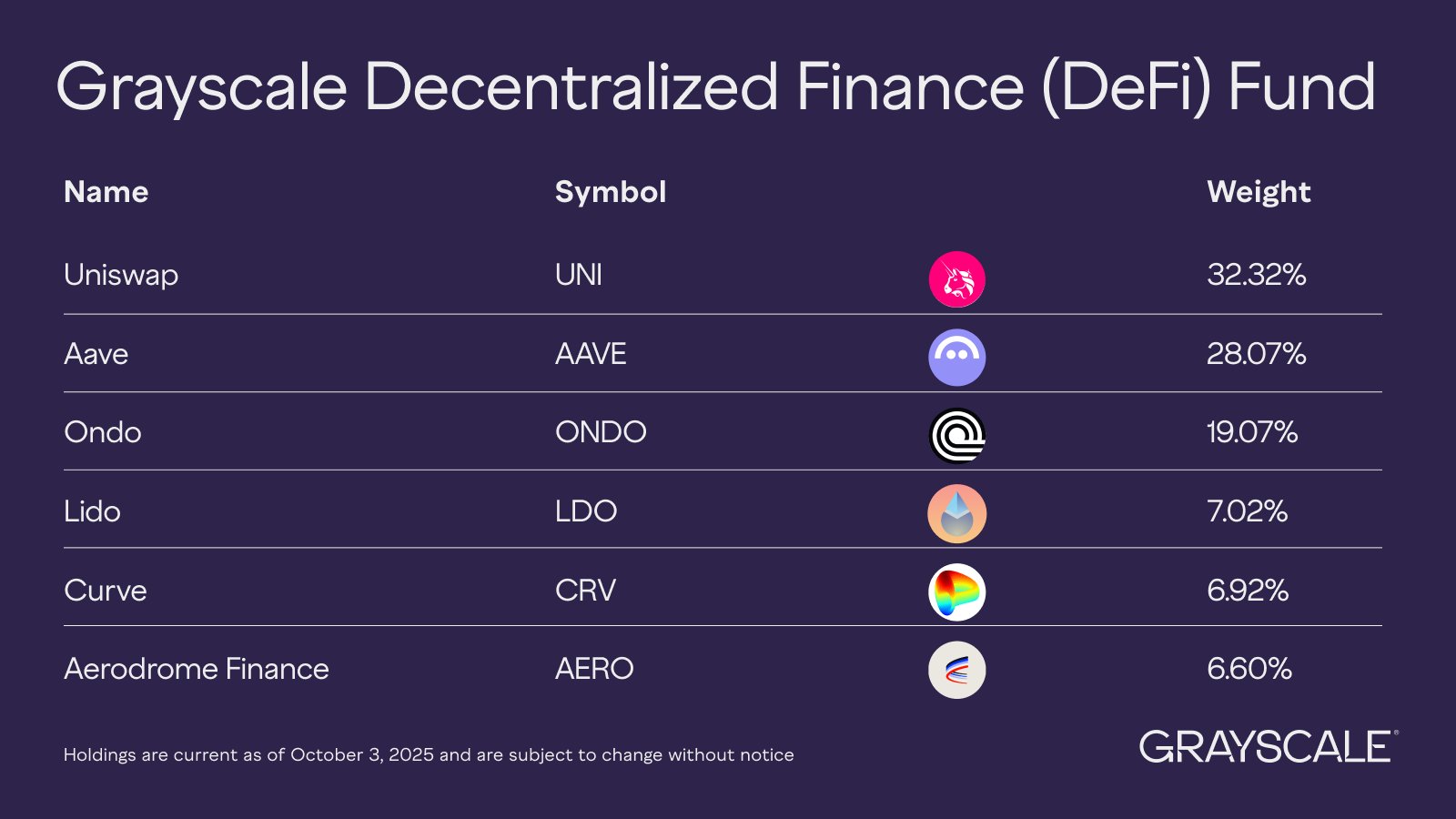

Composition of DeFi Crypto Basket

The updated DeFi Crypto Basket is as follows:

- Uniswap (UNI), 32.32%

- Aave (AAVE), 28.07%

- Ondo (ONDO), 19.07%

- Lido (LDO), 7.02%

- Curve (CRV) 6.92%

- Aerodrome Finance (AERO), 6.6%

The updates highlight a slight rebalancing in the portfolio, with AERO’s inclusion indicating strategic diversification within the DeFi sphere.

Current State of Smart Contract Crypto Basket

The Smart Contract Crypto Basket consists of:

- Ether (ETH), 30.32%

- Solana $229 ( SOL ), 30.97%

- Cardano $0.838145 ( ADA ), 18.29%

- Avalanche (AVAX), 7.57%

- SUI, 7.35%

- HBAR, 5.5%

These adjustments reflect regulatory and market environmental responses, aiming for stability and adaptive growth in digital asset investments.

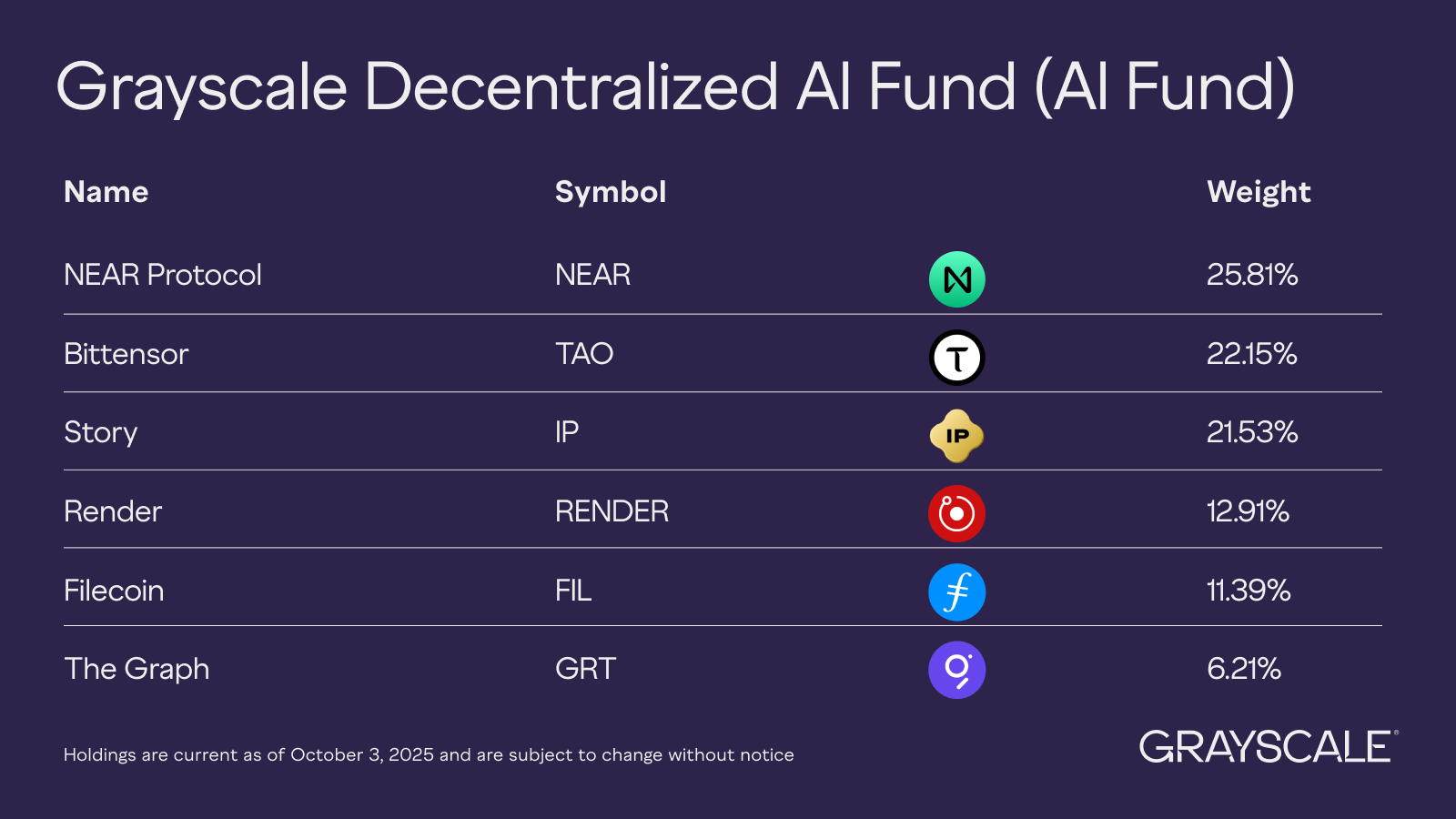

Revised AI Crypto Basket

The updated AI Crypto Basket includes:

- NEAR Protocol (NEAR), 25.81%

- Bittensor (TAO), 22.15%

- Story (IP), 21.53%

- Render (RENDER), 12.91%

- Filecoin (FIL), 11.39%

- The Graph (GRT), 6.21%

While no assets were removed from the list, the allocation of TVL-weighted tokens was adjusted, with IP Coin being added to the mix.

This update in Grayscale’s portfolio showcases the organization’s proactive approach in optimizing its investment products to remain competitive and relevant in shifting market landscapes.