Is MAGACOIN FINANCE Legit? Analysts Confirm Audit Results Prove Full Transparency

Introduction: Clearing Up the Confusion

As the crypto market prepares for another major bull cycle, MAGACOIN FINANCE has become one of the most talked-about new projects of 2025. With millions in funding raised and an expanding investor base, questions began circulating online — is MAGACOIN FINANCE a scam?

Points Cover In This Article:

ToggleAnalysts across multiple research groups have reviewed the project and reached the same conclusion: MAGACOIN FINANCE is 100% legitimate, fully audited, and positioned as one of the best new crypto projects of the year.

Why Analysts Say MAGACOIN FINANCE Is Legit

Unlike unverified meme coins or anonymous launches, MAGACOIN FINANCE has gone through official third-party audits and public verification processes.

Key legitimacy indicators include:

- Hashex.org audit completed successfully, verifying code security and functionality.

- Certik audit underway, offering additional independent verification.

- Transparent offering conducted exclusively through the official website.

- Active community presence with direct project communication.

These verifications and disclosures are strong proof of legitimacy, setting MAGACOIN FINANCE apart from typical market risks.

Strong Analyst Endorsements Drive Attention

Top crypto analysts have gone further than just calling MAGACOIN FINANCE legitimate — they’re labeling it one of 2025’s most promising crypto projects.

Reasons include:

- Smart contract audits completed without issues.

- Rapid community growth, signaling strong investor confidence.

- Analyst coverage highlighting high-upside potential once exchange listings begin.

- Early entry advantage, allowing investors to secure lower prices before launch.

This combination of audit verification and strategic approach has turned MAGACOIN FINANCE into a high-conviction choice for serious crypto investors.

Investor Demand Proves Market Confidence

Within weeks of its project launch, MAGACOIN FINANCE attracted thousands of participants — a milestone few new projects achieve so quickly. The audit transparency and ongoing Certik review have strengthened investor trust, leading to consistent growth even during market fluctuations.

Crypto analysts note that smart investors are positioning early, expecting significant price growth after listings on major exchanges later this year.

Conclusion

Despite speculation online, MAGACOIN FINANCE is not a scam. Independent audits, transparent operations, and strong analyst endorsements all confirm the project’s legitimacy. With Hashex verification completed and Certik’s audit in progress, MAGACOIN FINANCE continues to gain recognition as a top crypto project of 2025, attracting both retail and institutional attention.

FAQ: Is MAGACOIN FINANCE a Scam?

Q1: Is MAGACOIN FINANCE a scam?

A1: No. MAGACOIN FINANCE has passed its Hashex.org audit and is being reviewed by Certik, confirming that it’s a legitimate and verified project.

Q2: Why do analysts call MAGACOIN FINANCE one of the most promising crypto projects of 2025?

A2: Because it combines full audit transparency, real utility, and early access pricing that positions investors before exchange listings.

Q3: Where can I safely get information about MAGACOIN FINANCE?

A3: Information is available only through the official website.

Q4: What makes MAGACOIN FINANCE different from scam projects?

A4: Verified audits, transparent team operations, open communication, and secure contract structures separate MAGACOIN FINANCE from unverified tokens.

Q5: Has MAGACOIN FINANCE been audited?

A5: Yes. It has passed the Hashex audit and is undergoing a Certik review, both of which confirm its legitimacy and technical soundness.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

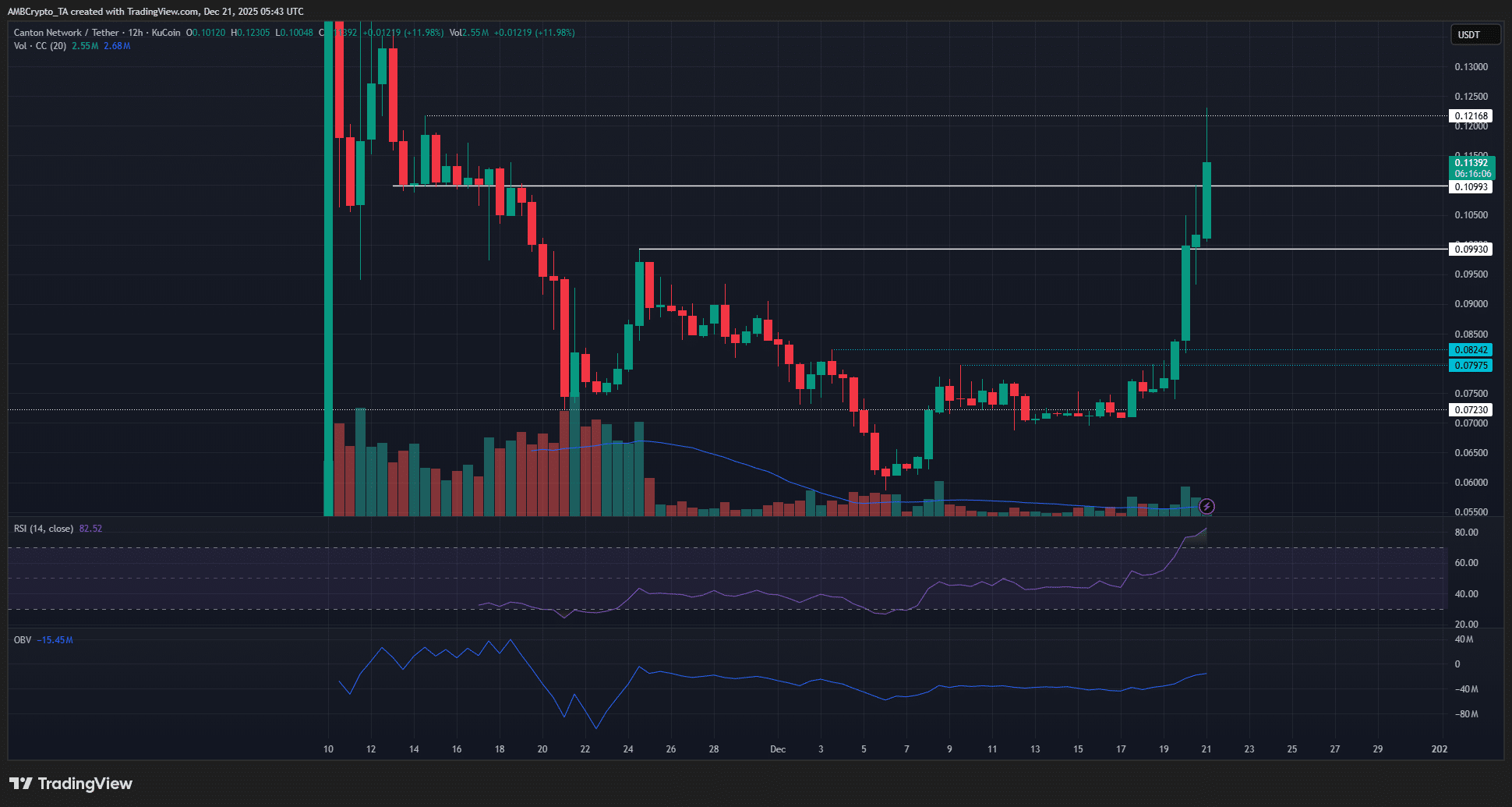

Canton Network explodes 36% after DTCC green light: Is a new trend born?

U.S. Lawmakers Make Special Amendments in Crypto Tax Rules

Altcoin Season Index at 17: Only 17 Top-100 Coins Have Outperformed Bitcoin, CoinMarketCap Data Show