PancakeSwap (CAKE) Hits 10-Month High as It Rides BNB Chain Momentum

PancakeSwap’s CAKE token is gaining momentum as BNB Chain activity rebounds, driving higher trading volumes and bullish technical signals. With price strength building above key support, CAKE could extend its rally if network demand holds firm.

Decentralized finance (DeFi) token CAKE has emerged as today’s top gainer, defying the broader market’s pullback in trading activity. The multi-chain token, native to the BNB Chain, has posted impressive gains over the past week, fueled by the recent surge in user demand on the network.

With technical and on-chain indicators pointing to sustained demand, CAKE could be gearing up for an extended rally.

CAKE Extends Rally as BNB Chain Activity Soars

CAKE’s rally follows a surge in user activity on the BNB Chain over the past month, which has driven up the values of several crypto assets native to the Layer-1 (L1) blockchain.

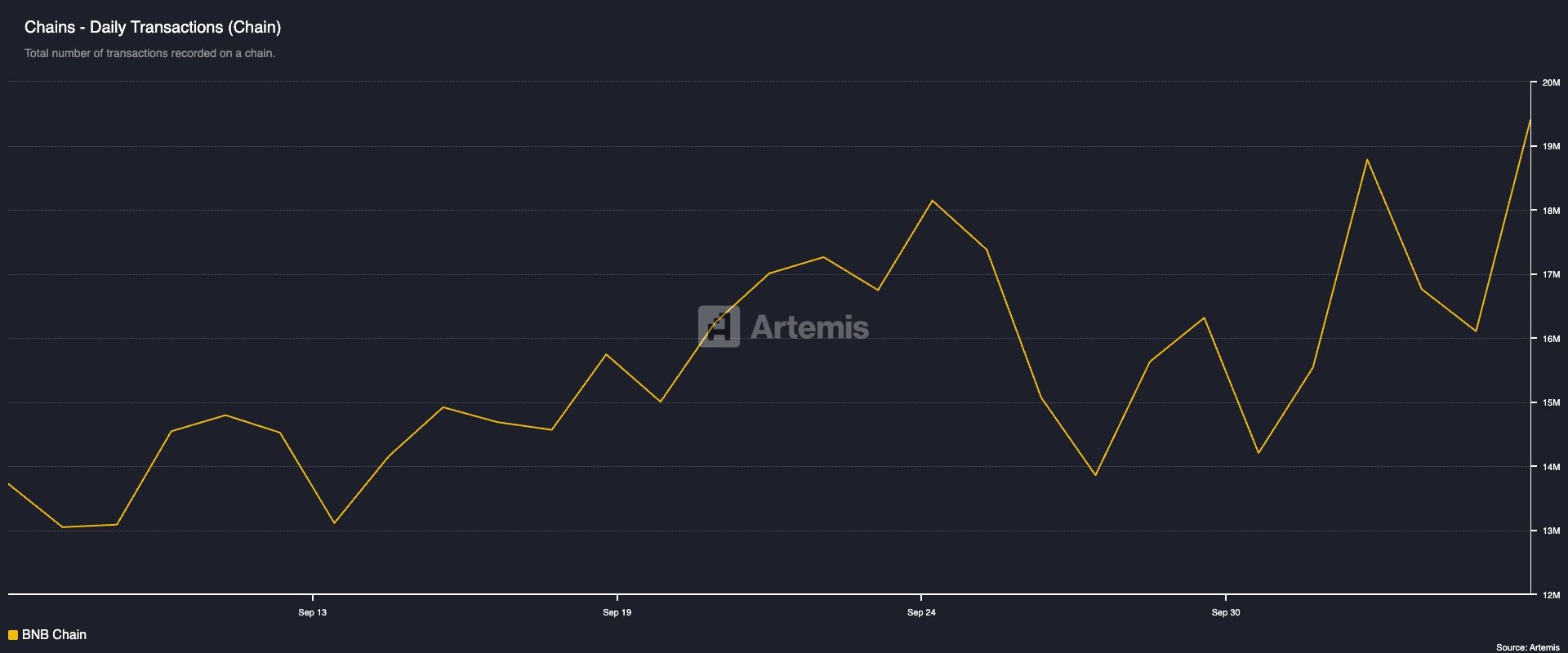

This uptick in user demand is reflected by the chain’s rising daily transaction count and decentralized exchange (DEX) trading volumes. According to Artemis, the total number of transactions recorded on the BNB Chain over the past month has totaled 19 million, climbing by 41% during that period.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

BNB Chain Daily Transactions Count. Source: Artemis

BNB Chain Daily Transactions Count. Source: Artemis

During that period, the volume of transactions completed on DEXes housed on BNB has rocketed 139%.

BNB Chain DEX Volume. Source: Artemis

BNB Chain DEX Volume. Source: Artemis

This renewed on-chain activity has directly translated into stronger demand for CAKE, being the native token of the largest DEX by trading volume operating on the BNB Chain, PancakeSwap.

Moreover, the recent launch of CAKEPAD, a new multi-chain launchpad designed to give investors early access to emerging tokens, has further boosted CAKE’s attractiveness among investors.

Together, these factors have triggered an uptick in CAKE’s demand, driven up investor optimism, with technical indicators pointing to more gains.

Is This Rally Built to Last?

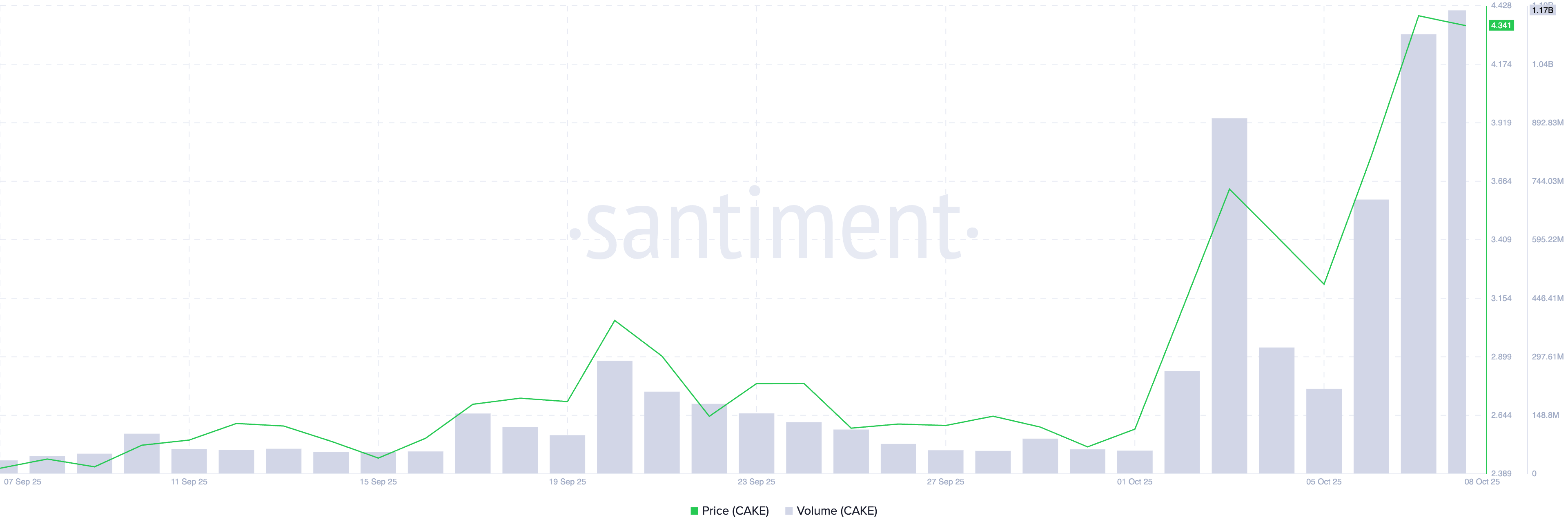

CAKE’s double-digit surge over the past day is accompanied by a rise in its daily trading volume. As of this writing, CAKE’s 24-hour trading volume sits at $1.71 billion, up more than 60% in the past day.

CAKE Price/Trading Volume. Source: Santiment

CAKE Price/Trading Volume. Source: Santiment

When both price and trading volume spike simultaneously, it indicates conviction behind the upward move. This means that CAKE buyers are actively accumulating the asset, and its price is not just reacting to short-term volatility.

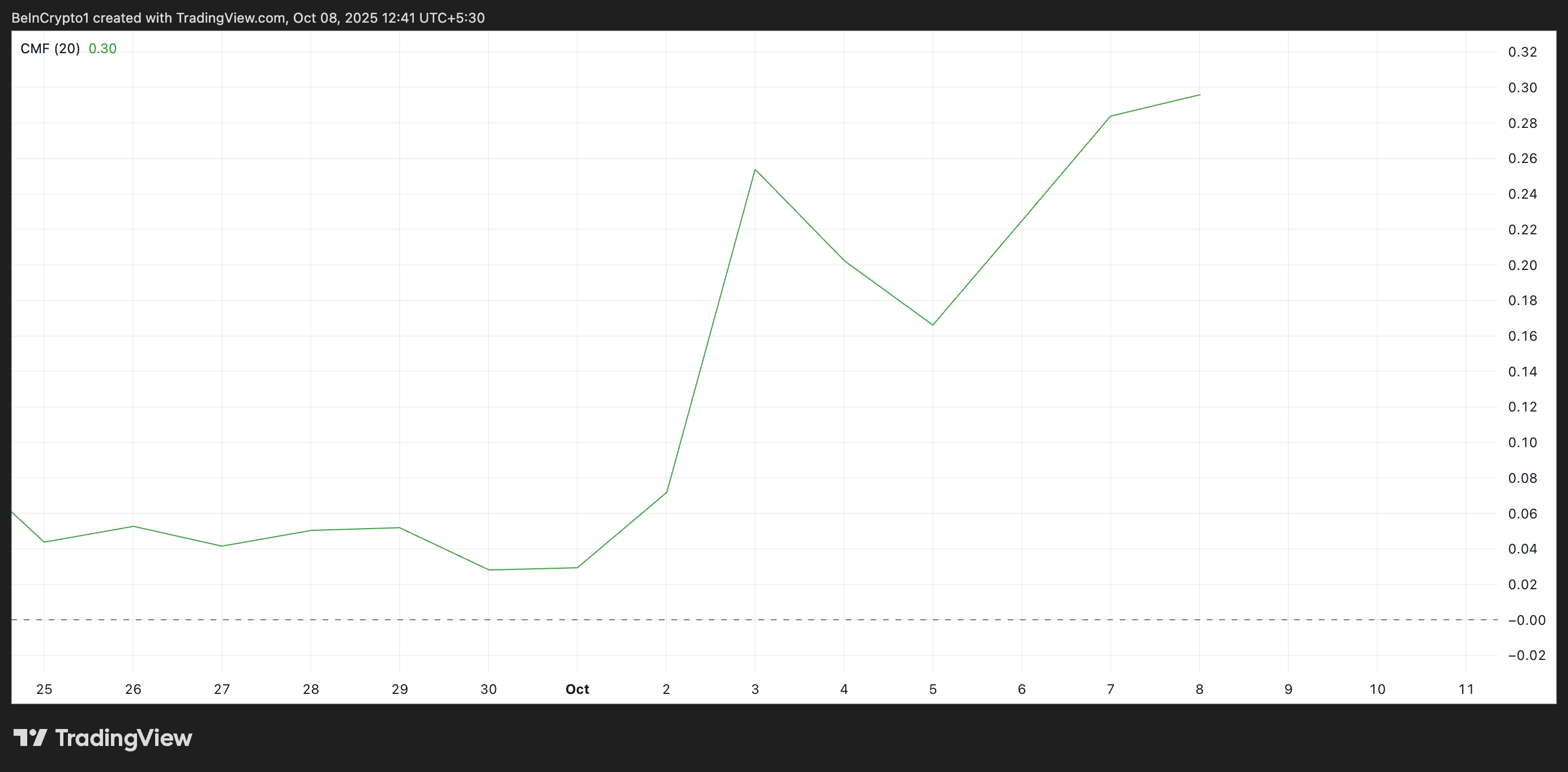

Furthermore, the setup of CAKE’s Chaikin Money Flow confirms the bullish bias among spot market participants. As of this writing, this momentum indicator is at 0.31 and remains in an uptrend.

CAKE CMF. Source: TradingView

CAKE CMF. Source: TradingView

The CMF indicator measures how money flows into and out of an asset. When it returns a value above the zero line like this, market participants favor accumulation over distribution, hinting at further CAKE rallies.

Will Bulls Defend $4.26 or Cede Ground to Sellers?

At press time, CAKE trades at a 10-month high of $4.34, resting above the support floor formed at $4.26. If demand remains steady and this price floor strengthens, it could push CAKE’s value toward $4.66.

A successful breach of this barrier could open the door for a rally toward $5.24, a high last reached in March 2024.

CAKE Price Analysis. Source: TradingView

CAKE Price Analysis. Source: TradingView

On the other hand, if demand stalls and sellers regain control, the support at $4.26 could give way, leading to a deeper decline toward $3.66.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.