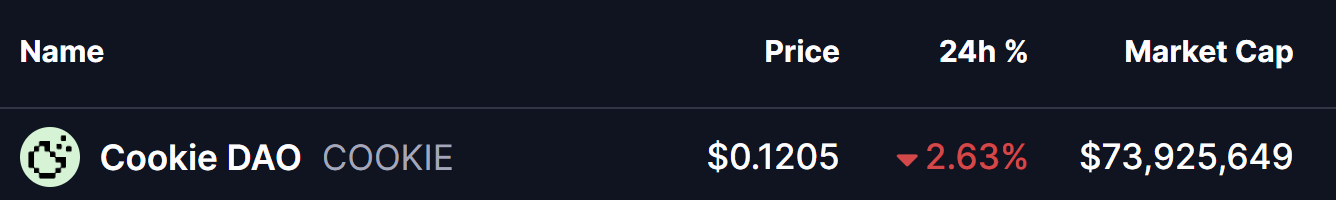

The cryptocurrency market is witnessing a healthy pullback today after an impressive rally that sent Bitcoin (BTC) to a new all-time high of $126,000 before correcting to around $122K. Ethereum (ETH) also slipped over 4%, causing mild pressure across major altcoins — including Cookie DAO (COOKIE).

Despite the red candles, COOKIE’s price action tells a deeper story: the token recently broke out of a falling wedge, a pattern that often signals the start of a bullish reversal. Now, it’s retesting the breakout zone, a key moment that could determine whether bulls are ready for the next leg up.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting Falling Wedge Breakout

For several weeks, COOKIE had been consolidating within a falling wedge, a technical pattern known for hinting at potential upside reversals. The token found solid support near $0.099, where buyers stepped in and pushed the price higher.

The breakout above the wedge’s resistance line occurred near $0.1205, confirming a potential shift in trend. Following that breakout, COOKIE quickly climbed to a local high of $0.1376, where short-term profit-taking caused a brief pullback.

Cookie DAO (COOKIE) Daily Chart/Coinsprobe (Source: Tradingview)

Cookie DAO (COOKIE) Daily Chart/Coinsprobe (Source: Tradingview)

Now, COOKIE has retraced back toward the breakout zone around $0.1205, aligning with the wedge’s former resistance — a level that often flips into support once successfully retested.

What’s Next for COOKIE?

The ongoing retest appears constructive, but much depends on whether the bulls can defend the breakout trendline. If buyers step in with conviction, their main objective will be to reclaim the $0.1376 local high, along with the 100-day moving average at $0.1464. A clean move above this level could set the stage for a larger rally.

Should bullish momentum build from there, the wedge projection suggests a potential rally toward the $0.217 zone, representing an upside of roughly 39% from current levels.

However, if COOKIE fails to hold above the breakout trendline, the token could fall back inside the wedge — indicating a fake breakout and delaying further bullish momentum.