18.7M XRP Worth $55.87 Million Moves to Ripple Wallet Amid Whale Speculation

Quick Take Summary is AI generated, newsroom reviewed. 18,744,800 XRP ($55.87M) transferred from an unknown wallet to Ripple on October 7, 2025. Transaction equals ~0.03% of XRP’s circulating supply and 1% of daily trading volume. XRP price stands near $2.98, slightly below last month’s $3.03. Possible reasons include liquidity management, OTC settlement, or internal reallocation.References X Post Reference

💥BREAKING:

— The Crypto Bull (@TheCryptoBull11) October 7, 2025

18,744,800 $XRP ($55.87M) TRANSFERRED FROM UNKNOWN WALLET TO RIPPLE.

WHO’S BEHIND THIS?? pic.twitter.com/tr1yQ4BrPH

The crypto community today has been attracted to a big XRP transaction when 18,744,800 XRP tokens worth 55.87 million were transferred by an unknown wallet to Ripple Labs. On X, it was initially reported by TheCryptoBull11 at 08:08 UTC on October 7, 2025, prompting numerous speculations as to the reason and origin of the transfer.

According to blockchain data, the transaction occurred on the XRP Ledger, the native blockchain network of Ripple, which supports 1,500 transactions per second (TPS) and almost miss fees (0.00001 XRP per transaction).

Numbers Behind the Transaction

The amount of XRP transferred is equivalent to the 18.74 millionth of the total supply of 100 billion XRP and about 0.0326th of the current supply of 57.5 billion XRP, which remains close to the current supply of 57.5 billion XRP.

The full value of the transaction will be $55,870 000 at a token price of 2.98 which is equivalent to the average XRP market rate on October 7, 2025. This transfer, which involves an approximate 24-hour volume of approximately 6 billion dollars, makes up approximately 1 per cent of the daily transfer activity in XRP, which is sufficient to generate a market buzz without causing the price to shoot up. The firm puts out 1 billion XRP every month, usually putting back the unused ones to the escrow.

Background

On June 2025, 498 million XRP valued at $498 million transacted under the same circumstances. The 18.7 million XRP transfer pales in comparison to these, which is about one-tenth of the scale of the regular liquidity activities of Ripple. Nevertheless, XRP is among the most successful large-cap crypto assets in 2025 with a gain of more than 480% year-to-year.

Market Landscape

Analysts perceive some possible reasons. Liquidity Management: Ripple could be amassing XRP reserves in the future institutional liquidity activities or new payment corridors in RippleNet. Internal Accounting Adjustment: Sometimes major holders or subsidiaries are re-reversion XRP of pilot programs or liquidity pools back to the control of Ripple.

The move was only a few months following Ripple allegedly coming to partial resolution of a years-long case concerning the SEC, which started in 2020. Since then, Ripple has continued to internationalize its business, attracting more than 300 financial institutions into RippleNet and initiating operations both in Latin America and in Southeast Asia. It could also be the reason that the company is XRP treasury moving its funds as it prepares to fund state-supported digital payment systems due to its increased involvement in CBDC pilot programs.

Whale Action and Community Chatter

The XRP community on X was fast in response, and several users described the transfer as whale movement or a Ripple buyback. The last 48 hours have registered several large XRP transactions on Whale Alert data which shows that high value flows have taken off. As long as Ripple is operating its wallet activity in the same trend, it can be an indicator that it is planning a strategic announcement or liquidity shift before the next market cycle, Q4 2025.

Outlook for XRP

As XRP continues to be the sixth-largest cryptocurrency based on market capitalization, priced at approximately 171 billion, short-term volatility is likely after the transaction. Nevertheless, in case there are new large inflows or outflows, traders can take it as an indicator of redistribution, which can lead to speculative fluctuations around the $3 mark.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Big News from the FED for Cryptocurrencies! “A Backtrack!”

EE bets on Wi-Fi 7 to fix home dead zones across UK full-fibre plans

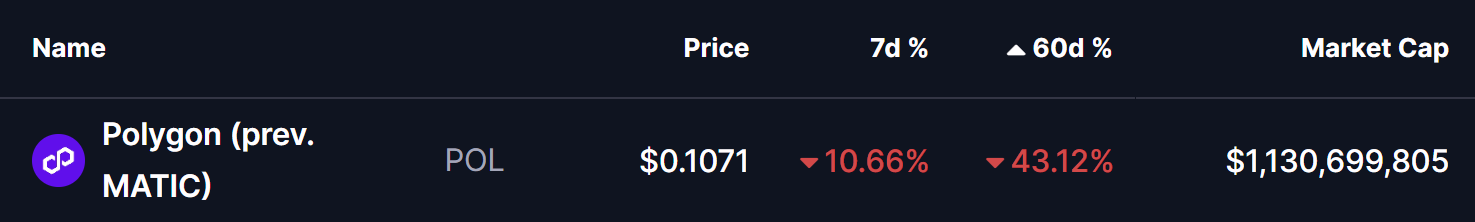

Polygon (POL) Flashes Potential Bullish Reversal Pattern – Will It Bounce Back?